On December 3, 2025, Thuong Dinh Shoe Joint Stock Company (stock code: GTD) submitted an explanatory document to the State Securities Commission and the Hanoi Stock Exchange regarding the consecutive ceiling price increase of GTD shares over five sessions from November 26, 2025, to December 2, 2025.

The company’s leadership confirmed that its production and business operations remain normal, with no unusual fluctuations observed.

Thuong Dinh Shoe stated that the share price increase is an objective market dynamic driven by supply and demand, and the company commits to not influencing the trading price in any way.

Previously, Thuong Dinh Shoe had submitted a similar explanation for the consecutive ceiling price increase of GTD shares over five sessions from November 19 to November 25.

By the end of the December 3 trading session, GTD shares reached their 11th consecutive ceiling price at 52,200 VND per share, a 342% increase compared to November 18.

The continuous ceiling price surge followed the Hanoi Stock Exchange’s (HNX) announcement of an auction for over 6.3 million shares of Thuong Dinh Shoe, owned by the Hanoi People’s Committee. This represents the Committee’s entire stake in the company, equivalent to nearly 69% of its charter capital. The successful bidder will gain controlling interest in Thuong Dinh Shoe.

The starting price is set at 20,500 VND per share. If all shares are successfully auctioned, the Hanoi People’s Committee could raise at least 131 billion VND.

The auction is scheduled for the morning of December 16, 2025, and is open to domestic and international economic organizations, social organizations, and individuals.

With over 60 years of history, Thuong Dinh Shoe currently exports to the EU, Australia, and several Asian countries. However, over the past five years, the influx of global brands like Adidas, Puma, and Nike has intensified competition, significantly marginalizing Thuong Dinh Shoe in the domestic market.

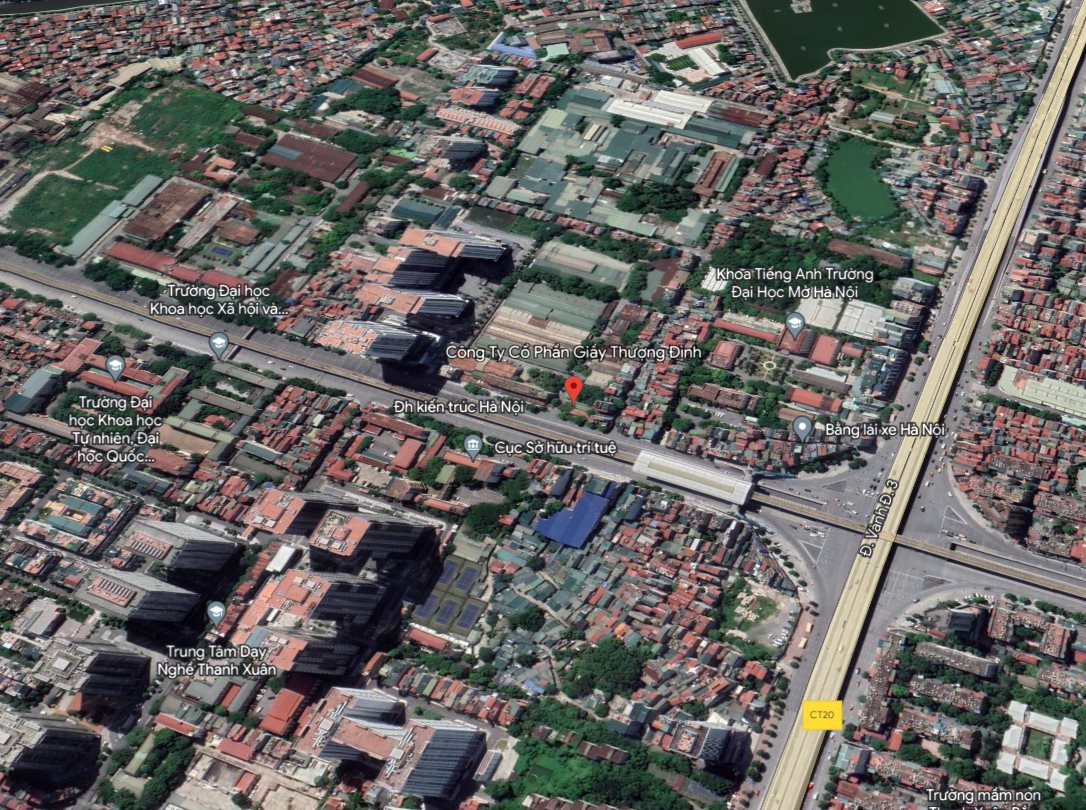

One notable asset of Thuong Dinh Shoe is its 36,105 m² land plot at 277 Nguyen Trai, Hanoi. This prime location, with extensive frontage along Nguyen Trai Street, is earmarked for relocation under Hanoi’s urban planning policy.

According to approved plans, the site will be redeveloped into the Thuong Dinh Commercial-Office-Service-School Complex, with Thuong Dinh Shoe as the primary investor. The total investment is estimated at 1.6 trillion VND, targeting completion by 2030 following the factory’s relocation.

Two Stocks Hit 12 Consecutive Upper Limits Following State Capital Withdrawal Announcement

Following the announcement of the state divestment plan, both VTC and GTD surged to their upper limits for 12 consecutive sessions, pushing their market prices to historic highs while liquidity exploded.

Iconic Family Shoe Stock Surges with 7 Consecutive Circuit-Breaking Rallies

Shares of Thuong Dinh Shoe Joint Stock Company (UPCoM: GTD) have surged dramatically, hitting the upper limit for seven consecutive sessions, reaching 30,000 VND per share, despite low trading volumes of just a few hundred shares per session. This remarkable rally comes just ahead of the Hanoi People’s Committee’s planned auction of its entire 68.77% stake in GTD on December 16th.

Hà Nội Seeks to Divest from Once-Iconic Shoe Brand, Sparking Stock Market Speculation

Starting at an initial price of 20,500 VND per share, the Hanoi People’s Committee stands to generate a minimum revenue of 130.9 billion VND should the entire lot of shares be successfully auctioned.