Since the beginning of 2025, the State Bank of Vietnam (SBV) has consistently lowered the interest rate on treasury bills from 4% to 3.1% per annum as of March 4, 2025. Concurrently, it has gradually reduced the issuance scale and officially ceased issuing treasury bills from March 5. This move sends a strong signal about the policy to reduce interbank interest rates, enabling credit institutions to access low-cost capital. This, in turn, supports the government’s directive to lower lending rates, contributing to achieving the credit growth target of 16% and the economic growth target of 8%.

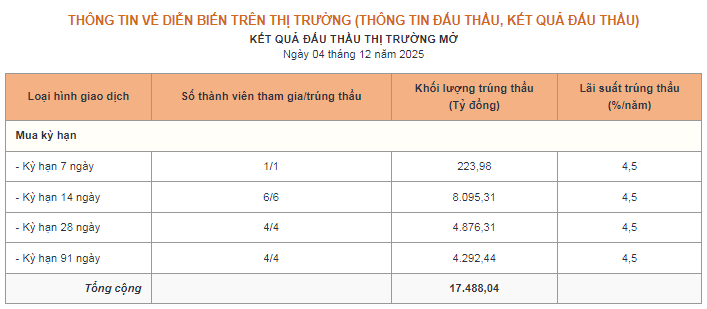

In parallel, since early 2025, the SBV has regularly conducted term purchases of securities daily, extending the term to up to 105 days and increasing the capital injection volume to ensure timely liquidity for the system. As of December 3, the SBV has net injected nearly VND 340.5 trillion at a fixed interest rate of 4% per annum.

|

Overnight interbank interest rates to date. Unit: %/year

Source: VietstockFinance

|

Despite the regulator’s continuous liquidity support, end-of-year seasonal tensions and heightened capital demand have pushed overnight interest rates to their highest level in three years. In response, the SBV has raised the repo rate to 4.5% per annum, a 50 basis point increase. This new move raises questions about whether the overall market interest rates will face adjustment pressure in the near future.

Source: SBV

|

Balancing Growth Support and Exchange Rate Stability

Explaining this decision, Assoc. Prof. Dr. Nguyễn Hữu Huân – Senior Lecturer, University of Economics Ho Chi Minh City, suggests considering the broader context of monetary policy and the current economic landscape. Vietnam’s monetary policy has maintained a loosening stance for an extended period, and the market is now entering the year-end phase, a time when capital demand typically surges due to seasonal cycles.

Over the past period, the SBV has injected a substantial amount of liquidity into the market to support the economy. However, this is a trade-off, as continuing to inject ample liquidity while keeping interest rates too low could pose certain risks, particularly pressure on the exchange rate, which often intensifies toward year-end.

“With economic growth targets deemed achievable, the regulator no longer faces significant pressure to stimulate growth at all costs. Instead, the SBV is shifting its focus to macroeconomic stability. Therefore, the slight increase in the OMO interest rate is a necessary step to rebalance the market. Maintaining low interest rates would exert considerable and hard-to-control pressure on the exchange rate,” explained Mr. Huân.

Regarding the exchange rate, Mr. Huân noted that while seasonal factors inevitably increase year-end pressure, the SBV’s proactive increase in the OMO interest rate will serve as a crucial technical measure. This will help mitigate and reduce pressure on the exchange rate, thereby maintaining overall stability in the financial market during the final months of the year.

Rising Capital Costs Without Signaling a Strong Interest Rate Hike Cycle

Meanwhile, Mr. Nguyễn Quang Huy – CEO of the Faculty of Finance and Banking, Nguyen Trai University, believes that the SBV’s decision to raise the OMO interest rate to 4.5% is a necessary adjustment to restore market synchronization, bolster confidence, and strengthen liquidity discipline in the current context.

According to Mr. Huy, the adjustment of the term securities purchase interest rate from 4% to 4.5% occurred when systemic liquidity showed significant tightening signs, with interbank interest rates rising to 6–7%, reflecting peak seasonal capital demand. However, the SBV’s continued large-scale liquidity support via the OMO channel alongside the interest rate increase demonstrates a highly flexible, proactive, and stable regulatory approach.

Technically, the OMO interest rate adjustment primarily aims to reduce the phase shift between the regulator’s capital cost and actual market interest rates. As the interbank market (Market 2) experiences significant volatility due to short-term capital demand, the previous 4% rate no longer fully reflects the current supply-demand dynamics. The increase to 4.5% will help restore harmony within the interest rate corridor and reinforce the OMO’s role as a “policy floor.”

“Notably, despite the interest rate hike, the regulator maintains a net injection stance. This combination of stable volume and slight price adjustment confirms that the SBV is not tightening but fine-tuning monetary policy toward a more neutral and reasonable stance for year-end liquidity conditions. This ensures sufficient operational capital for the system while clarifying that support capital must come with costs reflecting market conditions,” emphasized the expert.

Additionally, normalizing the OMO interest rate to 4.5% encourages credit institutions to be more proactive in capital management, term restructuring, and liquidity strategies. With OMO borrowing costs no longer excessively cheap, banks will be motivated to return to market-based capital channels and enhance internal discipline, reducing reliance on short-term capital from the regulator. This strengthens the system’s self-regulation capabilities, fostering sustainable development of the money market. Moreover, this adjustment helps maintain a reasonable differential between VND and USD interest rates, a critical factor in stabilizing exchange rate expectations amid volatile international conditions, without resorting to overly aggressive intervention measures, thus cautiously maintaining the local currency’s position.

Regarding whether this signals an impending increase in Market 1 lending rates, Mr. Huy assessed that while pressure exists, it is not coercive or indicative of a strong interest rate hike cycle. As banks’ input capital costs rise—from both OMO and interbank channels—new lending rates may tick up. However, with inflation remaining below target and economic recovery still a priority, coupled with the SBV’s unchanged benchmark rates, any Market 1 adjustments will be controlled, reasonable, and gradual.

– 11:31 05/12/2025

Dr. Nguyen Tri Hieu Warns of Bubble Signs in Vietnam’s Real Estate Market

The market is teetering on the brink of a bubble as supply threatens to surge, inventories swell, and housing becomes increasingly inaccessible for the general population.

“A Detailed Roadmap is Essential to Eliminate the Credit Room Allocation Mechanism”

The proposal was put forth by Nguyen Thi Viet Nga, Deputy Head of the Hai Phong City Delegation, during the morning plenary discussion session on December 3rd.