On December 4, 2025, KraneShares announced the launch of the KraneShares Dragon Capital Vietnam Growth Index ETF (KPHO). KPHO provides access to carefully selected Vietnamese companies, leveraging a specialized fundamental growth analysis approach, within one of Southeast Asia’s most dynamic and promising economies.

Dragon Capital will serve as the designated advisor for KPHO. With over 30 years of hands-on experience in Vietnam and a 78.2% market share in ETFs as of October 31, 2025, Dragon Capital’s deep local market expertise and robust product foundation will enable KPHO to capitalize on growth opportunities in Vietnam’s equity market.

The KPHO ETF portfolio combines the DCVFM VN Diamond ETF (high-growth stocks not directly accessible to foreign funds) with a selection of tradable growth stocks. Unlike other U.S.-listed Vietnam investment products, KPHO overcomes traditional ownership cap barriers, allowing global investors to participate in Vietnam’s robust growth phase through the fund.

According to Dominic Scriven, Chairman and Co-Founder of Dragon Capital, KPHO offers foreign investors efficient and comprehensive access to Vietnam’s domestic equity market at a pivotal moment. This comes as Vietnam nears potential inclusion in major global indices such as FTSE and MSCI Emerging Markets.

– 18:00 05/12/2025

Foreign Funds Reduce Stake in Dat Xanh Group Below 9%

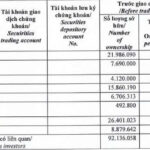

Dragon Capital has recently divested 852,000 shares of DXG through four of its member funds, reducing its ownership stake in Dat Xanh Group to 8.9592%.

MBS Partners with Dragon Capital to Distribute Open-Ended Fund Certificates on MFUND Platform

MBS and Dragon Capital have officially partnered to distribute open-ended fund certificates via the MFUND platform. This collaboration between a leading billion-dollar market cap securities firm and a top fund manager is poised to enhance product accessibility, foster long-term investment trends, and elevate capital professionalism in the market.

Vietnam’s Recovery Phase: Corporate Profits Poised to Rise, Says Dominic Scriven (Dragon Capital)

At the Annual Listed Companies Conference held on the afternoon of December 3rd, Mr. Dominic Scriven, Chairman of the Board of Directors of Dragon Capital Fund Management JSC, delivered a keynote address. His presentation focused on assessing the global and Vietnamese macroeconomic landscape, emphasizing the critical roles of policy, public investment, and capital markets. Additionally, he provided insightful analysis and predictions regarding the Vietnamese stock market.

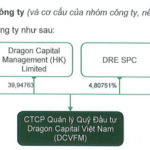

Dragon Capital Seeks to List Shares on UPCoM

On December 1st, Dragon Capital Vietnam Fund Management JSC (Dragon Capital – DCVFM) announced a Board of Directors resolution approving the registration of centralized custody of shares with the Vietnam Securities Depository (VSD). Simultaneously, the company has registered for trading its shares on the UPCoM system.