Mr. Nguyen Dang Quang, Chairman of Masan Group, at the MCH Roadshow event.

At the afternoon Roadshow on December 4th, Masan Consumer (MCH) leadership unveiled their new development strategy, shifting from a traditional Fast-Moving Consumer Goods (FMCG) company to a Consumer-Tech model.

This transformation involves redefining the target market, expanding from 27 million Vietnamese households to cater to the personalized needs of 100 million domestic consumers, and aiming for the global market of 8 billion people. To achieve the ambitious goal of a $15.7 billion market by 2030, the company relies on two key pillars: R&D capabilities and the Digital 4P technology platform.

Reports indicate that MCH’s R&D efficiency surpasses industry averages. The success rate of new products stands at 20%, four times higher than the 5% average for FMCG companies in Asia.

This success is bolstered by the integration of production and the WinCommerce retail system. Utilizing over 3,600 supermarkets and convenience stores as real-world testing grounds has reduced product development time from idea to market to 6-12 months, a 50% decrease from the typical 24-36 months in the industry.

Ms. Le Thi Nga, R&D Director of Masan Consumer

“While the success rate of new products in the Asian FMCG industry is around 5%, MCH achieves 20%—four times the industry average. The secret lies in leveraging the 4,500 WinCommerce outlets as real-world testing environments to accurately gauge consumer response.”

— Ms. Le Thi Nga, R&D Director of Masan Consumer

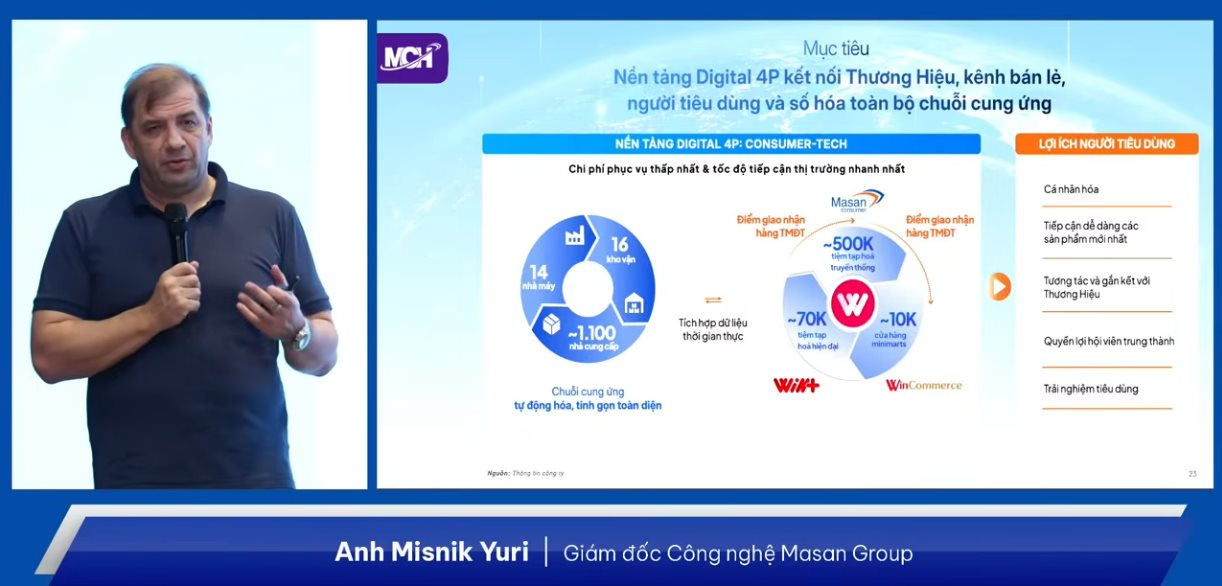

A critical component of the operational optimization strategy is the implementation of the “Digital 4P” platform and the “Retail Supreme” model. According to Mr. Yuri, the Group’s Technology Director, Digital 4P is not a marketing concept but a comprehensive digitization of the value chain, directly connecting Manufacturers, Retailers, and Consumers. The core of this system is the Retail Supreme project, which digitizes a distribution network of nearly 500,000 general trade outlets, with approximately 345,000 actively operating.

Mr. Misnik Yuri, Technology Director of Masan Group

Instead of the traditional “push” model, which relies on fixed sales routes and risks phantom inventory, Retail Supreme adopts a demand-driven “pull” model based on real-time needs and geographic areas.

This strategic shift resulted in a short-term “tactical retreat,” reflected in a 6% decline in Q3/2025 revenue compared to the same period last year. The direct cause was the proactive reduction of distributor inventory (destocking) to cleanse the system.

However, MCH leadership emphasizes this as a necessary trade-off. Reducing distributor inventory to 15 days ensures that product flow accurately reflects 100% of actual consumer demand (sell-out) rather than purchase orders (sell-in), while maintaining product freshness.

Simultaneously, 3,500 sales staff were transformed into “business partners,” using AI applications to optimize routes and product portfolios for each store. Data from a pilot in Ca Mau since July 2024 shows this model increases coverage and sales without raising personnel costs.

The Digital 4P system also employs QR codes on each product, enabling grocery store owners to place orders, provide feedback, and participate in engagement programs without relying on sales representatives.

Data from 500,000 outlets is integrated into a central processing center, allowing the company to accurately forecast production needs, reduce waste, and lower logistics costs. MCH leadership estimates that this technology platform will contribute an additional 2% to annual revenue and profit growth, creating a competitive barrier in distribution technology.

The effectiveness of the R&D and technology strategy is directly reflected in financial metrics. From 2017 to 2024, MCH achieved a compound annual revenue growth rate (CAGR) of 13% and maintained a net profit margin above 20%.

Mr. Huynh Viet Thang, CFO of Masan Consumer

Stable cash flow from operations has enabled the company to implement a cash dividend policy, distributing $1.5 billion over the past seven years. With a strong domestic market presence, where 98% of households use MCH products, the company aims for international sales to account for 10-20% of total revenue in the next five years through a premium brand-building strategy, rather than export processing.

Anticipated Catalysts for MCH Stock Post HOSE Listing

Hailed as the “missing piece” of Vietnam’s stock market, MCH shares are taking center stage ahead of their upcoming transfer to the HOSE. With the advantages of the transfer, coupled with a favorable macroeconomic backdrop and strong corporate fundamentals, analysts are confident in Masan Consumer’s explosive growth in 2026 and beyond.

Why Does Masan Group Consider MCH a “Priceless Diamond” in Chairman Nguyen Dang Quang’s Eyes?

For Masan Group, as the largest shareholder, MCH shares are more than just a financial instrument—they are akin to a “crown jewel.” These shares encapsulate a spectrum of values, from consumer engagement and aesthetic appeal to cultural significance and investment potential, making them a truly precious and enduring asset.

Vietnamese Enterprise: Nearly 30 Years of Bringing Authentic Vietnamese Flavors to the World

Over the past three decades, Vietnam’s economy has undergone transformative shifts, reshaping the fast-moving consumer goods (FMCG) market. From an era of scarcity, the market has evolved into a supply boom and now thrives in an age of enhanced experiences and added value. Amid this evolution, leading enterprises are no longer defined solely by production capabilities but by their ability to redefine and modernize the consumer experience for millions of Vietnamese households.

MCH to Officially Announce HOSE Listing Plan on December 4th

As a leading player in the fast-moving consumer goods (FMCG) industry, Masan Consumer’s (UpCom: MCH) announcement of its listing roadmap on HOSE has captured market attention. The anticipation stems from the expectation that HOSE will welcome a robust enterprise with strong brands and a substantial scale, poised to become a long-term anchor for both domestic and foreign capital.