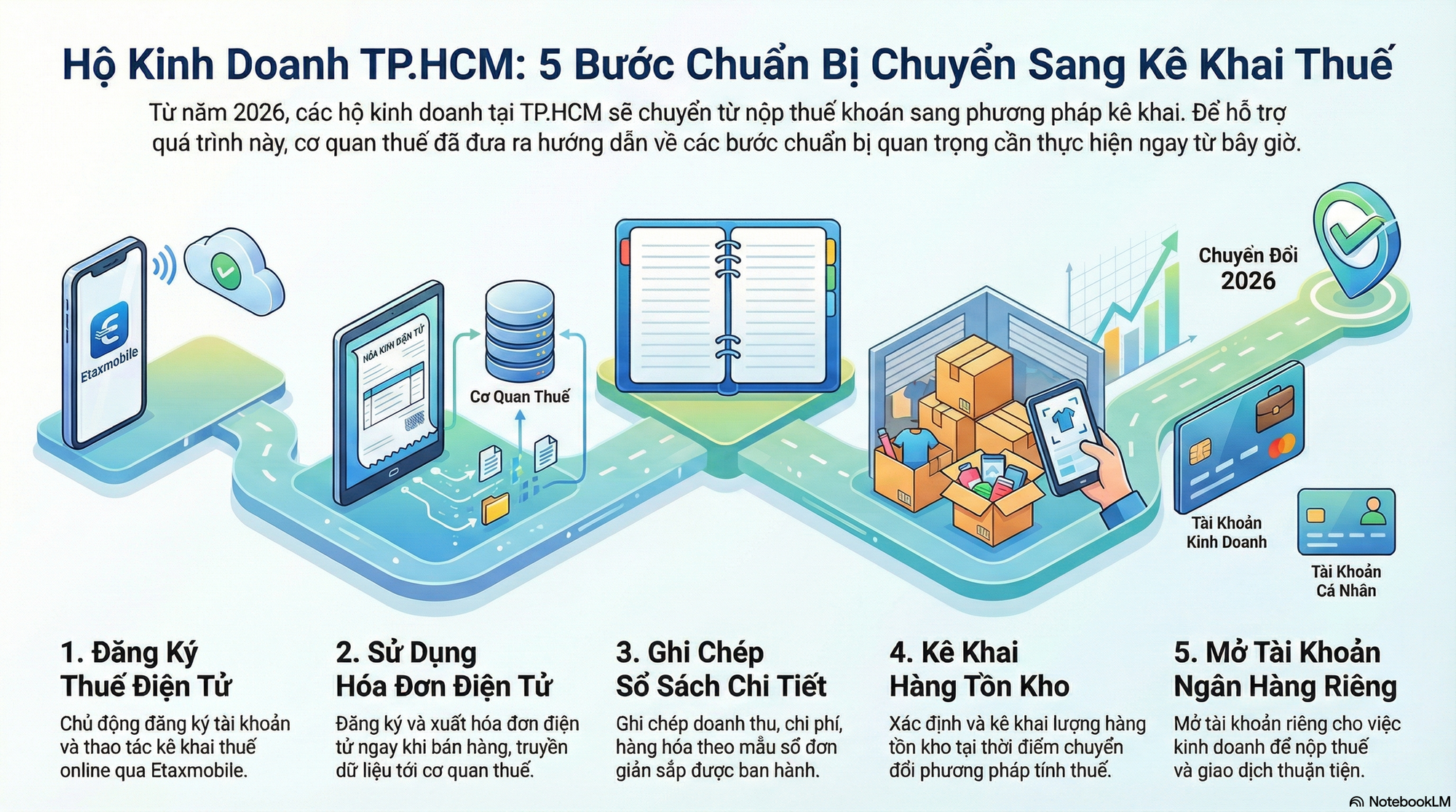

To support small businesses transitioning from lump-sum tax to revenue-based tax declaration and payment starting in 2026, the Ho Chi Minh City Tax Department has issued guidelines outlining the preparatory steps and implementation process.

Accordingly, the Ho Chi Minh City Tax Department encourages business owners to proactively register for an e-tax account and perform online tax declarations via the e-Tax system, Etaxmobile, or the public service portal.

Graphic: AI – V.Vinh

Additionally, businesses required to issue invoices must register for electronic invoices or electronic invoices generated from cash registers through the Electronic Invoice System (https://hoadondientu.gdt.gov.vn). They should also research and select a certified e-invoice software provider recognized by the Tax Authority, issue invoices immediately upon sale, and set up data transmission to the tax authority upon invoice creation.

Importantly, business owners should meticulously record revenue, expenses, tools, inventory, financial details, and tax obligations.

The Ministry of Finance will issue a circular providing simple and applicable ledger templates for various business types.

To manage inventory, the Ho Chi Minh City Tax Department advises businesses to identify and declare existing inventory at the time of transitioning from lump-sum tax to tax declaration.

Furthermore, businesses are encouraged to open a separate bank account for electronic tax payments, receiving payments, and transactions to avoid confusion with personal account activities.

Critical Note: 4 Essential Steps for Sole Proprietors to Declare Property Rental Taxes via eTax Mobile

The Tax Department has launched the “Experience Portal,” enabling business households and individuals leasing real estate to file their taxes seamlessly via the eTax mobile app.