Van Phat Hung Joint Stock Company (HOSE: VPH) has announced a change in its senior leadership. Mr. Ngo Thanh Xuan has resigned from his position as CEO and legal representative, effective December 2, 2025, citing personal reasons. The Board of Directors approved his resignation on December 5, 2025.

His successor is Mr. Chau Quang Dat, currently the Deputy CEO. Notably, Mr. Dat was appointed as Deputy CEO of VPH on November 7, 2025, less than a month before assuming the top executive role.

Prolonged Losses

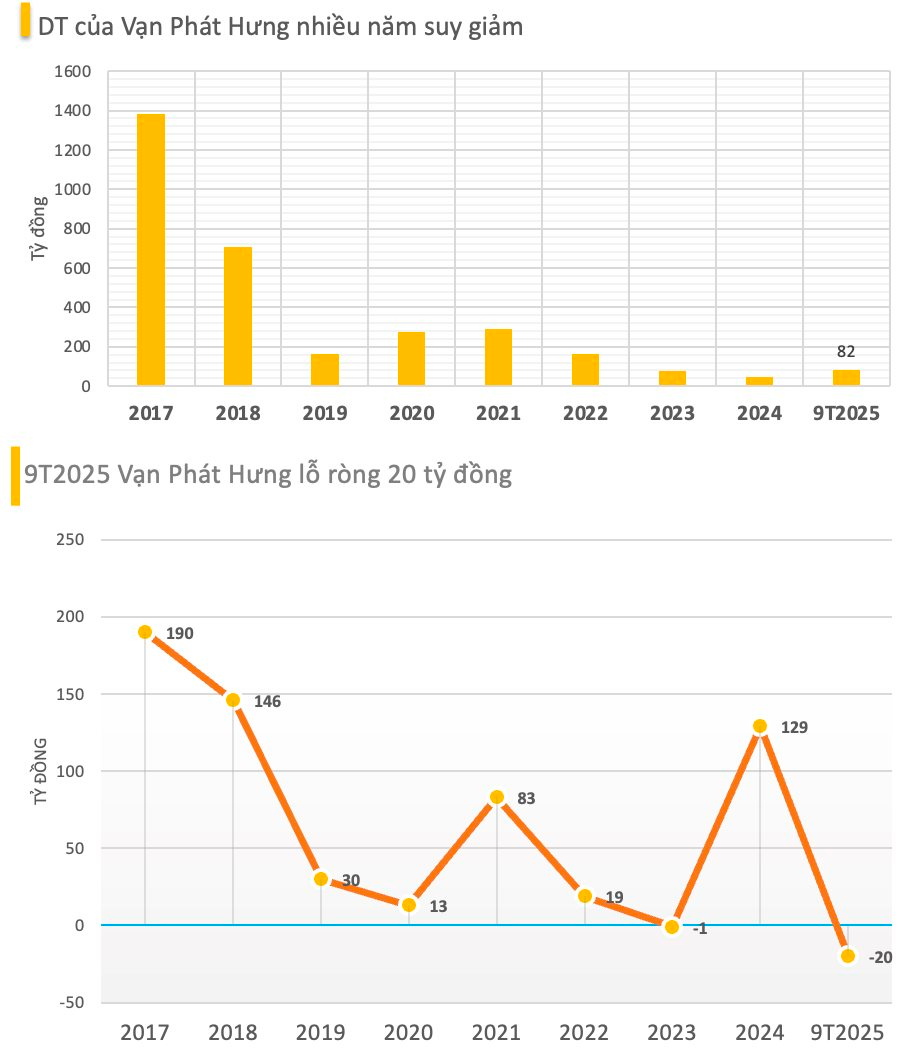

This leadership change comes amid VPH’s fourth consecutive quarter of losses. In Q3 2025, the company reported nearly VND 39 billion in net revenue but still incurred a loss of over VND 10 billion due to the absence of real estate revenue, its core business. Construction activities during the period also failed to generate profits, as most work was outsourced to third parties.

For the first nine months of the year, VPH achieved VND 82 billion in revenue (up 2.4 times year-on-year) but still recorded a net loss of nearly VND 20 billion. Operating cash flow remained deeply negative at over VND 480 billion, primarily due to a VND 415 billion increase in receivables.

Beyond declining business performance, shareholders were further disappointed by the company’s decision to delay the 2024 dividend payment until July 17, 2026, to balance cash flow and ensure stability during financial restructuring. Previously, VPH had approved a 5% cash dividend, totaling approximately VND 47 billion.

2024 Success Contrasts with 2025 Challenges

In stark contrast to its 2025 struggles, VPH recorded significant success in 2024, generating VND 349 billion from the sale of the Nhon Duc residential area (Nha Be). This transaction also resolved a long-standing dispute with Lotte Land.

For 2025, the company set a revenue target of VND 158 billion and an after-tax profit of VND 23 billion. However, management acknowledged the real estate market’s high-risk environment, leaving VPH without stable revenue sources this year.

Long-Term Focus: Elderly Care, Education, and New Land Acquisitions

Strategically, Van Phat Hung aims to restructure its portfolio and expand into less volatile sectors.

The Dinh An Elderly Care Institute is a key project, leveraging Vietnam’s aging population trend, particularly in Ho Chi Minh City, where demand for elderly care services is expected to surge over the next five years.

In education, VPH plans to capitalize on its land assets to diversify revenue streams.

Simultaneously, the company will seek new land acquisitions aligned with its long-term development strategy, shifting away from large, high-risk projects pursued in previous phases.

Van Phat Hung Joint Stock Company originated from Van Phat Hung Limited Liability Company, established on September 9, 1999, by Mr. Vo Anh Tuan and Mr. Tran Van Thanh.

Van Phat Hung was once known as a real estate powerhouse, investing in numerous high-profile projects such as Phu My Residential Area, Phu Xuan Residential Area, Nhon Duc Residential Area, La Casa Complex, Tulip Tower, Hoang Quoc Viet Apartment, Phu My Thuan Apartment, and Sai Gon Moi Residential Area.

Surge in Homebuyers Turning to Mortgages

In the first nine months of 2025, residents in the Southern region significantly increased their consumer credit borrowing for purposes such as purchasing homes, renovating properties, transferring land use rights for construction, and buying household items. The total outstanding consumer credit debt in this sector reached over 900 trillion VND, accounting for more than 61% of the total consumer credit debt and marking a 7% increase compared to the end of 2024.

Quốc Cường Gia Lai Seeks Asset Sales to Settle Remaining VND 1,783 Billion Debt to Trương Mỹ Lan

National Realty Group is strategically restructuring its portfolio by divesting stakes in subsidiaries and affiliated companies, while also exploring partnerships and investments in real estate projects and products. These initiatives aim to settle outstanding financial obligations to Mrs. Truong My Lan.

Unprecedented Price Surge for Once-Overlooked Condos in Ho Chi Minh City’s Urban Area

Nestled just a stone’s throw from Ho Chi Minh City’s bustling center, the Cát Lái Urban Area was once overlooked by homebuyers due to its dusty streets and heavy container traffic. However, in a remarkable turnaround, property prices in this neighborhood have skyrocketed to unprecedented levels, nearly doubling over the past three years.

Transforming Ho Chi Minh City: A $2.1 Billion Metro Project Set to Break Ground in Just 2 Months

The Bến Thành – Tham Lương metro line is set to break ground in January 2026. Upon completion, this line is expected to significantly reduce travel time between the city center and the northwestern gateway of Ho Chi Minh City, providing swift connectivity to Tan Son Nhat Airport and delivering a substantial boost to the real estate market.