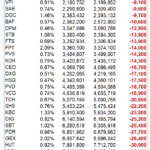

Last week, the VN-Index dropped by 94.43 points, closing at 1,646.89. Similarly, the HNX-Index fell by 10.56 points to 250.09.

On the HoSE, foreign investors net-sold for five consecutive sessions, offloading 91.2 million units with a net value of nearly VND 5,803 billion. On the HNX, they net-sold 4.6 million units, valued at over VND 115 billion.

For the Upcom market, foreign investors net-sold 2.6 million units, totaling over VND 68 billion. Overall, during the trading week from December 8-12, foreign investors net-sold 98.4 million units across all markets, amounting to more than VND 5,987 billion.

Becamex IDC Shifts Capital Flow

Becamex IDC (stock code: BCM) has been actively raising capital through bond issuances. On December 8, they successfully issued VND 900 billion in bonds under the code BCM12504, with a 3-year term (maturing on December 8, 2028) and an interest rate of 10.3% per annum.

Becamex IDC continues to seek capital through bond issuances.

Previously, Becamex IDC also raised VND 2,000 billion through the issuance of BCM12502 bonds, with a 4-year term (maturing on August 29, 2029).

As of September 30, Becamex IDC’s total debt stood at VND 22,239 billion, equivalent to 100.7% of its equity. This includes short-term loans of over VND 7,410 billion and long-term loans exceeding VND 14,828 billion.

Notably, on September 17, Becamex IDC conducted a written shareholder vote. However, representatives of over 95% of the total voting shares rejected the proposal for a public offering of shares.

The rejected plan involved offering 150 million shares to the public via an auction on HoSE. The starting price was to be determined by the Board of Directors, with a minimum of VND 50,000 per share.

Hoang Quan Real Estate Consulting Services JSC (stock code: HQC) approved the issuance of 50 million shares to convert VND 500 billion in debt. The issuance price is VND 10,000 per share, with a conversion rate of VND 10,000 in debt per share. These privately issued shares will be restricted from transfer for one year post-issuance.

The debt conversion list includes four parties: Hai Phat Investment JSC (HPX) converting VND 212 billion for 21.2 million shares, Mr. Truong Anh Tuan (HQC’s Chairman) converting VND 236 billion for 23.6 million shares, increasing his stake to 11.76%, Mrs. Nguyen Thi Dieu Phuong (Mr. Tuan’s spouse) converting VND 33 billion for 3.3 million shares, and VDC Construction Design Consulting LLC converting VND 19 billion for 1.9 million shares.

Currently, HQC shares trade at around VND 3,180 per share. The private issuance price is 213% higher than the market price. If successful, Hoang Quan’s charter capital will rise from VND 5,760 billion to VND 6,266 billion.

In late November, HQC temporarily halted the private issuance for debt conversion to update and adjust the registration dossier.

Dien May Xanh to List on Stock Exchange

The Gioi Di Dong Investment JSC (stock code: MWG) approved Dien May Xanh’s plan to conduct an initial public offering (IPO) and list its shares on the stock exchange, scheduled for 2026.

Dien May Xanh to IPO and list on the stock exchange in 2026.

In November, MWG finalized the restructuring of its subsidiaries into specialized entities. Retail segments for electronics (Thegioididong, TopZone, Dien May Xanh, Tho Dien May Xanh, Erablue joint venture), pharmaceuticals (An Khang), and mother-and-baby products (AVAKids) are now independent legal entities. This aims to enhance operational autonomy, strategic focus, and business efficiency.

MWG stated that the IPO and listing of DMX mark a strategic shift to drive new growth for its electronics retail division.

MWG also decided not to participate in DMX’s private issuance, which represents 1% of its charter capital and is reserved for key management to reinforce long-term commitment. These shares will be restricted from transfer for 18 months post-issuance.

Mr. Le Huu Son, Deputy General Director of Tin Viet Finance JSC (VietCredit, stock code: TIN), registered to purchase an additional 1 million TIN shares for personal purposes. Post-transaction, his holdings are expected to exceed 4.5 million shares, or approximately 4.94% of TIN’s charter capital. The estimated cost of this transaction is VND 49 billion.

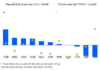

Surprise Power Injects Hundreds of Billions to Scoop Up Vietnamese Stocks Amid Market Plunge in Final Week’s Session

Proprietary trading desks at securities companies executed a net buy of VND 341 billion on the Ho Chi Minh City Stock Exchange (HOSE).

Foreign ETFs Continue Net Selling as VN-Index Surpasses 1,700, VIC Weighting Rises to Nearly 17%

During the period from November 28 to December 5, 2025, as the VN-Index officially surpassed the 1,700-point milestone, the VanEck Vectors Vietnam ETF (VNM ETF) continued its net selling activity across all stocks within its portfolio.

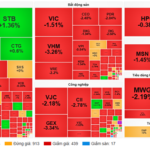

Market Pulse 12/12: Over 660 Stocks Decline, VN-Index Plunges Another 52 Points

At the close of trading, the VN-Index dropped 52.01 points (-3.06%), settling at 1,646.89 points, while the HNX-Index fell 5.78 points (-2.26%), closing at 250.09 points. Market breadth was overwhelmingly negative, with over 660 decliners and only 200 advancers. Similarly, the VN30 basket saw a sea of red, with 29 decliners and just 1 advancer.