By the end of the December 12th session, selling pressure intensified, particularly during the ATC phase, pushing the VN-Index down to nearly 1,638 points. Thanks to some blue-chip stocks narrowing their losses in the final minutes, the index rebounded slightly above 1,640 points. However, it still closed over 52 points lower than the reference level—a significant decline unlikely to reverse in the short term. Bottom-fishing demand remained weak.

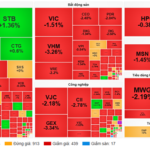

Selling pressure spread across the market, causing indices to plummet. VHM, VRE, and VPL all hit their lower limits. VIC closed 1.4% lower, narrowing its decline from the earlier 4% drop recorded during the session.

Three Vingroup stocks hit their lower limits.

Red dominated the board, with nearly 300 declining stocks—over seven times the number of gainers. Caution gripped investors as the market easily breached the 1,700 mark and continued to face proactive selling pressure. The VN30 basket was hardest hit, losing over 57 points and falling below the 1,900 level—a steep decline highlighting significant pressure on leading stocks. This marked the fourth consecutive losing session since the index failed to surpass 1,770 points, with the total correction exceeding 100 points in just a few days.

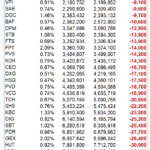

The HoSE recorded 31 stocks hitting their lower limits, spanning sectors from real estate to industrials and finance, including CII, DIG, EIB, HDG, NVL, APH, DXG, FIT, GEX, PDR, TAL, TCH, and VIX.

Key sectors influencing the market—banking, securities, real estate, and high-capitalization, liquid stocks—all remained in negative territory. VPB fell 5.7%, second only to VHM in its negative impact on the VN-Index. VPB closed down 5.7%. VPX, VPBankS’ securities arm, also continued its post-listing correction, dropping 1.6%.

On the upside, only 40 stocks managed to stay green. QCG stood out as the sole stock hitting its upper limit, marking its third consecutive session at the ceiling and offering a rare bright spot in a deeply negative session.

Liquidity on the HoSE surged to nearly VND 24.3 trillion, significantly higher than the previous weak session. However, the increased trading volume primarily came from sellers, reflecting a strong sell-off as the market repeatedly breached support levels.

At the close, the VN-Index fell 52.01 points (3.06%) to 1,646.89. The HNX-Index dropped 5.78 points (2.26%) to 250.09, and the UPCoM-Index declined 0.73 points (0.61%) to 119.26.

Market Pulse 12/12: Over 660 Stocks Decline, VN-Index Plunges Another 52 Points

At the close of trading, the VN-Index dropped 52.01 points (-3.06%), settling at 1,646.89 points, while the HNX-Index fell 5.78 points (-2.26%), closing at 250.09 points. Market breadth was overwhelmingly negative, with over 660 decliners and only 200 advancers. Similarly, the VN30 basket saw a sea of red, with 29 decliners and just 1 advancer.

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.