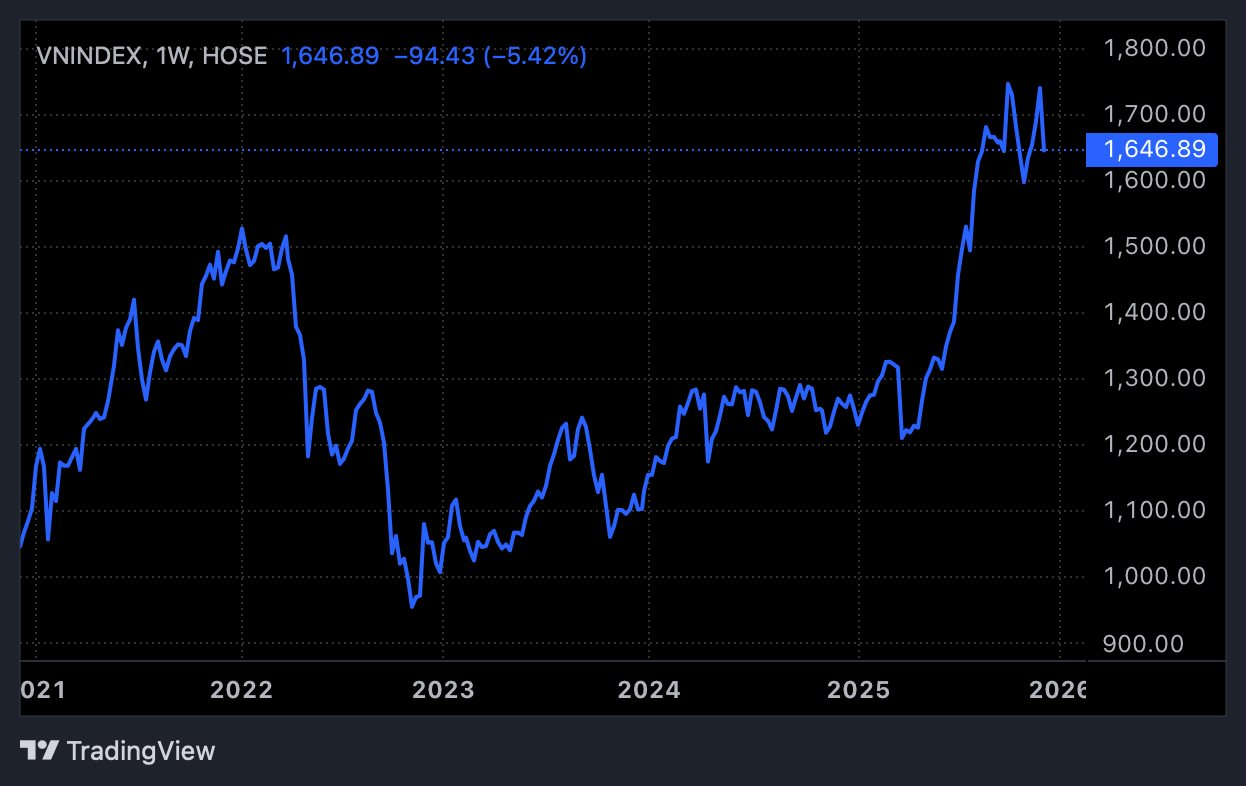

Elevated selling pressure caused a sharp decline in Vietnam’s stock market during the final trading session of the week. At one point, the VN-Index plummeted by over 60 points before narrowing its losses to close 52 points lower (-3.06%), falling below the 1,650-point mark. This performance made Vietnam one of Asia’s worst-performing markets on December 12, starkly contrasting the region’s overall recovery trend. It marked the fourth consecutive day of decline, with the VN-Index shedding nearly 100 points in total.

Selling pressure was widespread across the market, with nearly 600 stocks declining, vastly outnumbering gainers. Notably, bottom-fishing activities remained cautious, as liquidity stayed low with HoSE’s trading value reaching only around VND 22 trillion. Additionally, foreign investors continued to exert pressure by net-selling nearly VND 600 billion on HoSE, marking their sixth consecutive session of capital outflows, although the selling intensity had eased compared to previous days.

According to Mr. Do Bao Ngoc, Deputy Director of Kien Thiet Securities, the week’s sharp decline was primarily driven by large-cap stocks, particularly the Vingroup ecosystem. Selling pressure from this group quickly spread to real estate, securities, and banking sectors, causing many blue-chip stocks to plummet and fostering a negative sentiment that dragged the market downward.

“Today’s session typifies ’emotional selling,’ as the market endured a prolonged sideways phase with low liquidity and weak capital inflows. Many stocks were already at low levels but continued to be sold off, indicating panic-driven investor behavior,” the expert commented.

Regarding macroeconomic factors, the expert noted the absence of new negative elements. The FED’s recent rate cut is considered positive, and no adverse domestic data has emerged. However, market liquidity has significantly weakened: interbank liquidity is tight, interbank rates are rising, and cash demand among institutions is higher at year-end. While these factors aren’t new, the market’s weakened liquidity amplifies its reaction to negative developments in large-cap stocks.

In terms of trends, the expert believes the market has entered a clear short-term downtrend. After four consecutive declining sessions, the VN-Index has lost approximately 100 points. The index has breached multiple key support levels, including MA10, MA20, MA50, and MA100. If supply and demand do not improve and new supportive information is lacking, the VN-Index could retreat to the 1,600 ± 10-point range – the nearest historical support level before this correction.

The medium-term uptrend remains intact, but if the VN-Index falls below 1,600 points, the medium-term trend could also be affected. However, the likelihood of a deeper decline depends on the performance of large-cap stocks, as many have already been heavily discounted and fallen below previous lows.

The expert suggests that after several deep declines, many stocks have become attractively valued. This could create opportunities for more rational trading and gradual market stabilization starting next week, as medium- to long-term capital begins to focus on fundamentally strong stocks with favorable valuations.

Regarding strategy, Mr. Ngoc advises most investors – who have already reduced their equity exposure – to maintain a low allocation in the short term. When the market declines to more attractive levels, investors should review their portfolios, assess next year’s prospects, and consider gradual medium- to long-term deployments. In the current volatile environment, maintaining a cautious stance, avoiding leverage, and limiting short-term trading remain priorities.

VPX Debuts on HOSE with a $2.4 Billion Valuation on December 11th

On December 11th, 1.875 billion VPX shares will commence trading on the HOSE at a reference price of VND 33,900 per share, propelling the company’s market capitalization to nearly VND 64 trillion and introducing a valuable addition of high-quality securities to the market.

Market Pulse 12/12: Over 660 Stocks Decline, VN-Index Plunges Another 52 Points

At the close of trading, the VN-Index dropped 52.01 points (-3.06%), settling at 1,646.89 points, while the HNX-Index fell 5.78 points (-2.26%), closing at 250.09 points. Market breadth was overwhelmingly negative, with over 660 decliners and only 200 advancers. Similarly, the VN30 basket saw a sea of red, with 29 decliners and just 1 advancer.

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.