As of the December 5th session, the USD Index (DXY) closed at 98.97 points, shedding an additional 0.44 points compared to the previous week. This marks its second consecutive weekly decline, reaching its lowest point since early November.

Downward pressure on the greenback intensified following the cooling of the core Personal Consumption Expenditures Price Index (core PCE), the Federal Reserve’s preferred inflation gauge. In September, core PCE rose by 0.2% month-over-month, aligning with forecasts. Year-over-year, the index increased by 2.8%, falling short of the expected 2.9% and decreasing from August’s 2.9%. This weaker-than-anticipated inflation data further bolsters the case for the Fed to embark on interest rate cuts.

Source: SBV

|

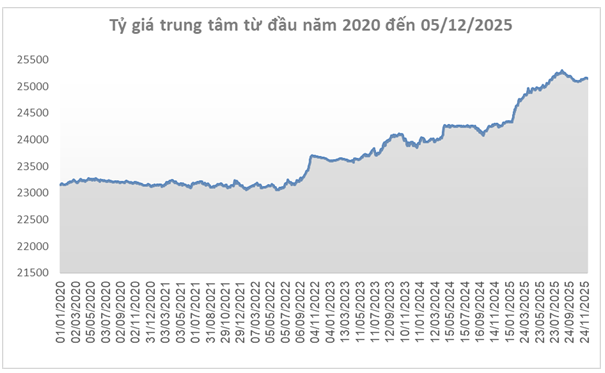

Domestically, the USD/VND exchange rate also experienced a slight reversal after a month-long upward trend. On December 5th, the State Bank of Vietnam set the central rate at 25,151 VND per USD, a 4-dong decrease from the previous week’s close. With a ±5% band, commercial banks are permitted to trade within the range of 23,893 – 26,409 VND per USD.

At the Foreign Exchange Management Department, the reference exchange rate was listed at 23,944 – 26,358 VND per USD (buying – selling), reflecting a 4-dong decrease in both directions over the week.

Source: VCB

|

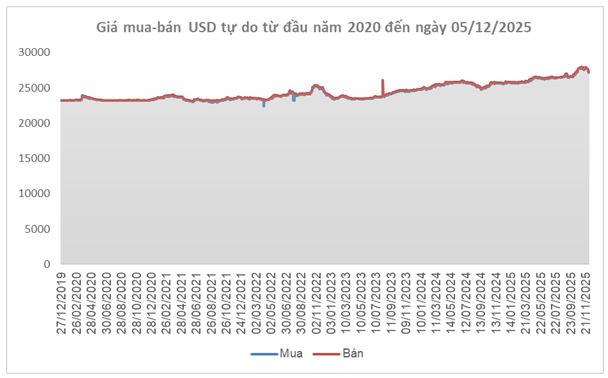

Within the banking system, Vietcombank reported the USD rate at the week’s end as 26,138 – 26,408 VND per USD (buying – selling), a 6-dong increase in the buying rate but a 4-dong decrease in the selling rate compared to the prior week.

Source: VietstockFinance

|

Notably, in the free market, the USD/VND exchange rate saw a sharp decline, dropping to 27,200 – 27,260 VND per USD (buying – selling), representing a significant decrease of 450 and 470 dong, respectively, from the previous week’s close.

– 6:17 PM, December 7, 2025

Is the Stock Market Set for a Breezier December?

The VN-Index concluded November with its second consecutive weekly gain, edging closer to the 1,700-point milestone. However, weak liquidity and a zigzagging upward trend indicate cautious investor sentiment. As we enter the final month of the year, the market is anticipated to turn more positive, yet significant volatility remains likely due to heightened pressure from portfolio rebalancing and NAV (net asset value) closures.

Gold Ring Prices Surge Dramatically

This morning (November 30th), while SJC gold bars held steady at their peak, gold rings continued their upward surge. The highest price for gold rings reached over 154 million VND per tael.