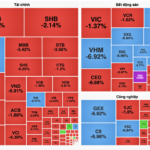

Vietnam’s stock market experienced a “Black Friday” on December 12th, with a widespread sell-off as red dominated nearly the entire market. Over 600 stocks declined, far outpacing the fewer than 200 that rose. A 3-4% drop was common, with some large-cap stocks even hitting their lower limits.

The VN-Index closed down 52 points (-3.06%) below the 1,650 mark. This made Vietnam the worst-performing market in Asia on December 12th, even going against the region’s overall trend.

This marked the fourth consecutive day of declines after failing to test the peak. Notably, bottom-fishing money hasn’t fully entered the market yet, with liquidity remaining low. Trading value on HoSE reached around VND 22 trillion. Foreign investors continued to put pressure by net selling nearly VND 600 billion on HoSE, marking their sixth consecutive selling session, though the selling momentum has cooled compared to earlier.

The market’s sharp decline on the super sale day of December 12th reminded investors of a somewhat paradoxical phenomenon, previously mentioned by Dragon Capital in a recent report: “We eagerly hunt for 50% off sales on clothes, but panic sell stocks when they drop just 5%.”

The foreign fund explains that in shopping, discounted goods are seen as clear opportunities, stimulating the excitement of “sale hunting.” Conversely, in investing, when the market falls, abstract financial losses activate brain regions similar to those triggered by physical pain. This survival response pushes investors into a “fight or flight” state, leading to panic selling to escape short-term pain.

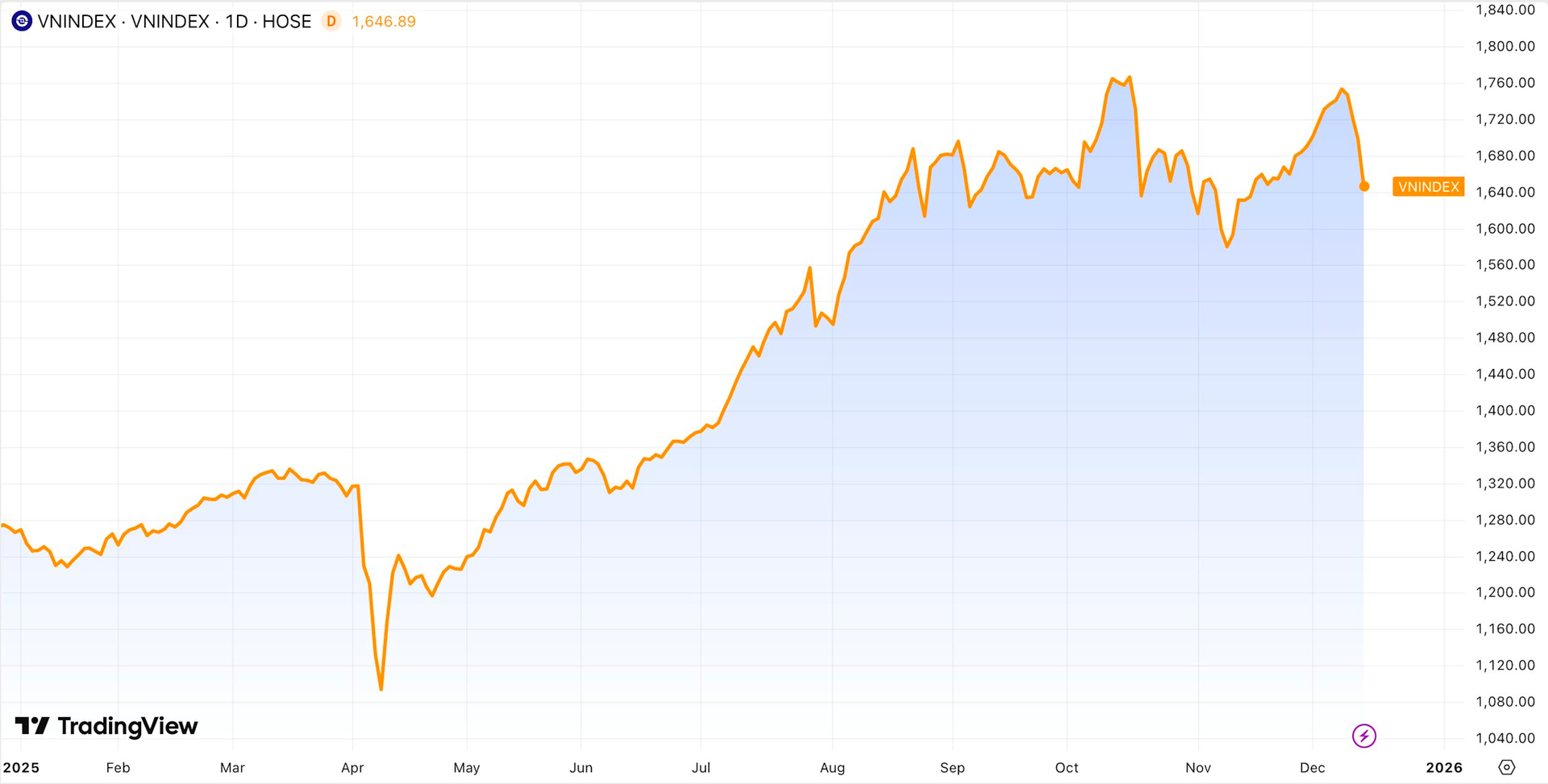

Looking at Vietnam’s stock market history over the past five years (2020–2025), it’s not hard to see that this period has seen many market-wide sales due to global and local economic, political, health, and policy events. However, it’s noteworthy that after these sharp declines, the market has always recovered, whether quickly or slowly.

Currently, the market is clearly under pressure. A recent SGI Capital report suggests that financial market pressures stem from year-end bond redemptions and high equity issuance volumes, expected to surpass 2021 levels and set a new record for Vietnam’s stock market. Additionally, the market isn’t cheap enough given rising interest rates, limiting short-term demand.

Profit-taking pressure on previously overheated stocks is a short-term challenge. Many blue-chip stocks, though deeply discounted from their peaks, haven’t found equilibrium yet, which is another factor to consider. For medium to long-term investment prospects, Dragon Capital believes Vietnam’s market has strong fundamentals to sustain positive growth in 2025–2026.

First, corporate earnings continue to exceed expectations. Statistics show that profits for 80 companies tracked by Dragon Capital rose 22.4% in the first nine months, higher than the year’s initial forecast. Full-year 2025 growth is estimated at 21.3%, with 16.2% expected in 2026.

Second, market valuations are attractive, with a projected 2025 P/E of just 12.5–13 times and 11 times for 2026—lower than many regional markets, despite strong earnings growth.

Finally, Vietnam’s upgrade from a frontier to an emerging market will unlock significant re-rating opportunities, as large-scale international capital flows in, fueling a new growth cycle.

Why Did the VN-Index Plunge 52 Points in the Final Session of the Week?

The selling pressure from this group swiftly spread to real estate, stocks, and banking sectors, causing a sharp decline in many blue-chip stocks and fostering a negative sentiment that dragged the market downward.

Stock Market Outlook for the Week of December 8-12, 2025: Storm Clouds Gather

The VN-Index plummeted relentlessly in the final session of the week, marking its steepest weekly decline since the tariff shock in April 2025. Pessimism is spreading as the market loses all support from blue-chip stocks, while buying power remains insufficient to counter the mounting selling pressure.