Tien Phong Securities JSC (TPS, Stock Code: ORS, HoSE) has announced a resolution approving the issuance plan for the second private bond offering in 2025.

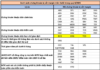

Accordingly, TPS plans to issue 5,000 ORS1502 bonds, each with a face value of VND 100 million, aiming to raise a maximum of VND 500 billion. These bonds are non-convertible, unsecured, and do not include warrants, creating direct debt obligations for the issuer.

The issuance is scheduled for December 5, 2025, through certificate and book-entry forms via an agent.

With a 12-month term, the bonds offer an initial interest rate of 8.25% per annum for the first interest period. Subsequent periods will be based on the reference rate plus a 2.7% margin, capped at 8.25% per annum. Interest is payable quarterly.

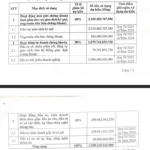

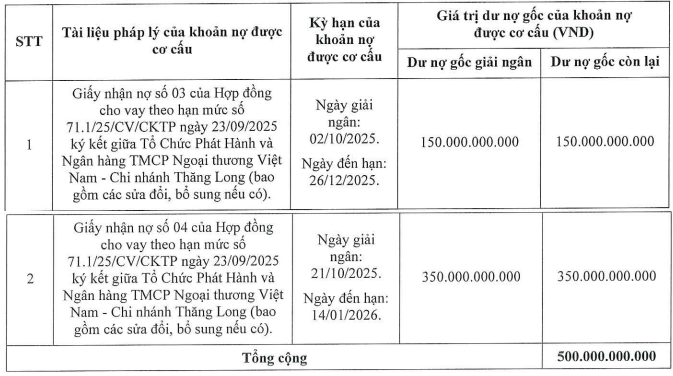

The proceeds will be used to settle principal payments on two bank loans maturing on December 26, 2025, and January 14, 2026, as detailed below:

Source: TPS

Previously, from September 24, 2025, to October 17, 2025, TPS issued 10,000 ORS12501 bonds domestically. With a face value of VND 100 million per bond, the total issuance value was VND 1,000 billion, maturing on September 24, 2028. The issuance interest rate was 8.3% per annum.

In other developments, on December 3, 2025, Tien Phong Securities finalized the shareholder list for the 2025 Extraordinary General Meeting.

The meeting will be held on December 27, 2025, both in-person and online. The agenda has not yet been disclosed.

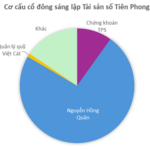

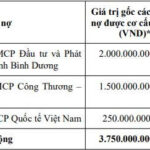

Billions Invested: Securities Firms Establish Digital Asset Companies

Unveiling on October 14th, Digital Asset Corporation emerges as a newly established entity with a robust charter capital of 120 billion VND.