According to recent reports, Birch Real Estate Business Limited Liability Company (BIRCH), a subsidiary of UOB, finalized the acquisition of Phuong Dong Real Estate Investment and Business Company Limited (Phuong Dong Real Estate) in late February. The total cash value of the deal was 6.9 trillion VND, equivalent to 365 million USD.

As of February 28, 2025, Phuong Dong Real Estate’s net asset value was 2.4 trillion VND. The agreed-upon purchase price resulted in BIRCH acquiring 100% ownership of Phuong Dong Real Estate post-transaction.

In a recent report, PwC stated that the transaction value was 270 million USD. Through its subsidiary, UOB now holds 100% ownership of Phuong Dong Real Estate.

Prior to the acquisition, in December 2024, Phuong Dong Real Estate was led by Ms. Vu Thi Phuong Thu as CEO and legal representative. The company’s charter capital was 2,811 billion VND, with Saigon Investment and Development Corporation (SDI) holding 90% and Masterise Agents LLC holding 10% (as of December 2024).

| SDI is the developer of the Sai Gon Binh An urban area (commercially known as The Global City), spanning over 117 hectares. It is strategically located at the intersection of the Long Thanh – Dau Giay Expressway and Do Xuan Hop Street in the former Thu Duc District, Ho Chi Minh City. |

Subsequently, SDI divested entirely, leaving Masterise Agents with 99.99% ownership and Ms. Bui Thi My Duyen with 0.01%. By early February 2025, Phuong Dong Real Estate increased its charter capital to 2,966 billion VND, maintaining the same ownership structure. Ms. Vu Thi Phuong Thu remained as CEO and legal representative.

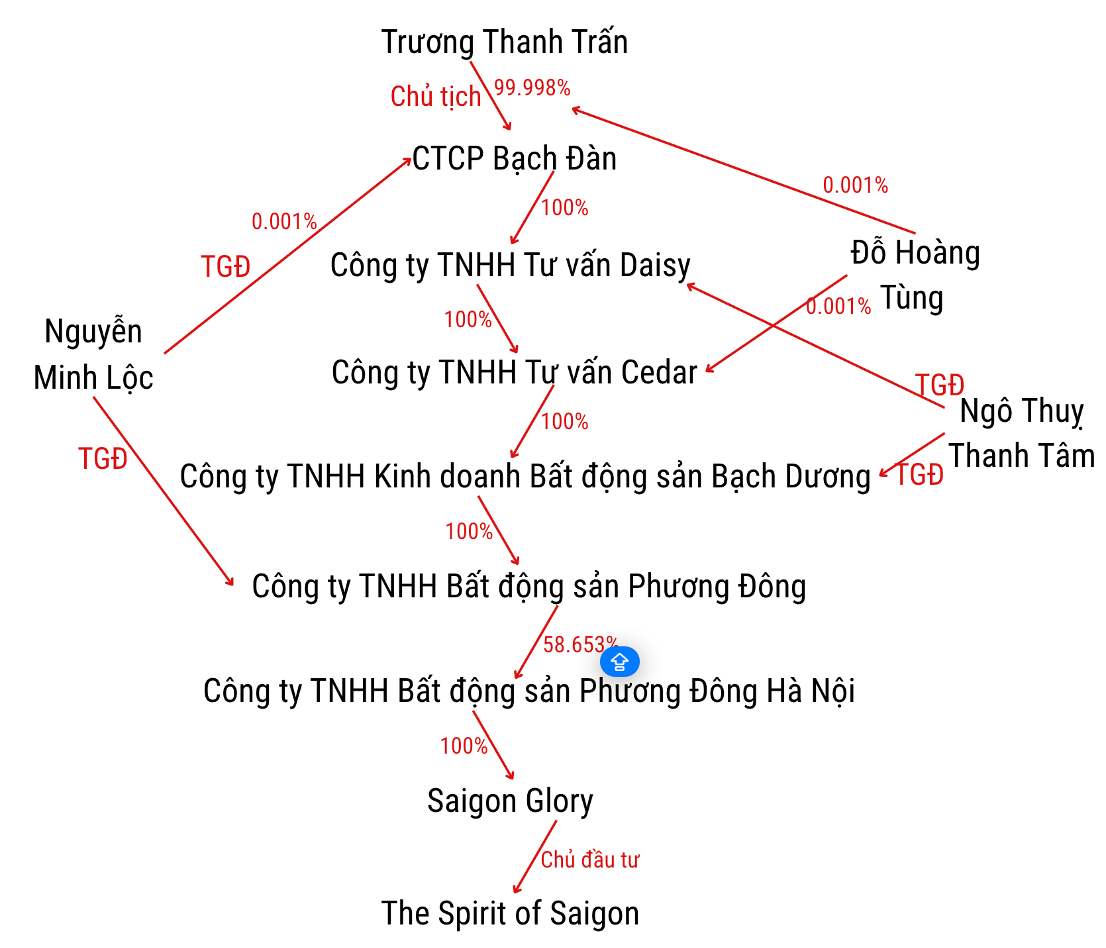

On February 24, the legal representatives changed to Mr. Ko Eng Ken (Singaporean) as Chairman of the Board and Mr. Nguyen Minh Loc as CEO. Concurrently, the company’s ownership shifted to Bach Duong Real Estate Business LLC (Bach Duong Real Estate).

Bach Duong Real Estate, established in October 2024, primarily engages in real estate business. With an initial charter capital of 1 billion VND, it is owned by Cedar Consulting LLC. Its legal representatives include Mr. Wee Chai Lin, Corrine (Singaporean) as Chairman and Ms. Ngo Thuy Thanh Tam as CEO.

In December 2024, the company increased its capital to nearly 750 billion VND. By mid-February 2025, just before the Phuong Dong Real Estate acquisition, its capital was raised to nearly 4,846 billion VND. Mr. Corrine holds 99.998% of the authorized capital, with the remainder split between Ms. Tam and Ms. Nguyen Thi Hoai Thu.

Cedar Consulting, established approximately two weeks before Bach Duong Real Estate, shares the same address at 67 Nguyen Thi Minh Khai, Ben Thanh Ward, District 1, Ho Chi Minh City. Registered solely for management consulting services, its initial charter capital was 1 billion VND, owned by Daisy Consulting LLC. Its legal representatives are Mr. Witthawat Phetgajaysaeng (Thai) as Chairman and Mr. Do Hoang as CEO. By December 2024, Cedar Consulting increased its capital to nearly 750 billion VND, with 99.998% authorized to Mr. Phetgajaysaeng and the remainder split between Mr. Tung and Mr. Huynh Thanh Thanh.

Daisy Consulting, established in September 2024, is also headquartered at 67 Nguyen Thi Minh Khai. With an initial charter capital of 1 billion VND, it is owned by Bach Dan Corporation. Its legal representatives are Ms. Mona Yong Lai Peng (Singaporean) as Chairman and Ms. Ngo Thuy Thanh Tam as CEO.

In December 2024, the company raised its capital to nearly 750 billion VND, with 99.998% authorized to Ms. Peng and the remainder split between Ms. Tam and Ms. Nguyen Thi Hoai Thu. By mid-February 2025, its capital was increased to match Phuong Dong Real Estate’s 4,846 billion VND, maintaining the same ownership ratio.

Bach Dan Corporation, established in August 2024, is also located at 67 Nguyen Thi Minh Khai. Registered solely for management consulting services, its initial charter capital was 1 billion VND. Mr. Truong Thanh Tran, as Chairman and legal representative, held 99.998%, with the remainder split between Mr. Do Hoang Tung and Mr. Nguyen Minh Loc, CEO and legal representative. Mr. Loc also serves as CEO of Phuong Dong Real Estate.

In October 2024, the legal representatives changed to Mr. Lai Jing Wey (Singaporean) as Chairman and Mr. Loc as CEO. Simultaneously, 99.998% of the capital was held by Linden Property Investment Vietnam Pte. Ltd (headquartered at UOB Plaza, Singapore).

By December 2024, the company’s capital was raised to nearly 750 billion VND, matching its subsidiaries. In mid-February 2025, the capital was further increased to 4,846 billion VND, maintaining the same foreign ownership ratio.

The Complex Ownership Structure of Phuong Dong Real Estate Under UOB’s Acquisition

Compiled by the author

|

Phuong Dong Real Estate founded and held 50% of Phuong Dong Hanoi Real Estate LLC in May 2019. By June 2019, its ownership increased to 58.653%, which was later transferred to Eastern Real Investment LLC. Phuong Dong Hanoi Real Estate is the new owner of Saigon Glory, the developer of the iconic Ben Thanh quadrilateral project, The Spirit of Saigon. Among the foreign executives, Mr. Witthawat Phetgajaysaeng serves as Senior Vice President of Project Management at UOB and heads the corporate real estate services division of UOB Thailand. Ms. Mona Yong Lai Peng and Mr. Lai Jing Wey are also senior UOB executives specializing in legal, management, operations, and leasing of commercial and office projects. In April, UOB Singapore announced an additional investment of 2,000 billion VND to increase the charter capital of United Overseas Bank (Vietnam) Limited Liability Company to 10,000 billion VND. Pending regulatory approval, UOB Vietnam will become the second-largest foreign-owned bank in Vietnam by charter capital. Alongside this capital increase, UOB’s leadership announced plans to construct a new UOB Plaza headquarters along the Saigon River in District 1, Ho Chi Minh City. The project will support the group’s business operations and expand its workforce over the next five years. |

– 19:57 05/12/2025

Agora City: The Epicenter of Investment in Ho Chi Minh City’s Western Hub

In a fiercely competitive real estate market poised for a new cycle, Agora City stands out with its dual advantages: immediate pink book ownership and a master-planned urban lifestyle. This unique combination positions it as a magnet for secure year-end investments, offering investors the promise of sustainable value appreciation.

Phú Thọ Approves $4.4 Billion Investment for Eco-Urban Development Project

The Phú Thọ Eco-Complex Urban Area boasts an estimated preliminary investment of over 102.8 trillion VND (excluding land rental and land use fees).