Market sentiment improved, driving a positive session for the stock market on December 3rd. The VN-Index closed up 14.71 points (0.86%) at 1,731 points. Liquidity improved, with trading value on HOSE reaching nearly VND 24.3 trillion.

Foreign investors’ net buying was a highlight, with a net purchase of approximately VND 3.745 trillion.

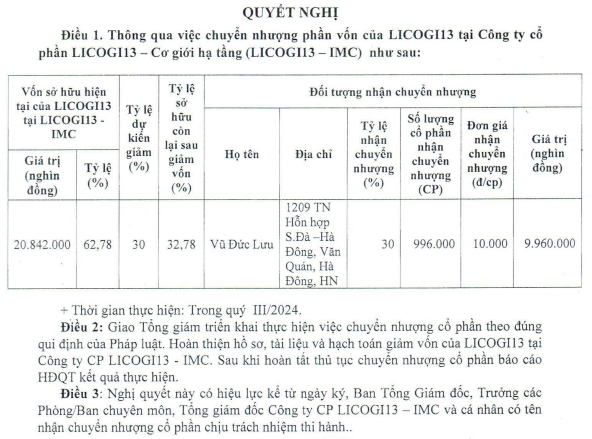

On HOSE, foreign investors net bought VND 3.798 trillion

On the buying side, VPL was the most heavily purchased stock by foreign investors on HOSE, with a value of over VND 3.439 trillion. MBB followed, with a net buy of VND 255 billion. Additionally, VPB and CTG were bought for VND 197 billion and VND 169 billion, respectively.

Conversely, VIC was the most heavily sold stock by foreign investors, with VND 125 billion. VCB and FPT were also sold, with VND 117 billion and VND 92 billion, respectively.

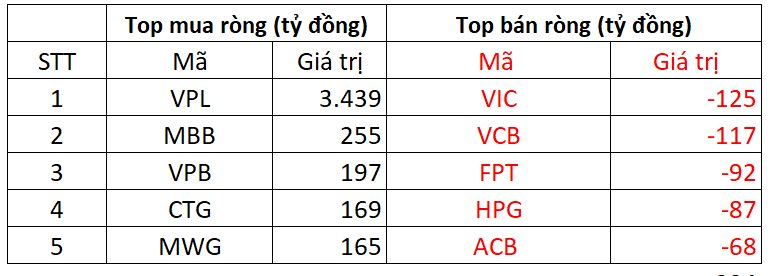

On HNX, foreign investors net sold VND 16 billion

On the buying side, CEO was the most heavily purchased stock on HNX, with a net buy of VND 12 billion. VFS followed with VND 4.6 billion. Foreign investors also bought NTP, APS, and NVB for a few billion dong each.

On the selling side, PVS faced the most selling pressure from foreign investors, with nearly VND 12 billion. MBS followed with VND 11 billion, and SHS, PVI, and MST were sold for a few billion dong each.

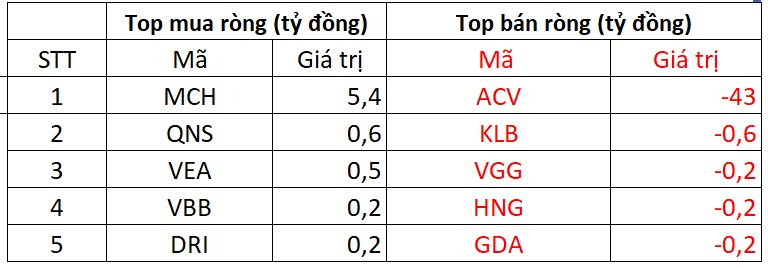

On UPCOM, foreign investors net sold VND 37 billion

On the buying side, HPP was purchased by foreign investors for VND 3 billion. QNS and F88 were also bought for a few billion dong each.

Conversely, MCH was sold by foreign investors for VND 18 billion. They also sold ACV, VGI, and others.

Market Pulse 12/05: Foreign Investors Resume Net Selling of Blue-Chip Stocks, VIC Keeps VN-Index in the Green

At the close of trading, the VN-Index rose 4.08 points (+0.23%) to 1,741.32, while the HNX-Index fell 1.66 points (-0.63%) to 260.65. Market breadth favored decliners, with 434 stocks falling and 282 advancing. The VN30 basket mirrored this trend, with 24 stocks declining, 3 advancing, and 3 unchanged.

December 4th: MBB Leads the Market, HDB Surges on Dividend News

At the close of the December 4th session, the banking sector saw 14 out of 27 stocks rise, with 6 declining and 7 remaining unchanged. Notably, MBB and HDB emerged as the top performers among bank stocks on the HOSE exchange, recording the most significant gains.

Anticipated Catalysts for MCH Stock Post HOSE Listing

Hailed as the “missing piece” of Vietnam’s stock market, MCH shares are taking center stage ahead of their upcoming transfer to the HOSE. With the advantages of the transfer, coupled with a favorable macroeconomic backdrop and strong corporate fundamentals, analysts are confident in Masan Consumer’s explosive growth in 2026 and beyond.

VPBankS Anticipated to List on Stock Exchange with Reference Price of VND 33,900 per Share

VPBankS has announced a reference price of 33,900 VND per share for the first trading day of VPX on the Ho Chi Minh City Stock Exchange (HOSE). This comes shortly after the successful completion of its IPO, which involved the issuance of 375 million shares, propelling its equity capital to the forefront of the industry.

Technical Analysis Afternoon Session 04/12: Aiming for the October 2025 High

The VN-Index has paused its upward momentum but remains close to the Upper Band of the Bollinger Bands, while the MACD continues its ascent. Meanwhile, the HNX-Index has rebounded after retesting its November 2025 low (around the 255-259 point range).