Asset Sales to Settle Debts with Truong My Lan

Quoc Cuong Gia Lai Joint Stock Company (stock code QCG, HoSE) has released a document seeking shareholder approval via written opinion on a financial restructuring plan to settle debts related to the Bac Phuoc Kien residential project. The deadline for opinions is December 16, 2025.

To secure the necessary funds for fulfilling outstanding legal obligations and repaying previously mobilized amounts, Quoc Cuong Gia Lai proposes transferring equity stakes in its subsidiaries and affiliates during 2025. Specific companies involved have not yet been disclosed. The transfer value will not be lower than the initial investment cost, and an independent valuation firm will assess the assets to determine the transfer price.

Eligible transferees include all partners and investors, including related parties, with sufficient financial capacity to ensure payment. The process will adhere to principles of equality, voluntariness, and mutual benefit, safeguarding the interests of the company and its shareholders.

Additionally, QCG seeks shareholder approval to collaborate with capable investors, including related parties, on real estate projects owned by the company.

Illustrative image

In its shareholder communication, Quoc Cuong Gia Lai acknowledges that 2025 remains challenging due to broader market difficulties and unresolved legal issues surrounding previous projects. The company faces a court-mandated payment of VND 2,882.8 billion related to Truong My Lan’s case, while ongoing projects and unsold inventory strain its financial position. Operational and investment costs further exacerbate these challenges, testing the leadership’s resilience.

In compliance with the Ho Chi Minh City Civil Judgment Execution Agency’s Decision No. 1672/QĐ-CTHADS dated January 10, 2025, Quoc Cuong Gia Lai has paid VND 1,100 billion (funded through advance payments from hydropower plant sales and personal loans).

Increased Borrowing from Leadership Affiliates

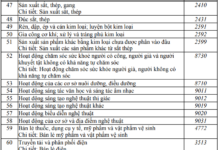

According to the Q3 2025 consolidated financial report, Quoc Cuong Gia Lai’s total assets stand at VND 8,761 billion, slightly down from the beginning of the year.

Cash and bank deposits total VND 154 billion. Inventory is valued at VND 1,178 billion, a VND 100 billion decrease year-to-date, comprising VND 568 billion in unfinished real estate and VND 558 billion in completed properties.

Long-term work-in-progress assets exceed VND 5,400 billion, tied up in the Bac Phuoc Kien residential project.

Liabilities total VND 4,150 billion, with short-term financial debt at VND 157 billion and long-term debt at over VND 200 billion.

The most significant liability remains the obligation related to the Bac Phuoc Kien project. As of September 30, 2025, the payable balance to Sunny Island Investment JSC has decreased to VND 1,983 billion.

In 2017, Sunny Island and Quoc Cuong Gia Lai signed a land purchase agreement for Bac Phuoc Kien, with Sunny Island committing VND 4,800 billion. After disbursing VND 2,882.8 billion, payments ceased, linking the transaction to Truong My Lan’s case and Van Thinh Phat Group.

In late 2024, the Ho Chi Minh City People’s Court ordered Quoc Cuong Gia Lai to return VND 2,882.8 billion to reclaim the project.

Concurrently, QCG recorded loans exceeding VND 1,100 billion from individuals, primarily leadership affiliates.

Notably, a VND 507 billion loan from Lai Thi Hoang Yen, daughter of Chairman Lai The Ha, increased by VND 400 billion from the previous quarter.

Similarly, a VND 527 billion loan from Lau Duc Duy, brother-in-law of CEO Nguyen Quoc Cuong, rose by VND 395 billion since Q2 2025.

For the first nine months, QCG reported revenue of VND 354 billion (up 46%), pre-tax profit of VND 46 billion, and post-tax profit of VND 34 billion, quadrupling year-on-year. However, these figures fall short of the annual targets of VND 2,000 billion in revenue and VND 300 billion in pre-tax profit.

Angimex Outlines 2026 Restructuring Plan, Presents Debt Resolution Strategies for Hundreds of Billions

After a prolonged delay due to staffing crises and financial reporting challenges, An Giang Import-Export Corporation (Angimex, UPCoM: AGM) has scheduled its 2025 Annual General Meeting of Shareholders for December 20. The assembly is expected to focus on strategies to address significant debt, collateralized assets, and restructuring plans for 2026.

Unified Moves by The World Mobile Group, Tan Dai Hung Plastic, T-Corp, and Gemadept

Under the new provisions of the 2019 Securities Law (effective from January 1, 2021), all treasury shares purchased must be canceled, and the company is required to reduce its chartered capital accordingly. Given that treasury shares can no longer be resold as before, what is the purpose of such transactions?