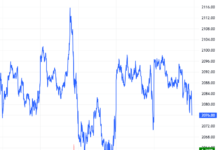

Contrary to the typical year-end exchange rate pressures, the USD/VND rate has largely remained stable over the past two months, amidst the complex and unpredictable dynamics of the international market.

In a media briefing on December 5th, Mr. Phạm Chí Quang, Director of the Monetary Policy Department at the State Bank of Vietnam (SBV), stated: “Since the beginning of 2025, the foreign exchange market and VND exchange rate have been primarily influenced by the intricate and unforeseeable developments in the global market. These include the unpredictable monetary policy of the US Federal Reserve (Fed), US trade and tariff policies, and the fluctuations of the international USD. During certain periods, the domestic foreign exchange supply-demand balance faced temporary pressures from short-term factors.”

In response, the SBV has implemented a flexible exchange rate management approach, tailored to market conditions, to absorb external shocks. This has been accompanied by coordinated monetary policy tools (interest rates, VND liquidity) and foreign exchange interventions to stabilize the foreign exchange market and exchange rate, thereby contributing to macroeconomic stability and inflation control.

As of December 5th, the USD/VND exchange rate has increased by approximately 3.5% compared to the end of 2024, with the foreign exchange market operating smoothly.

The USD/VND exchange rate has been largely stable over the past two months. Photo: Nam Khánh |

According to Mr. Phạm Chí Quang, following a period of pressure from external factors and short-term market volatility, these elements have shown signs of stabilization. Meanwhile, Vietnam’s trade activities and external balances remain positive.

“With the maintenance of fundamental macroeconomic factors, the medium- and long-term foreign exchange supply-demand balance is expected to be supported, fostering a more stable exchange rate environment,” Mr. Quang remarked.

He added that moving forward, the SBV will closely monitor domestic and international market developments, coordinating monetary policy tools and exchange rate management flexibly and synchronously. The bank stands ready to intervene in the foreign exchange market when necessary.

“In this process, unreasonable exchange rate expectations will be adjusted by the market as fundamental factors continue to reflect in actual developments,” Mr. Quang explained.

Mr. Phạm Chí Quang emphasized that in a multi-dimensional pressure market context, the SBV has been synchronously and flexibly managing monetary policy tools to regulate VND liquidity. This supports market liquidity, stabilizes the monetary market, and facilitates capital supply for the economy, while also contributing to exchange rate stability.

“The SBV has various monetary regulation channels and flexibly employs these tools at different stages, in line with market dynamics and monetary policy objectives,” the representative of the Monetary Policy Department affirmed.

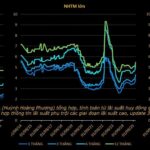

Recently, some credit institutions have increased their liquidity demands. To meet these needs, especially towards year-end, the Monetary Policy Department’s leadership noted that alongside open market operations, the SBV has implemented foreign exchange swap transactions with credit institutions to stabilize the monetary market.

Mr. Quang stated that the SBV will continue to closely monitor developments and proactively regulate using appropriate tools and solutions with suitable timing and dosage, both to support exchange rate stability and macroeconomic stability.

|

On December 4th, the State Bank of Vietnam (SBV) introduced a new foreign exchange swap (FX SWAP) channel with a maximum limit of 500 million USD, a 14-day term, and a rate of 23,945-23,955 VND/USD. Essentially, banks can temporarily exchange USD for VND for 14 days and then swap back, with a cost of approximately 1.1% per annum. According to Saigon-Hanoi Securities (SHS), this tool helps alleviate VND liquidity tensions and reduces swap costs in the market during the year-end peak period. The 500 million USD scale is likely a test of market reaction; if the tool operates smoothly, the regulator can expand the volume or repeat similar swap sessions in the future. |

Tuân Nguyễn

– 19:05 05/12/2025

How Will the Stock Market React as Interest Rates Begin to Rise?

Interest rates on deposits across numerous banks have risen across various terms, sparking concern among many investors.

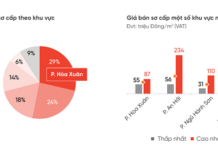

What Does the Surge in Housing Prices and Credit Reveal?

Real estate experts warn of a potential housing bubble as property prices surge to three times the average income, while real estate loans now account for a staggering 24% of total outstanding debt. Growing concerns surround rising bank deposit interest rates, speculative capital inflows into land, and escalating inventory levels, all of which heighten the risk of market instability.

Central Bank Unexpectedly Raises Interest Rates on Forward Purchases to 4.5%: What’s Behind the Move?

Following the overnight interbank interest rate surge to 7.48% per annum on December 3rd, the State Bank of Vietnam (SBV) unexpectedly adjusted the repo rate for collateralized lending from 4% to 4.5% per annum on December 4th. This move has sparked market speculation about potential ripple effects on the broader interest rate landscape in the interbank market, where transactions occur between banks, businesses, and individuals.

Dr. Nguyen Tri Hieu Warns of Bubble Signs in Vietnam’s Real Estate Market

The market is teetering on the brink of a bubble as supply threatens to surge, inventories swell, and housing becomes increasingly inaccessible for the general population.