The Tax Department has launched an Experience Portal for business households and individual business owners to familiarize themselves with the new model before its implementation on January 1, 2026. This initiative aims to streamline tax declaration and payment processes for these entities. Through the eTax mobile app, users can explore the interface, practice tax declaration, and simulate tax filing.

To access these features, taxpayers should update their eTax Mobile app to the latest version. The experience feature will appear directly on the home screen, with clear instructions guiding users through the process. The Tax Department of Hanoi encourages business households to actively practice tax declaration on the Experience Portal to minimize errors during official filings.

Step-by-Step Guide to Trial Tax Declaration on eTax Mobile

For business households renting real estate in Vietnam, follow these steps to practice tax declaration on the eTax Mobile Experience Portal:

Step 1:

Access the eTax mobile app and select “Experience for Business Households and Individuals” on the main screen. Choose “Tax Declaration” from the list of functions.

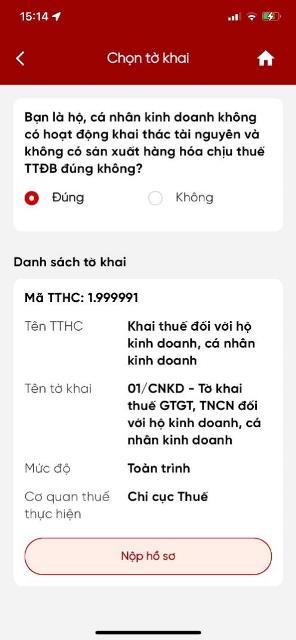

Step 2:

The system will display the “Select Tax Declaration” screen. If the business household does not engage in natural resource exploitation or excise-taxable goods production, check the “Correct” box.

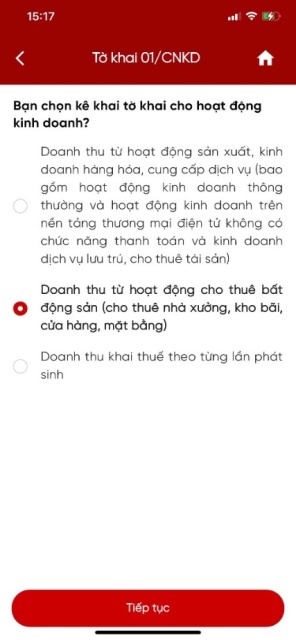

Select “Submit File” from the list of tax declarations. Choose “Rental income from real estate” and click “Continue.”

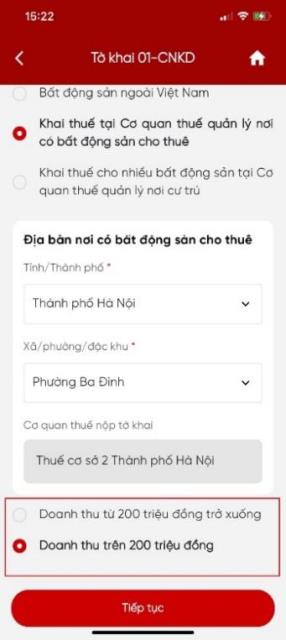

Select “Real Estate in Vietnam” and choose the appropriate tax authority based on the number of rental properties.

Enter the location of the rental property and select the tax authority. Choose the revenue threshold and click “Continue.”

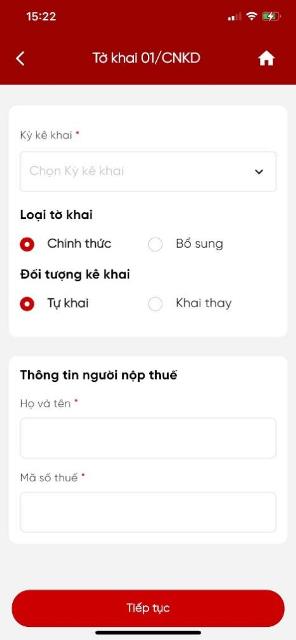

Select the tax period, declaration type, and taxpayer type. Enter taxpayer information and click “Continue.”

Step 3:

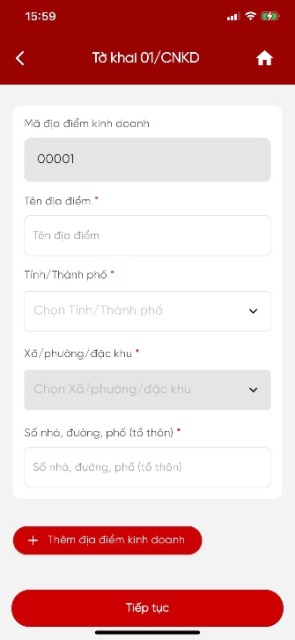

Enter rental property details. For multiple properties, click “Add Business Location.” Click “Continue.”

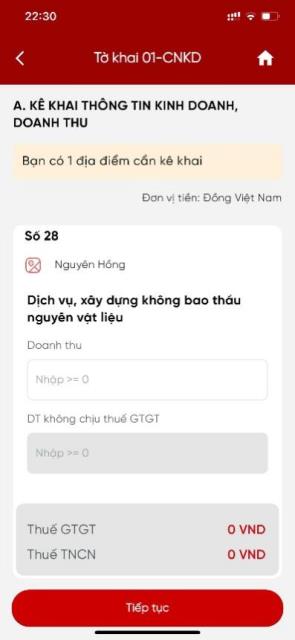

Enter revenue details. The system will calculate VAT and personal income tax. Click “Continue.”

Step 4:

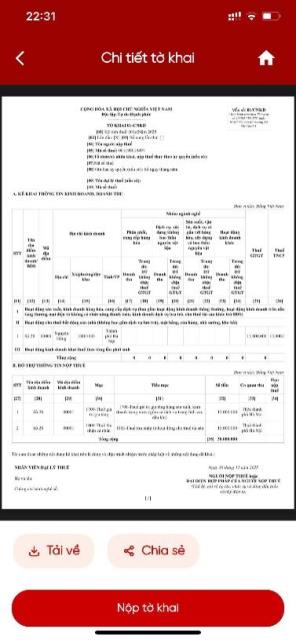

Review the tax declaration. Download or share the PDF file. Click “Submit Tax Declaration” and enter the OTP to complete the process.

Kỳ Thư

Eliminating Lump-Sum Tax: Business Households Grapple with Input Invoice Declaration

As of January 1, 2026, the lump-sum tax will be officially abolished, requiring business households to declare taxes or transition to a corporate model. The Hanoi Tax Department has provided detailed guidance addressing key concerns, including input invoice declarations and inventory management, even for goods purchased from individuals.

“Deputy Director of the Tax Department: The More Transparent and Open Businesses Are, the Less Likely They Are to Face Administrative Violations”

Mr. Mai Sơn, Deputy Director of the Tax Department, emphasizes: “The more transparent and compliant business households are, the less likely they are to face administrative violations. With proper collaboration with tax authorities, those who adhere to regulations will not be subject to inspections. In practice, audits are only conducted when there is a perceived risk.”