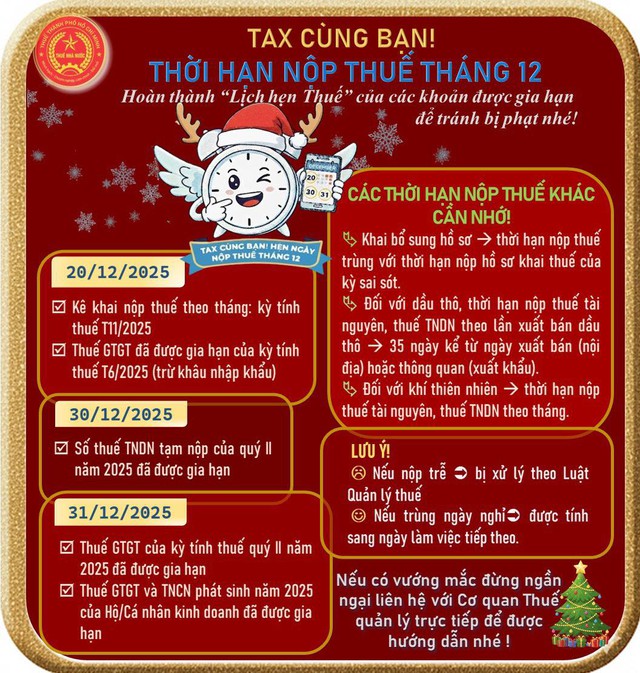

The Ho Chi Minh City Tax Department’s e-portal has announced key tax deadlines and reminders for December 2025:

For monthly tax filers, the payment deadline is the last day of the tax filing period, which is no later than the 20th of the following month.

– For amended tax returns, the payment deadline aligns with the original tax period’s filing deadline.

– Corporate income tax is paid quarterly, with the deadline on the 30th of the first month of the subsequent quarter.

– For crude oil, resource tax and corporate income tax payments are due within 35 days of domestic sales or customs clearance for exports.

– Natural gas taxes are paid monthly.

Additionally:

– Value-added tax (excluding imports):

+ VAT for June 2025 is due by December 20, 2025.

+ VAT for Q2 2025 is due by December 31, 2025.

– Corporate income tax

+ A 5-month extension is granted for Q2 2025 corporate income tax payments, with the new deadline set for December 30, 2025.

– VAT and personal income tax for businesses and individuals

+ Extended deadlines apply to VAT and personal income tax for eligible businesses and individuals under Decree 82/2025/NĐ-CP. Payments are due by December 31, 2025.

– If tax filing or payment deadlines fall on a holiday, they are extended to the next business day, as per Article 86 of Circular 80/2021/TT-BTC.

– Failure to meet extended tax payment deadlines will result in enforcement actions under Article 124 of the 2019 Tax Administration Law.

Phan Trang

Haxaco Fined for Tax-Related Violations

Haxaco has been fined for misreporting, resulting in underpayment of corporate income tax for the years 2020 and 2021.