The Vietnam Bond Market Association (VBMA) recently released a report on the bond market for the week of November 24–28, 2025.

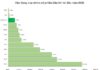

In the primary government bond market, on November 26, 2025, the State Treasury auctioned a total of VND 14,000 billion in government bonds across various tenors: 5 years (VND 3,000 billion), 10 years (VND 9,000 billion), 15 years (VND 1,500 billion), and 30 years (VND 500 billion).

The 5-year, 15-year, and 30-year bonds received no bids, while the 10-year bonds achieved a 67% bidding success rate.

From the beginning of 2025 to November 26, the State Treasury has raised nearly VND 306,919 billion through government bonds with tenors ranging from 5 to 30 years, meeting approximately 61.4% of the annual issuance target of VND 500,000 billion.

For the upcoming week (December 1–5, 2025), the State Treasury plans to auction VND 13,000 billion in government bonds: VND 3,000 billion for 5-year bonds, VND 8,000 billion for 10-year bonds, VND 1,500 billion for 15-year bonds, and VND 500 billion for 30-year bonds.

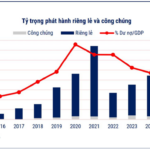

In the corporate bond market, according to VBMA data compiled from HNX and SSC (recorded by issuance and repurchase dates from HNX’s platform, subject to updates), as of November 28, 2025, there were 24 corporate bond issuances in November 2025, totaling VND 19,608 billion.

Source: VBMA

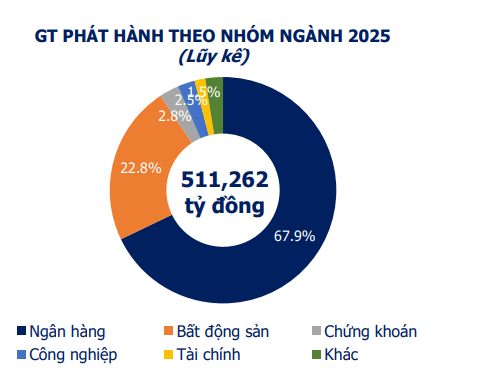

Year-to-date, the total corporate bond issuance value stands at VND 511,262 billion, comprising 28 public issuances worth VND 50,583 billion (9.9% of the total) and 418 private placements totaling VND 460,679 billion (90.1%).

Looking ahead, several companies have scheduled significant bond issuances. For instance, BAF Vietnam Agriculture JSC’s Board of Directors approved a public bond issuance plan for 2025, totaling up to VND 1,000 billion. These are non-convertible, unsecured bonds with a 3-year tenor and a fixed interest rate of 10% per annum.

Asia Commercial Bank’s Board of Directors also approved a third private bond issuance plan for 2025, divided into 20 tranches totaling VND 20,000 billion. These non-convertible, unsecured bonds have a face value of VND 100 million each and a maximum tenor of 5 years, with a mixed fixed and floating interest rate structure.

Conversely, in November 2025, companies repurchased VND 11,144 billion in bonds. Year-to-date, total early bond repurchases reached VND 271,756 billion, a 55% increase from 2024. Banks led this activity, accounting for 68.5% (VND 186,061 billion) of early repurchases.

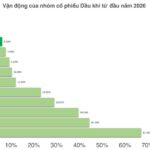

For the remainder of 2025, VND 28,082 billion in bonds will mature, with 35.9% (VND 10,078 billion) from the real estate sector and 28.7% (VND 8,050 billion) from the banking sector.

DIC Corp Completes Early Redemption of VND 800 Billion in Bonds

On November 27, 2025, DIC Corp successfully completed the early redemption of VND 800 billion in bonds under the code DIGH2326002, reducing the outstanding value of this bond issuance to VND 200 billion.

Is the Era of ‘Lost Trust’ in Corporate Bonds Over?

The corporate bond market is entering a phase of restructuring, marked by a surge in issuances but a sharp decline in buybacks. Concurrently, the Ministry of Finance has proposed new regulations designed to act as a “filter” for the market. These measures aim to enhance transparency and restore confidence, addressing the “trust deficit” that has previously plagued the sector.