Fecon Joint Stock Company (Stock Code: FCN, HoSE) has announced a Board of Directors Resolution approving the second dividend payment for 2022 to shareholders in cash.

Accordingly, Fecon plans to execute the second dividend payment for 2022 at a rate of 4%, meaning shareholders holding one share will receive 400 VND. The payment will be made in cash or via bank transfer.

The final registration date for shareholders to exercise their rights is December 18, 2025, with the expected payment date being December 30, 2025.

With over 157.4 million FCN shares outstanding, Fecon is estimated to allocate nearly 63 billion VND for this dividend payment.

Illustrative image

Regarding business performance, according to the consolidated financial report for Q3/2025, Fecon recorded net revenue of over 1,142.6 billion VND, a 53.5% increase compared to the same period last year. After deducting the cost of goods sold, gross profit reached over 157.2 billion VND, up 40.5%.

After accounting for taxes and fees, the company reported a net profit of over 16.5 billion VND, compared to just 29.4 million VND in the same period last year.

For the first nine months of 2025, Fecon achieved net revenue of over 3,289.6 billion VND, a 51.5% increase compared to the first nine months of 2024; post-tax profit reached over 33.6 billion VND, 24 times higher than the same period.

In 2025, Fecon set a business plan with a consolidated revenue target of 5,000 billion VND and a post-tax profit target of 200 billion VND. Thus, by the end of the first three quarters, Fecon has completed 65.8% of its revenue plan and 16.8% of its post-tax profit plan.

As of September 30, 2025, Fecon’s total assets increased by 15.3% compared to the beginning of the year, reaching over 11,194.4 billion VND. Of this, short-term receivables were nearly 4,780.8 billion VND, accounting for 42.7% of total assets; inventory was nearly 2,017.4 billion VND, accounting for 18% of total assets; and long-term work in progress was 1,499.7 billion VND.

On the other side of the balance sheet, total liabilities stood at over 7,806.8 billion VND, up 23.2% from the beginning of the year. Of this, loans and finance leases were over 5,162.3 billion VND, accounting for 66.1% of total liabilities.

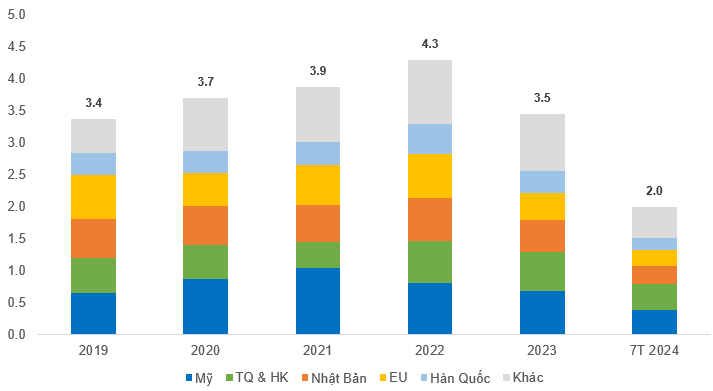

How Are Samsung’s Four Major Vietnamese Factories Faring Post-Trump’s Tariffs and Natural Disasters in Thai Nguyen?

South Korean conglomerate Samsung has unveiled its Q3 2025 business results, highlighting the performance of its four key manufacturing facilities in Vietnam: Samsung Thai Nguyen (SEVT) in Thai Nguyen province, Samsung Bac Ninh (SEV), Samsung Display Vietnam (SDV) in Bac Ninh province, and Samsung Electronics HCMC CE Complex (SEHC) in Ho Chi Minh City.

IDICO Announces 15% Cash Dividend Advance Payment

IDICO Group (HNX: IDC) has announced the dividend payment for its shareholders, offering a 15% cash dividend for the first phase of 2025, equivalent to 1,500 VND per share. The ex-dividend date is set for December 3rd, and shareholders can expect to receive their payments starting from December 23rd.

Top Hydropower Enterprise in Da Nang Announces Critical Update

The record date for shareholders is set for December 15, 2025, with the anticipated payment date following on December 25, 2025.