| Recent Foreign Trading Trends |

Foreign investors marked their 5th consecutive net selling session, with a total value of nearly VND 514.5 billion across the market. The selling pressure was most intense on the trio VIC, STB, and GMD, each recording net selling values exceeding VND 100 billion. VIC led with over VND 192 billion in net selling, followed by STB at approximately VND 158.5 billion, and GMD with more than VND 102 billion.

Newcomer VPX from VPBank Securities (VPBankS) debuted on HOSE but faced net selling of over VND 71 billion from foreign investors. VPX dropped by more than 9% compared to its reference price, closing at VND 30,800 per share on its first trading day.

| Top Stocks Traded by Foreign Investors on December 11th |

On the flip side, foreign investors heavily bought FPT with over VND 208 billion, significantly outpacing other stocks like VIX, VPL, and MBB, which saw net buying ranging from VND 46 to 52 billion.

Proprietary Trading Continues Net Buying, Focusing on VHM

| Recent Proprietary Trading Trends on HOSE |

Proprietary trading maintained its net buying position for the 3rd consecutive session, with a total value of nearly VND 192 billion on HOSE. However, the buying power was almost entirely concentrated on VHM, with net buying of nearly VND 101 billion, primarily through negotiated transactions. Other stocks saw more modest net buying, including MWG at nearly VND 32 billion, SSI at around VND 29 billion, and FPT with over VND 25 billion.

Source: VietstockFinance

|

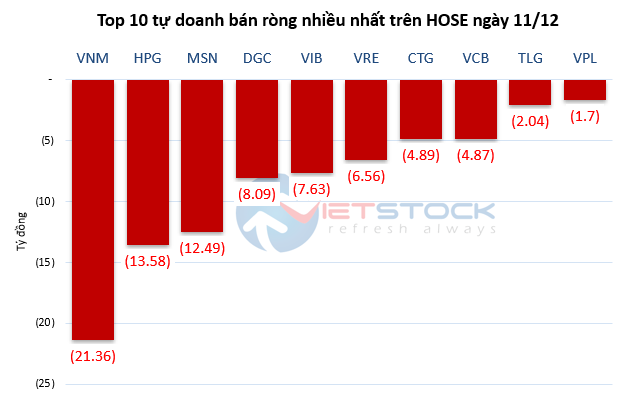

On the selling side, proprietary trading saw light selling with low values, led by VNM with over VND 21 billion, followed by HPG at nearly VND 14 billion, and MSN at approximately VND 12.5 billion.

Source: VietstockFinance

|

– 18:27 11/12/2025

Vietstock Daily 10/12/2025: Riding the Crest of the Windstorm

The VN-Index reversed its course, closing lower despite trading volumes surpassing the 20-day average as the index approached its October 2025 peak (around 1,760-1,795 points). Short-term risks are escalating, with the Stochastic Oscillator reversing and signaling a strong sell in overbought territory.

Vietstock Daily 09/12/2025: Approaching Previous Peak with Caution

The VN-Index extended its winning streak to nine consecutive sessions, closely tracking the Upper Band of the Bollinger Bands. However, trading volume dipped below the 20-day average, indicating investor caution. The index is approaching its October 2025 peak (1,760–1,795 points), while the Stochastic Oscillator remains deeply in overbought territory. Should sell signals re-emerge in upcoming sessions, a corrective pullback could materialize.

Vietstock Daily 12/12/2025: Falling Below the 1,700-Point Milestone

The VN-Index extended its losing streak to a third consecutive session, poised to retest the middle band of the Bollinger Bands. The Stochastic Oscillator continued its downward trajectory, reinforcing the sell signal and exiting overbought territory. Meanwhile, the MACD is gradually narrowing its gap with the Signal line, hinting at potential bearish momentum. Short-term outlook may turn increasingly pessimistic if this indicator triggers a sell signal in upcoming sessions.