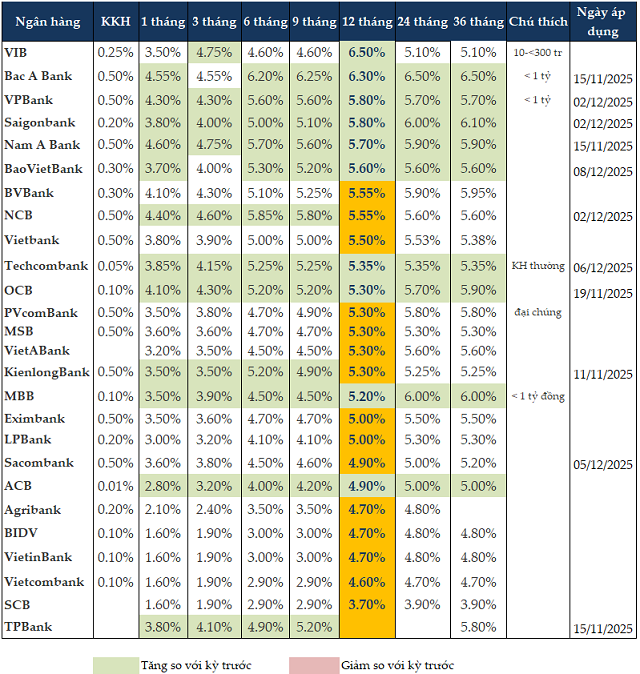

During the latest adjustment, VIB increased deposit interest rates for 3-month and 12-month terms compared to the previous period. Specifically, for deposits ranging from 10 to 300 million VND, VIB raised the 3-month deposit interest rate by 1.05 percentage points to 4.75%/year and the 12-month rate by 1.6 percentage points to 6.5%/year.

Starting November 15, Bac A Bank increased deposit interest rates across all terms by 0.15-0.4 percentage points. For savings deposits under 1 billion VND, the bank offers a 4.55%/year rate for 1-month terms, 6.2%/year for 6-month terms, 6.3%/year for 12-month terms, and 6.5%/year for terms over 12 months.

On the same day, Nam A Bank significantly raised deposit interest rates across all terms by 0.3-1 percentage points, pushing the 1-month rate to 4.6%/year, the 6-month rate to 5.7%/year, and the 12-month rate also to 5.7%/year.

OCB uniformly increased rates by 0.3 percentage points starting November 19, raising the 1-month mobilization rate to 4.1%/year, the 3-month rate to 4.3%/year, the 6-9 month rate to 5.2%/year, and the 12-month rate to 5.3%/year.

Additionally, other banks such as Saigonbank, BaoVietBank, KienlongBank, ACB, and TPBank slightly increased mobilization rates by 0.1-1 percentage points during the early December adjustment period.

However, state-owned banks like Vietcombank, VietinBank, BIDV, and Agribank remain outside the trend of raising mobilization rates.

As of December 8, 2025, savings deposit rates for 1-3 month terms range from 1.6-4.75%/year, 6-9 month terms from 2.9-6.2%/year, and 12-month terms from 3.7-6.5%/year.

For 12-month terms, VIB offers the highest deposit rate at 6.5%/year, followed by Bac A Bank at 6.3%/year. VPBank and Saigonbank both offer 5.8%/year.

For 6-month terms, Bac A Bank leads with a 6.2%/year rate, followed by NCB at 5.85%/year, and Nam A Bank at 5.7%/year.

For 3-month terms, VIB and Nam A Bank offer the highest rate at 4.75%/year, with NCB offering 4.6%/year.

|

Personal savings deposit rates at banks as of December 8, 2025

|

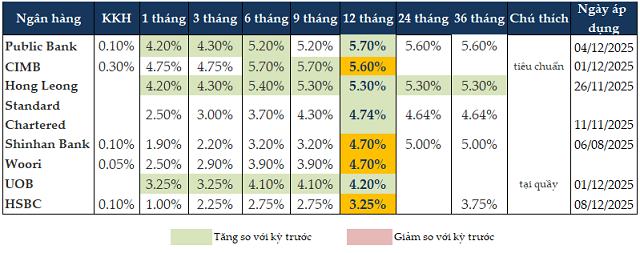

Foreign banks also increased mobilization rates from late November to early December, including Public Bank, CIMB, Hong Leong Bank, and UOB. For 12-month terms, Public Bank offers the highest rate at 5.7%/year; for 6-month terms, CIMB leads with 5.7%/year, and for 3-month terms, the rate is 4.75%/year.

|

Personal savings deposit rates at foreign banks as of December 8, 2025

|

In a media discussion about the State Bank of Vietnam (SBV)’s future policies, Pham Chi Quang, Director of the Monetary Policy Department, shared that amidst recent market pressures, the SBV has implemented synchronized and flexible monetary policy tools to regulate VND liquidity. These measures support market liquidity, stabilize the currency market, and facilitate capital supply for the economy. The SBV employs various monetary channels and flexibly adjusts tools based on market dynamics and policy objectives.

Regarding recent increased liquidity demands among credit institutions, Pham Chi Quang noted that to meet these needs, especially toward year-end, the SBV has utilized open market operations and foreign exchange swap transactions to stabilize the currency market. The SBV will continue monitoring developments and proactively adjust tools and solutions with appropriate timing and intensity to support exchange rate stability and macroeconomic balance.

In a November 24, 2025, banking sector report, MASVN suggested that the widening gap between deposit and credit growth indicates that current interest rates are misaligned with market demands. This divergence likely reflects corporate caution amid uncertain business conditions, prompting a preference for cash to maintain working capital. Additionally, concerns about potential rate hikes have influenced balance sheet restructuring decisions.

Mobilization rates are expected to rise more sustainably rather than seasonally, improving liquidity in Q4/2025 and 2026. While some adjustments are seasonal to meet year-end credit targets, the persistent slower growth of deposits compared to credit over the past 2-3 years suggests that current mobilization rates are below expected risk compensation levels.

Average mobilization rates are projected to increase by 60-100 basis points (depending on each bank’s balance sheet structure), enhancing liquidity and reducing reliance on non-traditional funding sources long-term. Maintaining an unusually low-interest environment is no longer necessary as the recovery phase nears completion. As policies shift toward boosting consumption and pursuing higher growth targets, gradual inflation is inevitable. Consequently, mobilization rates must rise to offset higher risks and preserve real yields for investors.

– 13:39 08/12/2025

Exclusive Youth Loan Package Suddenly Suspended

Select banks continue to offer special loan packages tailored for young individuals, albeit with adjusted interest rates to reflect current market conditions.

Credit Reaches VND 18.2 Trillion as of November 27, Up 16.56% Year-to-Date

Credit growth is showing promising signs, with a positive trajectory compared to previous years. As of November 27, 2025, the economy’s credit reached over 18.2 million billion VND, marking a 16.56% increase from the end of 2024. This growth is particularly notable when compared to the same period in 2024, which saw an 11.47% increase from the end of 2023, and the end of 2024, which recorded a 15.09% rise from the end of 2023.

How Will the Stock Market React as Interest Rates Begin to Rise?

Interest rates on deposits across numerous banks have risen across various terms, sparking concern among many investors.