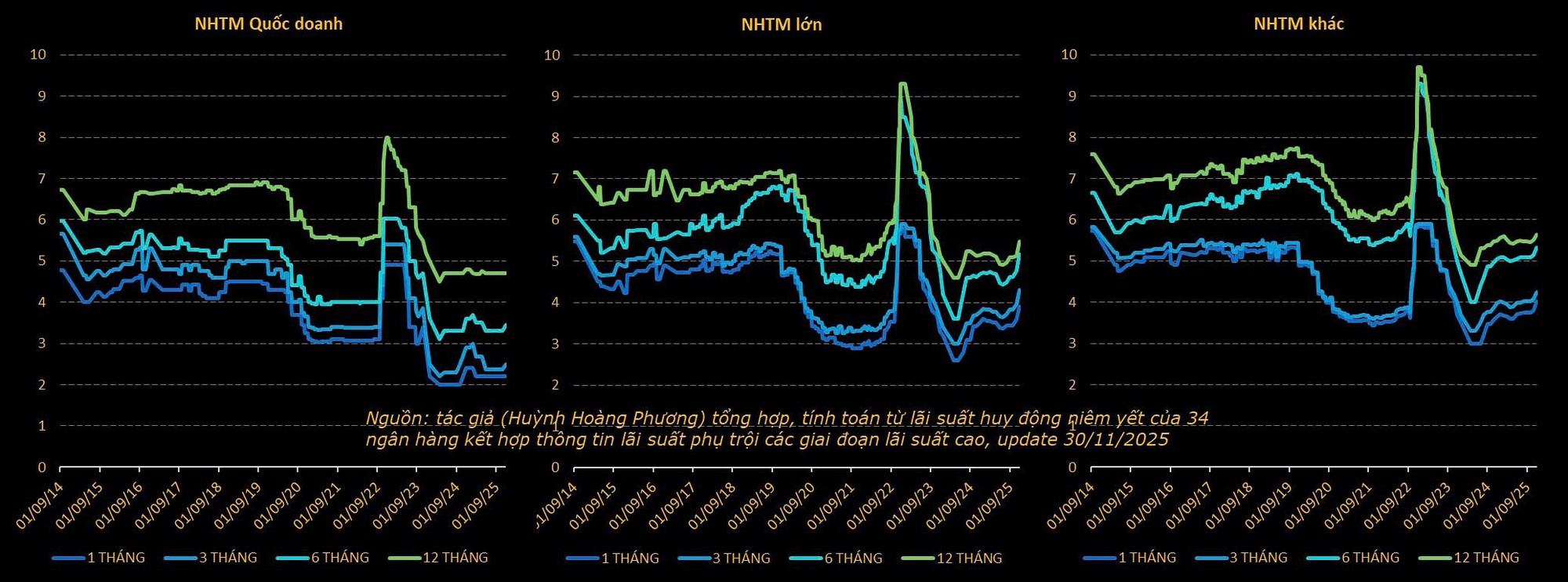

Recently, bank interest rates have shown signs of rising again. Initially, the increase was observed in a few banks and select tenors during August–September, but by October–November, this trend had spread across the entire system, with adjustments made to various tenors. Currently, some savings accounts offer interest rates of 6% per annum or higher, even for smaller deposits.

The rise in deposit interest rates across multiple banks and tenors has raised concerns among investors. However, financial expert Huỳnh Hoàng Phương suggests that to accurately assess the impact of interest rates—a core variable affecting most asset classes in Vietnam—a more comprehensive perspective is necessary.

A rapid and significant interest rate hike is unlikely

When evaluating the impact of interest rates on the market and investment flows, investors should consider two primary angles. First, the trend of change: whether interest rates are stable, rising, or falling, and the pace of adjustment. Second, the level or baseline: whether current and near-future interest rates are in a low (supportive), neutral, or high (tightening) range.

The current context reveals prolonged credit growth outpacing deposit growth, forcing many banks to rely heavily on interbank market funds (Market 2), pushing the loan-to-deposit ratio to high levels. Meanwhile, exchange rate risks persist, prompting the State Bank to prioritize exchange rate stability and reduce support in Market 2. This has tightened short-term capital and increased pressure on Market 1 interest rates.

According to experts, interest rates are likely to rise slightly in the near term, aligning with the current supply-demand dynamics of capital. The deposit market shows clear segmentation: private banks are raising rates faster than state-owned banks. Major private banks like MBB, ACB, TCB, VPB, and HDB have increased deposit rates to support lending expansion, particularly in real estate, over the first 10 months of the year.

Consequently, the interest rate gap between large private banks and state-owned banks has widened. Historically, when this gap expands, the “big four” state-owned banks often raise rates to retain deposits. With the loan-to-deposit ratio remaining high, further rate increases are possible, and the big four may soon join this adjustment cycle.

Experts believe a rapid, significant rate hike (change) leading to a tightening phase (level) that could jeopardize the economy and risky assets is unlikely. This is due to the global easing of monetary policy and the Fed’s rate-cutting cycle, which will reduce external pressure in 2026. Additionally, domestic inflation risks remain low, as actual consumption recovery is slow (despite short-term impacts from natural disasters).

Another factor is the economy’s need for recovery support, especially after a year of natural disasters, with growth heavily reliant on investment—which requires a favorable interest rate environment. Therefore, experts predict a slow rate increase, similar to 2015–2019, but not a sharp tightening phase, though low-probability scenarios must be monitored.

The era of cheap money is over—how will the stock market react?

Observing economic cycles and VN-Index movements reveals consistent market reactions to interest rate phases.

During the “golden phase,” when rates rise slowly from a low to neutral level, the market tends to consolidate, with movements driven by fundamentals. This phase sees significant sector differentiation, making stock selection critical.

In contrast, the “green phase,” marked by sharp rate cuts, sees cheap money fueling liquidity, leading to rapid, broad, and speculative market gains.

The “red phase,” characterized by steep rate hikes and tight policies, poses significant risks to risky assets like stocks and real estate.

Experts suggest the market entered the “golden phase” in September 2025, transitioning from the previous “green phase.” Rates are rising slowly from a low base, remaining in a supportive to neutral range.

This context supports key insights. First, the risk of a sharp market decline akin to the “red phase” remains low, but rate and exchange rate movements must be closely monitored. Second, the era of cheap money and extreme liquidity is over, reducing room for short-term speculation while increasing risk relative to expected returns.

The market’s consolidation phase may bore short-term investors but offers opportunities for long-term accumulation of quality stocks into 2026. This period demands careful selection and patience, not emotion-driven trading.

A notable comparison is the 2015–2017 period. As exchange rate pressures mounted, the State Bank raised interbank rates, gradually increasing deposit rates in 2015. The stock market entered prolonged consolidation but resumed its upward trend as exchange rates stabilized in 2016. By 2017, the market surged on strong foreign inflows.

In summary, while rate hikes are nearly certain, they are likely to be slow and non-disruptive, maintaining a supportive to neutral range for economic recovery. However, adverse scenarios, particularly from exchange rates, capital flows, and macroeconomic conditions, must be monitored.

In this context, the VN-Index is expected to operate in the “golden phase,” with fundamentals driving movements rather than risk-driven sentiment.

What Does the Surge in Housing Prices and Credit Reveal?

Real estate experts warn of a potential housing bubble as property prices surge to three times the average income, while real estate loans now account for a staggering 24% of total outstanding debt. Growing concerns surround rising bank deposit interest rates, speculative capital inflows into land, and escalating inventory levels, all of which heighten the risk of market instability.

Central Bank Unexpectedly Raises Interest Rates on Forward Purchases to 4.5%: What’s Behind the Move?

Following the overnight interbank interest rate surge to 7.48% per annum on December 3rd, the State Bank of Vietnam (SBV) unexpectedly adjusted the repo rate for collateralized lending from 4% to 4.5% per annum on December 4th. This move has sparked market speculation about potential ripple effects on the broader interest rate landscape in the interbank market, where transactions occur between banks, businesses, and individuals.