According to the latest resolution passed by the National Assembly Standing Committee in October, significant adjustments to the personal income tax policy will take effect from January 1, 2026. Specifically, the deduction for the taxpayer themselves will increase to 15.5 million VND, and for each dependent, it will be 6.2 million VND. This marks a substantial rise from the current 4.4 million VND, allowing salaried workers to retain a larger portion of their actual income to cover living expenses.

However, this policy will only be meaningful if your tax records fully account for all dependents. As per the Ministry of Finance’s regulations, a taxpayer can claim deductions for multiple dependents (such as parents, children, or spouses) as long as they meet the income and familial relationship criteria. For instance, a child can only claim a deduction for one parent, but parents can claim deductions for all eligible children.

To prevent oversight or lost records, citizens should proactively use the eTax Mobile app for verification. The process has been maximally streamlined through national data integration. Users simply need to open the app, log in via VNeID, and authenticate through the national identity app. On the home screen, the “Dependent Information Lookup” feature provides detailed results of dependents currently eligible for deductions.

How to Check Dependent Information on eTax Mobile

Step 1: Log in to the eTax Mobile app

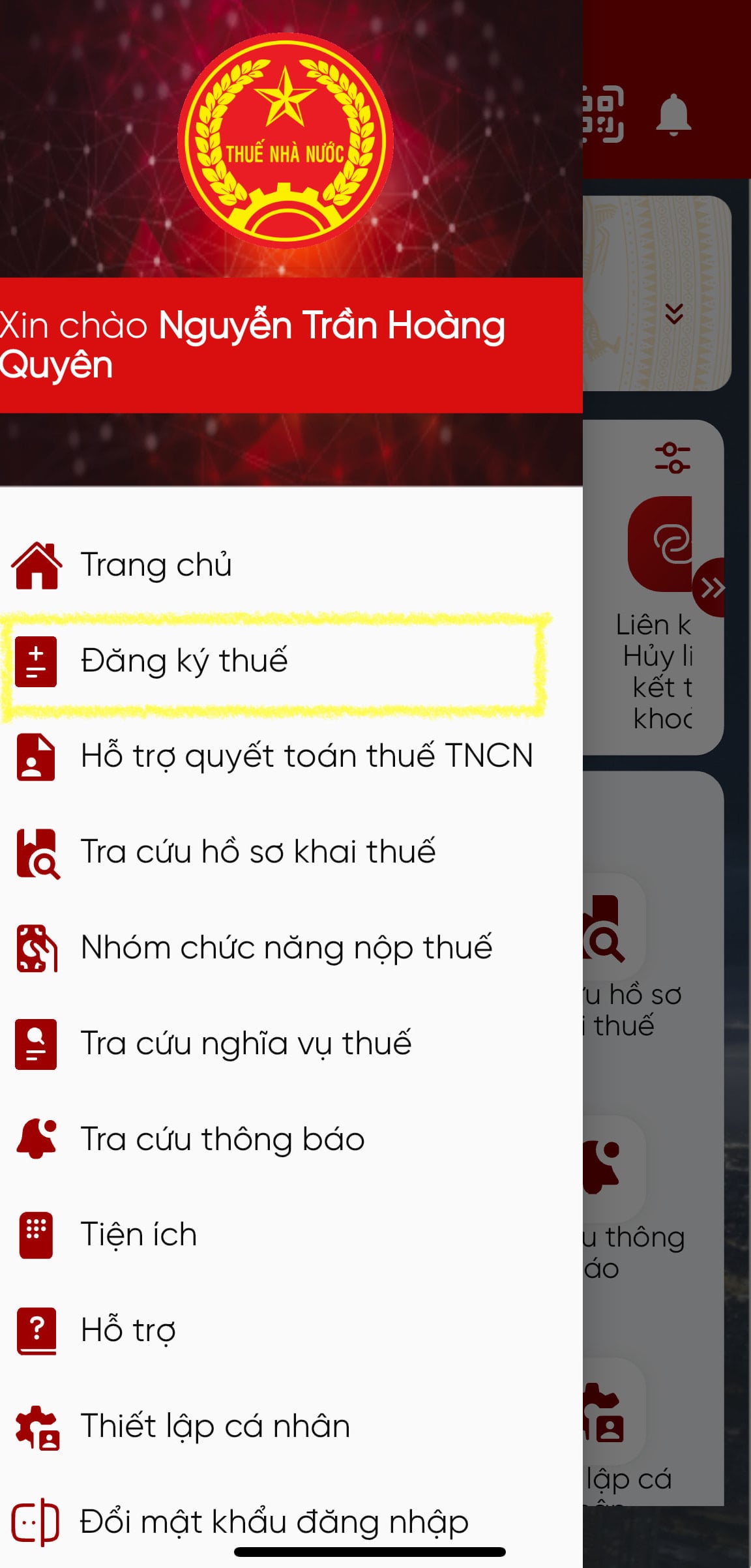

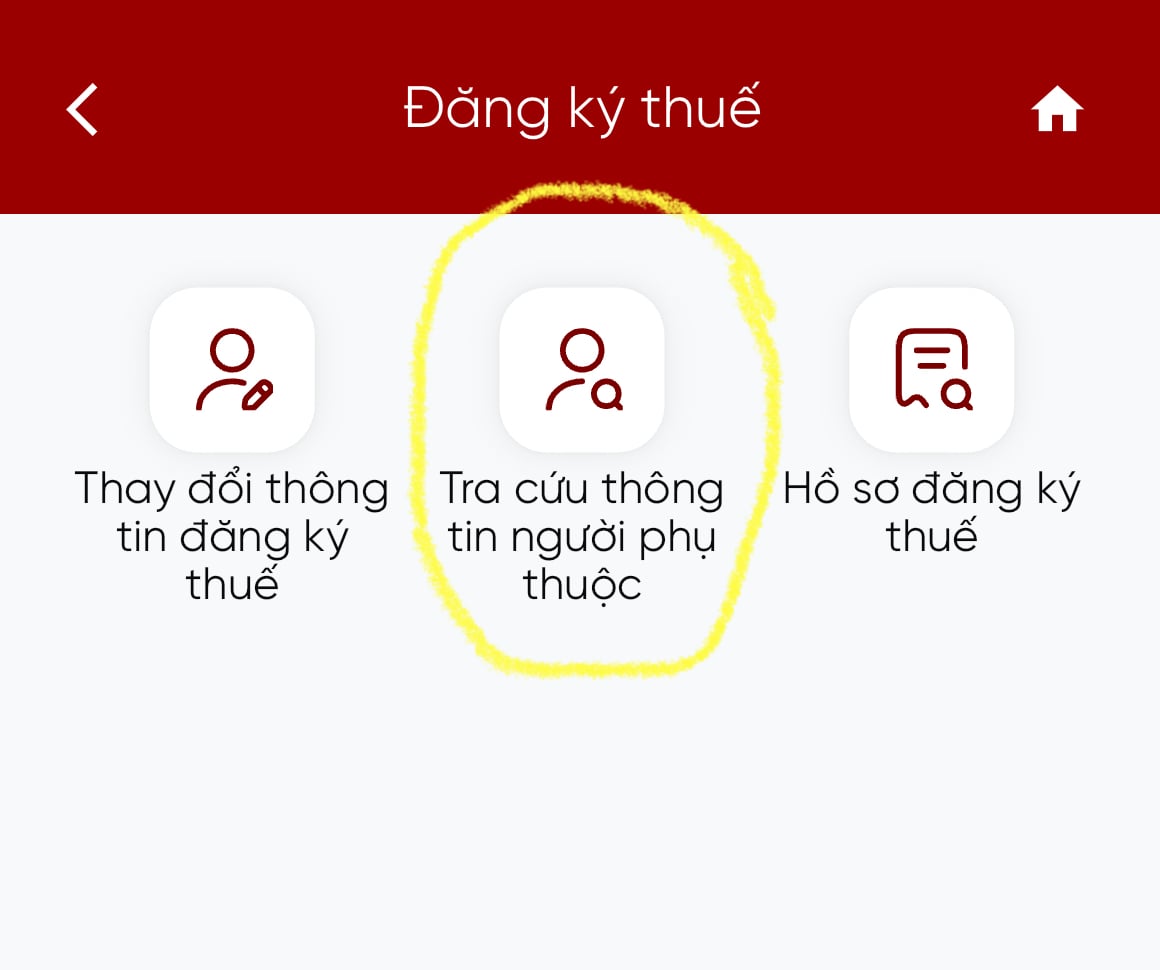

Step 2: Select Menu > Tax Registration > Dependent Information Lookup.

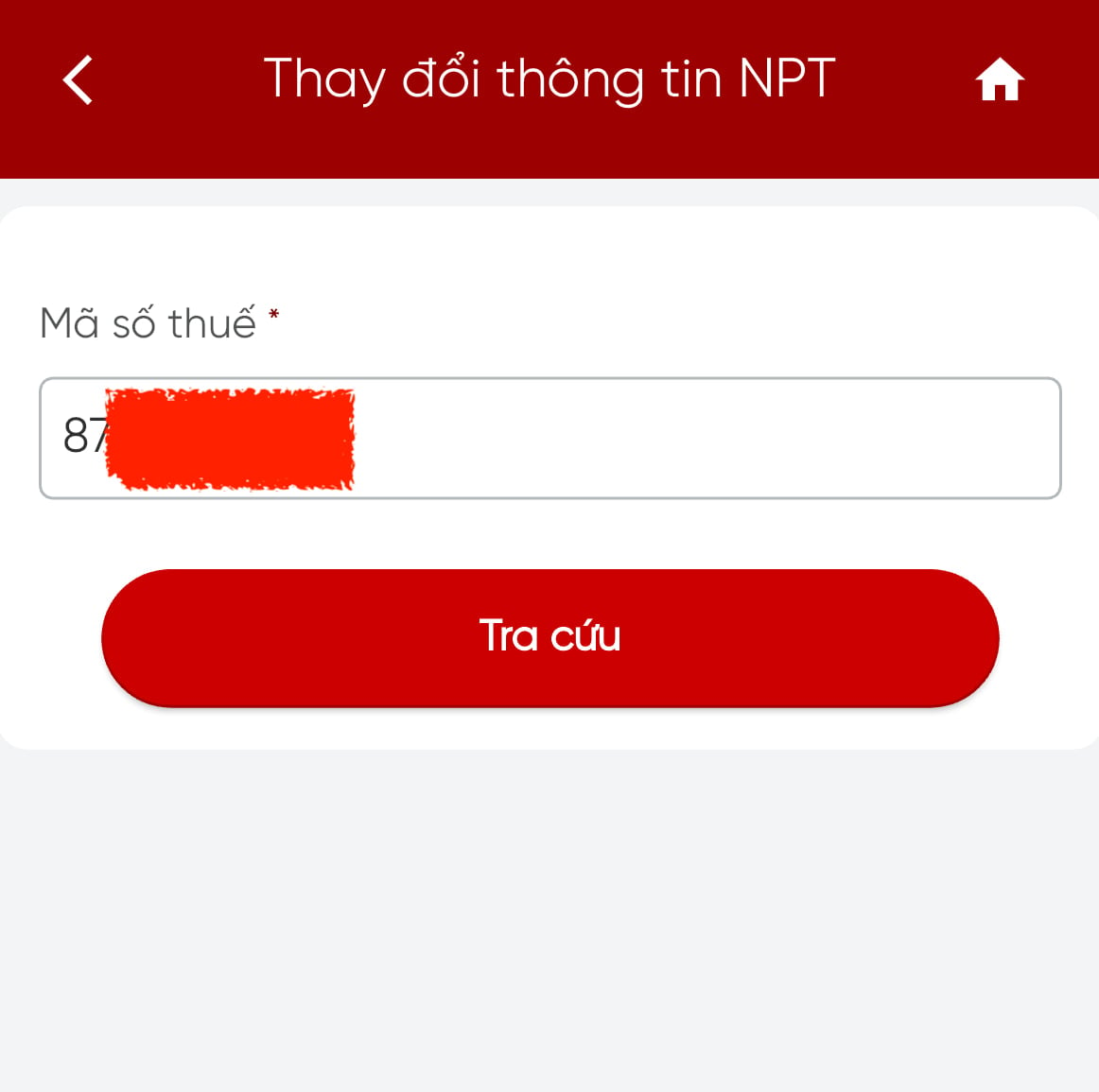

The system displays the “Dependent Lookup” screen with the following search criteria:

– Tax Code: Default displays the logged-in tax code, non-editable.

Step 3: Click [Search]

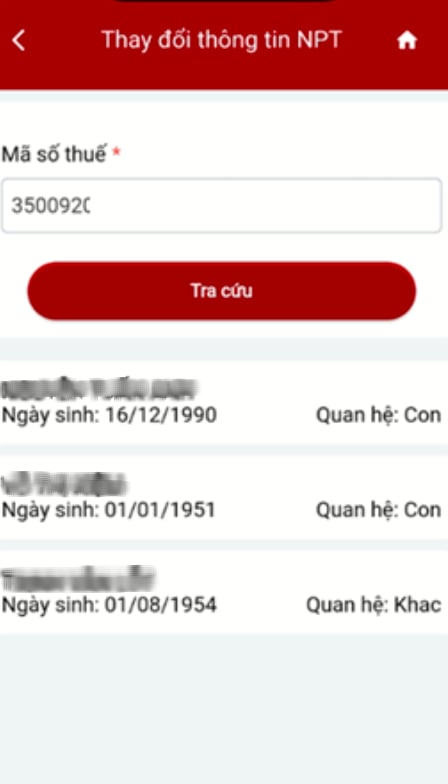

The system displays a list of dependent information linked to the taxpayer.

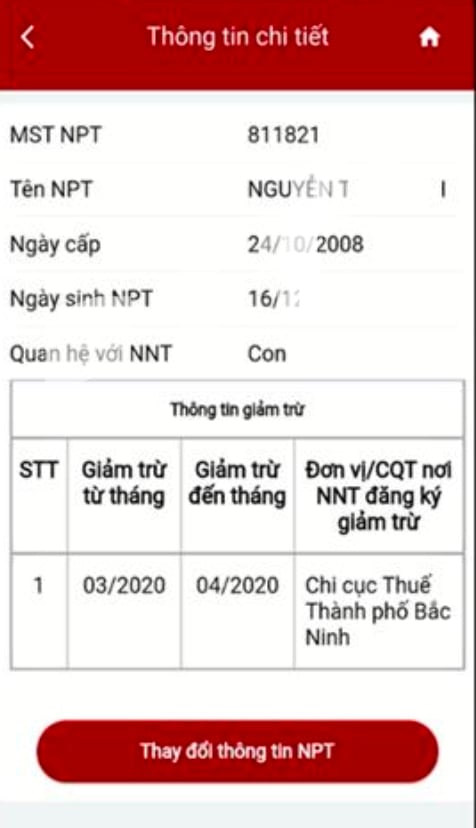

Step 4: Click on a dependent’s details, and the system will display:

– Dependent’s Tax Code

– Dependent’s Name

– Issuance Date: Shows the date the dependent’s tax code was issued

– Dependent’s Date of Birth

– Relationship to Dependent

– Deduction Details:

+ Serial Number: Auto-incremented.

+ Deduction Start Month: Displays the start month of the deduction.

+ Deduction End Month: Displays the end month of the deduction.

+ Unit/Tax Authority Where Deduction Was Registered: Displays the unit or tax authority where the deduction was registered.

If the results do not reflect the full number of dependents you support, promptly complete the supplementary procedures through your income-paying entity (your employer). Proactively reviewing this information not only ensures legal compliance but also effectively safeguards your finances amid upcoming tax policy changes.

Still Unsure About Gold Bullion Transaction Taxes?

Distinguishing between gold purchased for speculation, long-term accumulation, or special occasions like weddings can be surprisingly challenging, according to widespread opinion.

Are Holiday and Tet Bonuses Subject to Personal Income Tax?

Anticipated by many, holiday and Tet bonuses bring joy, but understanding when they’re subject to personal income tax, which amounts are exempt, and how in-kind rewards are regulated is essential.