Coteccons Construction JSC (Stock Code: CTD, HoSE) has announced its plan to issue shares to increase equity capital from shareholders’ equity.

The company intends to issue nearly 5.1 million bonus shares to shareholders at a ratio of 20:1, meaning for every 20 shares held, shareholders will receive 1 new share. The final registration date for allocation is December 25, 2025.

The total issuance value, based on the par value, is over VND 50.7 billion, sourced from the Development Investment Fund in the audited separate financial statements for 2025.

Illustrative image

If the issuance is successful, the total number of issued shares will increase from over 103.6 million to more than 108.7 million, raising the charter capital from over VND 1,036 billion to over VND 1,078 billion.

Previously, on December 2, 2025, Coteccons finalized the shareholder list for the 2025 dividend payment in cash at a rate of 10%, equivalent to VND 1,000 per share. The payment is scheduled for December 22, 2025.

With over 101.4 million CTD shares outstanding, Coteccons is estimated to allocate more than VND 101.4 billion for this dividend payment, sourced from the company’s undistributed after-tax profits.

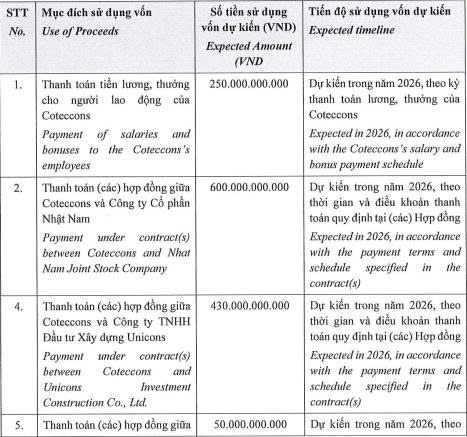

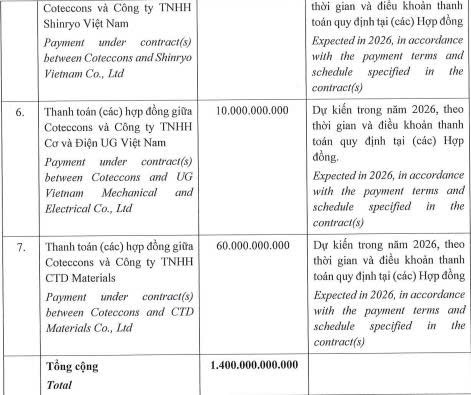

In other news, Coteccons recently announced a resolution approving the issuance plan, capital usage plan, and debt repayment plan from the 2025 public bond offering.

The company plans to issue 14 million public bonds with a par value of VND 100,000 each, totaling up to VND 1,400 billion. These are non-convertible, unsecured bonds without warrants.

The bonds will be issued in the form of book-entry or electronic data, with bond ownership certificates issued upon request or as required by current laws.

The bonds have a 3-year term and a fixed interest rate of 9% per annum, to be issued publicly through SSI Securities Corporation as the issuing agent.

Eligible buyers include domestic and foreign organizations and individuals. Individual investors can purchase a minimum of 5,000 bonds (VND 500 million), while institutional investors can buy a minimum of 10,000 bonds (VND 1 billion).

The VND 1,400 billion raised from the bond issuance will be allocated as follows:

Source: CTD

Coteccons plans to issue the bonds in Q4/2025 – Q1/2026, pending approval from the State Securities Commission. The specific issuance date will be determined by the Chairman of the Board of Directors.

The distribution period is expected to last a minimum of 20 days and a maximum of 90 days, as per legal regulations (excluding potential extensions if necessary).

Coteccons Plans Bond Issuance to Fund VND 250 Billion in Employee Bonuses and Debt Repayments, Offering Fixed 9% Interest Rate

Coteccons Construction Joint Stock Company (stock code: CTD) has announced a resolution to issue VND 1,400 billion in bonds, allocating nearly 18% of the total proceeds to employee bonuses and salaries.