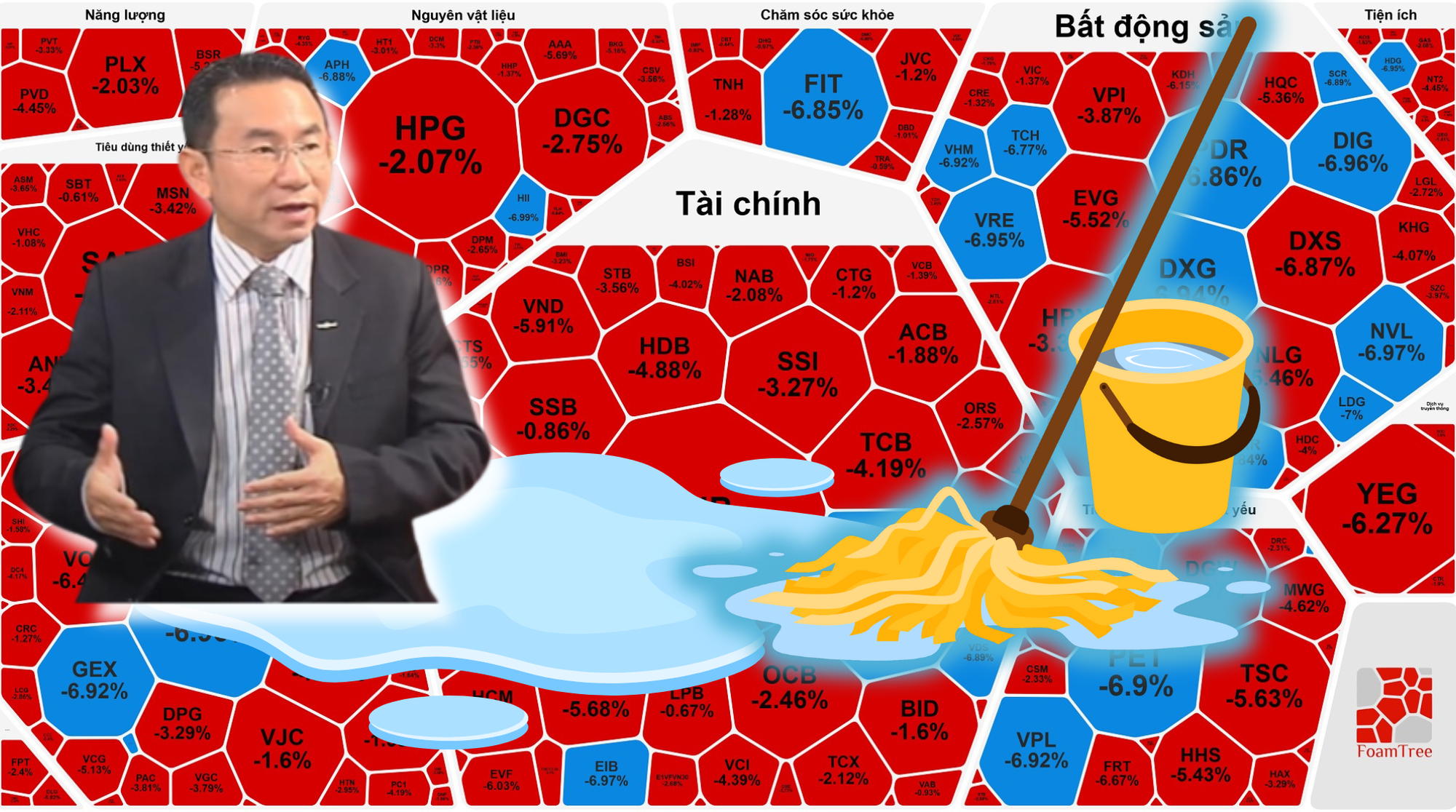

Vietnam’s stock market witnessed a “Black Friday” on December 12th, as a widespread sell-off engulfed nearly all stock groups. The trading board was awash with red, with numerous stocks plummeting to their floor prices by the session’s close, casting a pall of pessimism over the market.

Statistics reveal that over 600 stocks declined, while fewer than 200 advanced. Adjustments of 3%-4% were rampant, with many large-cap stocks even hitting their lower limits, indicating intense and widespread selling pressure.

By the close of the December 12th session, the VN-Index shed 52 points, or 3.06%, sinking to 1,646 points and breaching the 1,650 support level. This steep decline made Vietnam’s stock market the worst performer in Asia for the day, starkly contrasting the relative stability of other regional markets.

The index’s downturn was heavily influenced by blue-chip stocks. Vingroup-related stocks, including VHM, VIC, and VPL, collectively weakened, exerting significant pressure on the VN-Index. Additionally, the banking sector was not immune to the adjustment, with major stocks like VPB, TCB, MBB, and VCB experiencing deep declines, further dragging the market down.

Notably, this marked the VN-Index’s fourth consecutive losing session, following multiple failed attempts to test the peak. However, bottom-fishing demand remained cautious. Market liquidity failed to surge, with matching values on the HoSE hovering around VND 22 trillion, indicating that substantial capital remained on the sidelines.

Foreign investors continued to exert pressure, net-selling nearly VND 600 billion on the HoSE. Nonetheless, compared to previous sessions, the net-selling pace showed signs of slowing. The December 12th session also marked the foreign bloc’s sixth consecutive net-selling session, further straining market sentiment.

The session’s unexpected developments quickly became a hot topic on investment forums. Many investors sought reasons for the market’s sharpest decline since mid-October, especially given the absence of sudden negative macroeconomic factors.

Numerous large-cap and real estate stocks plummeted to their floor prices by the close of the December 12th session.

Báo Người Lao Động reporters had a quick exchange with Mr. Trương Hiền Phương, Senior Director of KIS Vietnam Securities Company, regarding today’s unexpected market developments and strategies for investors in upcoming sessions.

Reporter: Many investors are puzzled as there were no particularly significant factors affecting the market, yet the VN-Index still lost over 50 points?

Mr. Trương Hiền Phương: If we consider significant factors, personally, I don’t see any sudden causes for today’s developments. I believe it stems from a few reasons: The market has been moving sideways for about two weeks without strong enough information to drive it, and cautious capital has remained on the sidelines. Smart money has also not returned, insufficient to propel the market higher.

Technically, after a period of sideways movement, the market often experiences a shift—either upward with positive information or downward with weak information. But today’s session saw strong selling pressure at the close, leading to widespread market sell-offs.

A notable factor is that the Vingroup stocks officially “broke their trend.” Over the past two months, while the VN-Index hovered around 1,600 – 1,800 points, support for the index largely came from this group. Excluding Vingroup stocks, the VN-Index was actually around 1,500 points. With a lack of supportive information and prolonged sideways movement, weakened sentiment made investors fear further declines, leading to selling pressure.

Additionally, foreign investors continued to net-sell heavily, focusing on large-cap stocks, making domestic investors—already fragile—even more cautious amid numerous adverse factors.

Furthermore, there were signs of large capital selling. The strong selling concentrated at the close, with large volumes pushing many stocks to their floor prices—this did not come from retail investors but from institutions or large investors.

Given these developments, how do you foresee the market performing in the coming days?

+ The possibility of the market declining further over the next few sessions exists. When the market closes sharply lower, it often leads to margin calls (requests for additional collateral) in the following 1-2 sessions. Some investors will be forced to sell to cover margins due to insufficient funds, creating additional technical downward pressure. However, this decline does not stem from macroeconomic risks or issues with businesses or the economy but primarily from technical and psychological factors.

Therefore, if the market declines further, the downward momentum will likely weaken as margin-selling pressure subsides. This is likely a short-term adjustment rather than a significant risk.

Many investors are currently in the red as stocks have fallen 10-30% over several weeks. What strategy would be appropriate now?

+ For investors holding quality stocks, I believe there’s no need to sell at any cost at this point. Over the past 2-3 weeks, most stocks have declined 5-30%. Rebounds have only appeared for 1-2 sessions before falling more sharply, so most investors are currently at a loss. However, there’s no reason for panic selling, especially when the adjustment is technically driven.

At this point, investors holding cash can take advantage of opportunities to buy quality stocks at deep discounts—price levels previously unattainable. Investors with underperforming portfolios can also restructure, selling stocks without potential and shifting to those with strong fundamentals, high profit margins, or unique stories.

When the market stabilizes and capital returns, quality stocks will recover faster and stronger than weaker ones.

Stock Market Plunges Without Clear Explanation

The unexpected turn of this trading session quickly became a hot topic of discussion across investment forums.

Stock Market Plunges Sharply

The weekend trading session concluded on a negative note, with the VN-Index plunging over 50 points. This sharp decline erased all gains from the consecutive winning streak earlier in December.