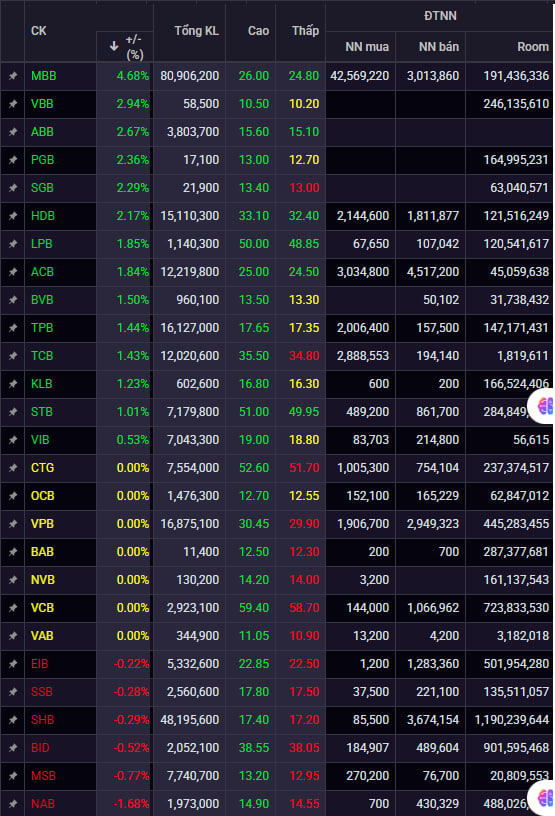

Banking stocks continued their positive momentum on December 4th, significantly contributing to the market’s overall green performance as substantial capital flowed into this leading sector. By the session’s close, 14 out of 27 banking stocks had risen, while 6 declined and 7 remained unchanged.

Among these, MBB emerged as the standout performer, surging 4.68% to VND 25,700 per share, with liquidity exploding to over 80.9 million shares traded—far exceeding its average volume and outpacing peers. MBB’s trading value topped the market at over VND 2,050 billion.

MBB’s rally was fueled by foreign investors’ net buying, which surpassed VND 1,000 billion, making it the most heavily accumulated banking stock by foreign entities in the session.

HDB also impressed with a 2.17% gain to VND 32,950, marking its third consecutive day of increases. This positive movement aligns with the State Bank of Vietnam’s (SBV) approval of HDBank’s capital increase plan via stock dividends and bonus shares for existing shareholders, totaling a 30% issuance ratio.

Post-issuance, HDBank’s chartered capital is projected to rise from VND 38,594 billion to over VND 50,000 billion. This equity boost is expected to strengthen HDBank’s financial capacity, enhance Basel II and III compliance, and expand credit growth, digital transformation, and its comprehensive financial ecosystem.

On UPCoM, smaller banking stocks also performed well: VBB (+2.94%), ABB (+2.67%), PGB (+2.36%), and SGB (+2.29%).

Mid-tier and large banks such as LPB, ACB, TCB, and STB posted 1–2% gains with stable liquidity, signaling broadening investor interest in high-cap banking stocks.

Conversely, only a handful of banking stocks—EIB, SSB, SHB, BID, MSB, and NAB—ended lower, though declines were minimal, mostly under 1%.

Vietstock Daily 05/12/2025: Aiming for the Previous Peak?

The VN-Index extended its winning streak, holding firm despite intraday volatility and closely tracking the upper Bollinger Band. Trading volume remained above its 20-day average, while the MACD indicator continued to widen its gap with the Signal line, reinforcing the index’s positive short-term outlook. This momentum positions the VN-Index to challenge its October 2025 peak, targeting the 1,760-1,795 point range.

Foreign Funds Reduce Stake in Dat Xanh Group Below 9%

Dragon Capital has recently divested 852,000 shares of DXG through four of its member funds, reducing its ownership stake in Dat Xanh Group to 8.9592%.