In a recent press briefing, Mr. Phạm Chí Quang, Director of the Monetary Policy Department, announced that the State Bank of Vietnam (SBV) has initiated foreign exchange swap transactions with credit institutions to stabilize the currency market.

According to Mr. Quang, this move aims to meet the liquidity demands of the market, especially during the year-end period, alongside the open market operations (OMO) channel for money supply.

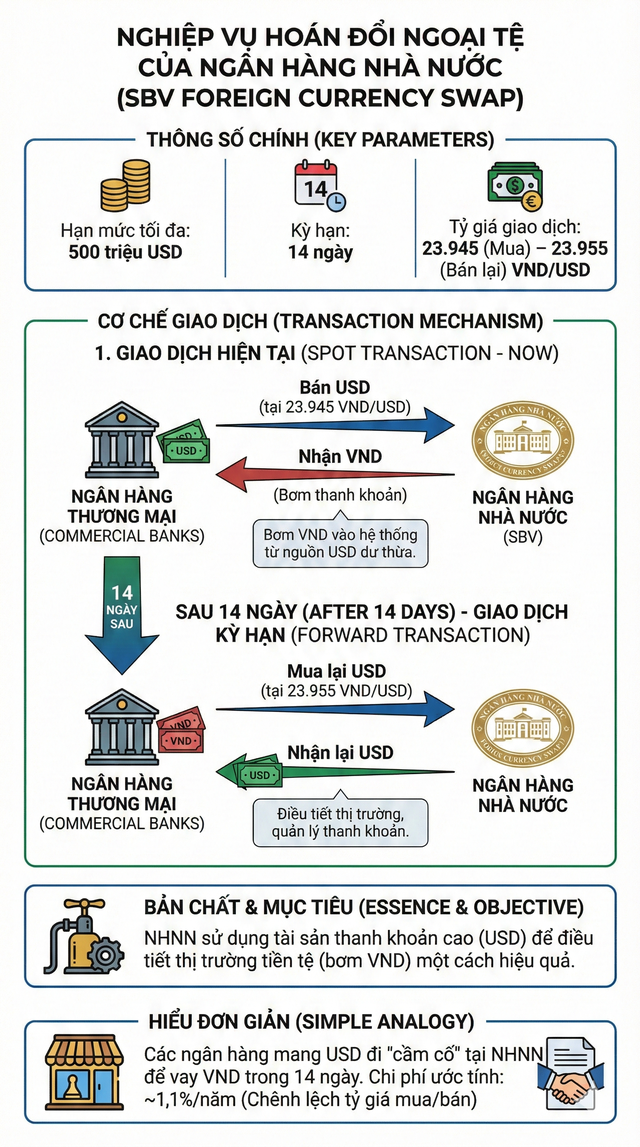

While Mr. Quang did not disclose specific details about the foreign exchange swap, interbank market sources indicate that the transaction began today (December 5) with a maximum limit of $500 million, a 14-day term, and an exchange rate ranging from 23,945 to 23,955 VND/USD.

Under this arrangement, the SBV purchases USD from banks at 23,945 VND/USD and sells it back after 14 days at 23,955 VND/USD. Essentially, commercial banks exchange their USD for VND from the SBV and repurchase the USD at the predetermined rate after two weeks. This mechanism allows the SBV to inject VND into the system using the excess USD in the banking system—a highly liquid asset that has not been fully utilized in monetary market regulation. Simply put, banks pledge their USD to the SBV to borrow VND for 14 days at an annual cost of approximately 1.1%.

SHS Securities commented, “This tool helps alleviate VND tension and swap costs in the market during the year-end peak. The $500 million volume is likely a test of market reaction, and if successful, the regulator could expand the volume or conduct similar swap sessions in the future.”

The SBV’s action comes amid rising liquidity demand in the banking system and interbank interest rates surging above 7%, the highest in three years. This new tool acts as an additional pipeline for VND injection into the banking system as the traditional OMO channel nears its limit.

The OMO channel, which relies on government bonds (GBs) held by banks as collateral, is constrained as the volume of OMO in circulation exceeds 360 trillion VND, nearly half of the eligible GBs for OMO pledging. This leaves limited room for further borrowing via this channel. In this context, the SBV has opened a “new liquidity reservoir” to inject VND without depending on GBs, making USD/VND swaps the most viable option.

The swap’s implementation had an almost immediate effect, quickly adding VND to the system, easing interbank interest rate pressure, and supporting system liquidity. Interbank rates cooled shortly after the transaction was announced on December 4 and are expected to decline further in the December 5 session.

However, injecting VND through swaps may exert some pressure on the exchange rate, as the narrowing VND-USD interest rate differential makes VND more abundant while reducing USD supply.

To mitigate this, the SBV simultaneously raised the OMO interest rate from 4.0% to 4.5% starting December 4, a crucial buffer measure. The 4.5% OMO lending rate establishes a “floor rate,” preventing interbank rates from falling too low and limiting pressure on the USD/VND exchange rate. The SBV aims to inject VND without making borrowing too cheap, and increasing the OMO rate is the optimal solution to preempt exchange rate pressures.

Over the past two months, the USD/VND exchange rate has largely stabilized despite external tensions and significant foreign currency purchases by the State Treasury. A key factor has been the positive VND-USD interest rate differential across most tenors, which has kept the exchange rate in check. However, this is only a temporary solution, as higher VND interest rates merely shift holdings between USD and VND within the system without attracting new USD inflows.

Analysts suggest that activating USD/VND swaps and raising OMO rates allows the SBV to address the system’s VND shortage without significantly disrupting interest rates or the exchange rate. Amid rising year-end capital demand, swaps provide greater flexibility and capacity to support system liquidity. This is not just a temporary fix but a signal that the SBV is expanding its regulatory toolkit, reducing reliance on a single channel, and enhancing its responsiveness to monetary market fluctuations.

Credit Reaches VND 18.2 Trillion as of November 27, Up 16.56% Year-to-Date

Credit growth is showing promising signs, with a positive trajectory compared to previous years. As of November 27, 2025, the economy’s credit reached over 18.2 million billion VND, marking a 16.56% increase from the end of 2024. This growth is particularly notable when compared to the same period in 2024, which saw an 11.47% increase from the end of 2023, and the end of 2024, which recorded a 15.09% rise from the end of 2023.

Central Bank Plans to Repeal 18 Outdated or Ineffective Legal Documents

The State Bank of Vietnam (SBV) is currently drafting and seeking feedback on a Circular to repeal several legal documents issued by the Governor of the SBV. This review is conducted in accordance with the Law on Promulgation of Legal Documents and its guiding decrees, with the aim of eliminating documents that have expired, lack a legal basis for application, or are no longer aligned with current management practices.

Central Bank Unexpectedly Raises Interest Rates on Forward Purchases to 4.5%: What’s Behind the Move?

Following the overnight interbank interest rate surge to 7.48% per annum on December 3rd, the State Bank of Vietnam (SBV) unexpectedly adjusted the repo rate for collateralized lending from 4% to 4.5% per annum on December 4th. This move has sparked market speculation about potential ripple effects on the broader interest rate landscape in the interbank market, where transactions occur between banks, businesses, and individuals.