In Q3/2025, Digiworld reported impressive business growth with net revenue reaching VND 7.4 trillion and post-tax profit hitting VND 168 billion, up 19% and 39% respectively compared to the same period in 2024.

The company’s product structure continued to shift from mobile phones (26% of revenue) to laptops & tablets (43%) and office equipment (22%). Notably, the laptop & tablet and office equipment segments led the growth. The home appliance segment also saw a significant increase due to expanded partnerships. Consumer goods remained stable, while mobile phone sales experienced a slight decline.

In a recent analysis report, VNDirect highlighted Digiworld’s growth potential driven by its product structure transformation.

Data Center Investment Wave and FDI Boost Office Equipment Segment

In 2026, VNDirect expects the office equipment segment to remain a key driver of Digiworld’s revenue growth. Demand for office equipment is supported by two factors: (1) the surge in data center construction investments and (2) the expansion of FDI enterprises in Vietnam.

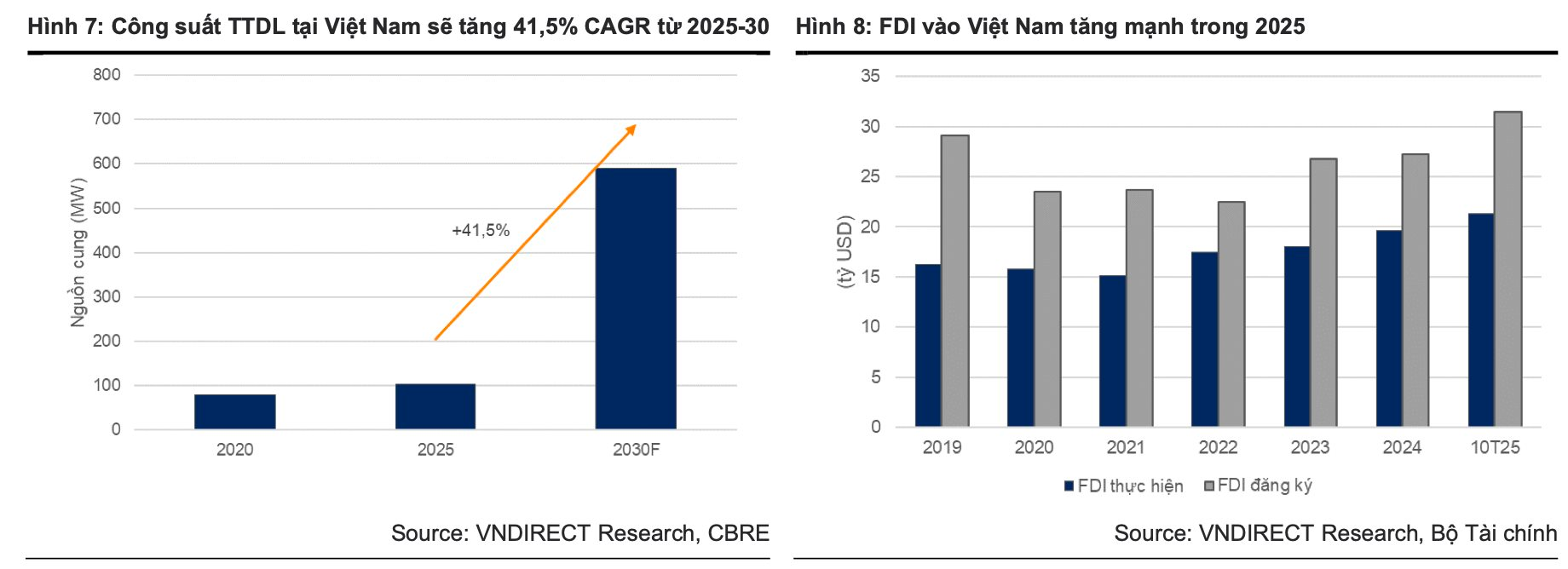

Vietnam’s stable macro environment, safe geographical location, and low data center construction costs make it an attractive destination, significantly boosting demand for office equipment and related infrastructure. According to CBRE, Vietnam’s data center market capacity reached 104MW as of October 2025 and is projected to hit 589 MW by 2030, a 5.6-fold increase.

Regarding FDI inflows, 2025 marked a high point with disbursed capital reaching its highest level in five years. In the first ten months of 2025, realized FDI in Vietnam was estimated at USD 21.3 billion, up 8.8% year-on-year, the highest in the past five years. In 2026, Vietnam is expected to remain an attractive destination for foreign investors.

VNDirect forecasts Digiworld’s office equipment revenue to grow by 42%/24% year-on-year, reaching VND 6.2 trillion/8.3 trillion (equivalent in USD) in 2025/2026.

Home Appliance Segment Benefits from Real Estate Recovery and Smart Home Devices

Alongside the office equipment segment, the home appliance segment will also contribute to Digiworld’s future growth, supported by (1) the recovery of the residential real estate market in 2026 and (2) the trend of integrating AI into home appliances.

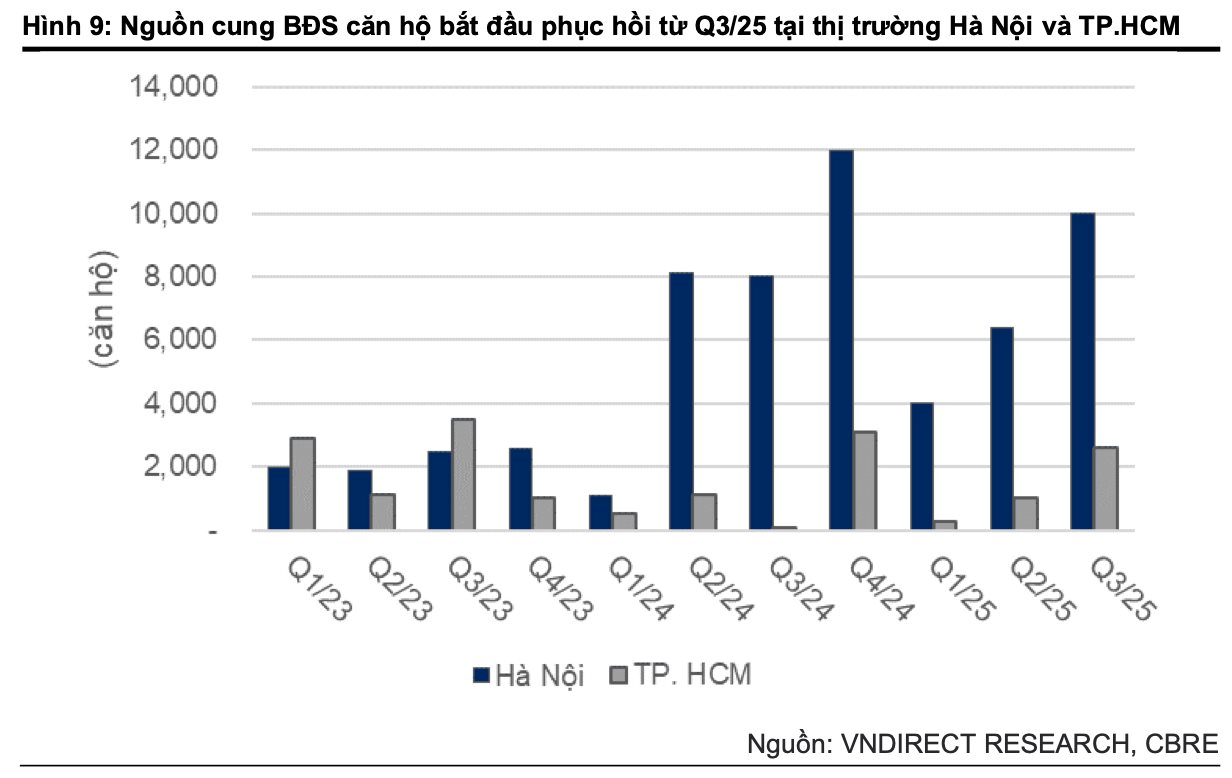

For the residential real estate market, by Q3/2025, supply in Hanoi began to improve. New supply absorption rates remained high, indicating continued strong market demand. According to CBRE and Savills, supply in Hanoi is expected to remain robust in Q4/25, while supply in Ho Chi Minh City will start recovering and accelerating from 2026.

In the race for smart home devices, major tech corporations are integrating advanced features, particularly AI, into their products. As personal incomes rise, consumers increasingly prioritize convenience, connectivity, and automation. Vietnam stands out in the region with over 100 million people and approximately 6 million high-income households.

VNDirect believes these factors will drive new purchases and replacements of home appliances. Digiworld’s home appliance revenue is projected to grow by 85%/68% year-on-year, reaching VND 1.8 trillion/3.1 trillion in 2025/2026.

Gross Profit Margin Improves with Expanded Product Portfolio

One of Digiworld’s consistent growth strategies is the quarterly addition of new brands. In Q4/2025, Digiworld expanded distribution for three new product groups from Xiaomi, Sony, and Motorola. Notably, Xiaomi’s product line is expected to positively contribute to improving profit margins.

In 2026, Digiworld plans to further expand its product portfolio with new models in office equipment, home appliances, and a new category related to electric vehicles—encompassing not only electric cars but also parts and related products. Consequently, VNDirect expects Digiworld’s gross profit margin to improve to 9.7% in 2026.

Eastern Real Estate Market Gains Momentum as Infrastructure Projects Accelerate in the Final Quarter

Real estate in Binh Duong, Dong Nai, Long An, and Ba Ria – Vung Tau (formerly known as such before consolidation) is emerging as a highlight towards the end of the year. Among these, the former Binh Duong area is garnering the most attention, thanks to its advantages in migrant population, land availability, and transportation infrastructure.