The Board of Directors of Mobile World Investment Corporation (stock code: MWG) has officially approved the plan to allow Dien May Xanh Joint Stock Company (DMX) to conduct an Initial Public Offering (IPO) and list its shares on the stock market. This strategic move is slated for 2026, marking a pivotal step in restructuring and optimizing MWG’s ecosystem.

According to the disclosure, MWG’s Board has thoroughly evaluated DMX’s IPO and listing plan. DMX, responsible for retailing electronics, consumer electronics, mobile phones, and technology devices, will become an independent public company. This transition is expected to unlock a new growth phase for DMX, aiming to sustain double-digit profit growth in the medium to long term.

MWG views the IPO as more than a capital-raising initiative; it’s a critical tool for DMX to enhance transparency and standardize governance and operations to meet listed company standards. Moving forward, DMX will focus on deepening its growth strategy, prioritizing quality, expanding value-added products and services, leveraging its Super App platform, and scaling operations in Indonesia.

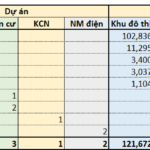

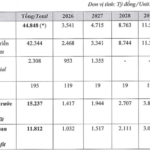

MWG emphasizes that DMX remains a core strategic component of its retail ecosystem. From 2026 to 2030, DMX is projected to significantly contribute to MWG’s consolidated revenue and profit. DMX’s independent listing is expected to yield long-term strategic, financial, and governance benefits, fostering broader growth across the Mobile World ecosystem.

Notably, MWG’s Board has decided not to participate in DMX’s private placement. DMX plans to issue approximately 1% of its charter capital to key individuals to strengthen long-term management commitment. These shares will be subject to an 18-month transfer restriction post-issuance.

Additionally, MWG approved advisory contracts to support its 2026 development phase, including a consulting agreement with a Board member for strategic and operational guidance.

The approval of DMX’s IPO is seen as a significant milestone, not only realizing the value of Vietnam’s largest electronics retailer but also potentially becoming one of the most notable IPOs in the upcoming market cycle. This move aligns with the resurgence of spin-offs and listings among subsidiaries.

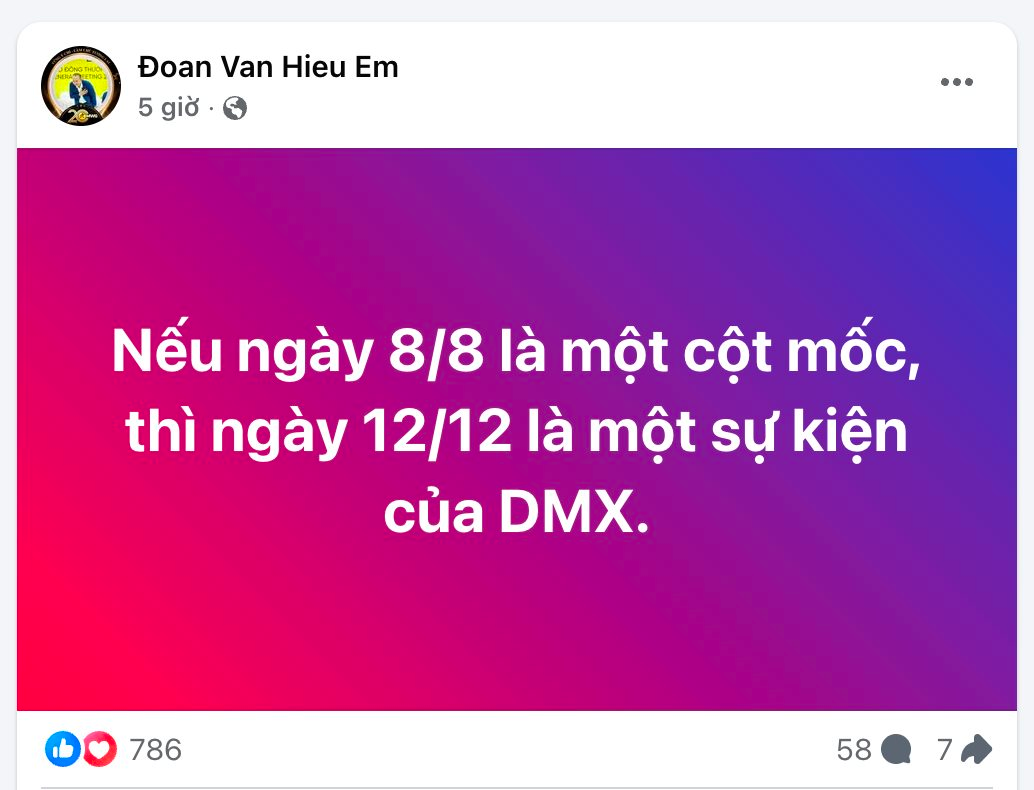

On social media, Mr. Doan Van Hieu Em, MWG Board member, posted: “If August 8 was a milestone, December 12 is a defining event for DMX.”

Leadership and successors are poised to realize the MW 2030 IPO vision. The company aims to double its 2025 profit by 2030, maintaining a growth rate above 15% annually.

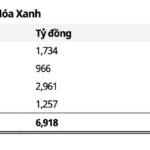

Strategic Roadmap to Eliminate Accumulated Losses, Paving the Way for Bach Hoa Xanh’s IPO

The MWG leadership believes now is the time for BHX to accelerate its vision for 2030. However, a recent report by Mirae Asset suggests that BHX’s potential IPO in the near future warrants close monitoring.

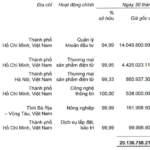

MWG Set to Execute Two Subsidiary Transfers Valued at Over 2.1 Trillion VND

MWG has recently approved the transfer of all shares in Thợ Điện Máy Xanh and Dược Phẩm An Khang Pharm, along with a strategic restructuring plan for its subsidiaries to focus on specialized business operations.