The stock market witnessed a dramatic trading session as the VN-Index adjusted in the morning, then reversed course with a sharp upward trend in the afternoon, resulting in a nearly 60-point fluctuation. From a low of around 1,630 points, the index surged to 1,688 points before closing at 1,679.18 points, up 33.17 points, officially ending a five-session losing streak.

Without any significant supportive news, the market reversed with a surge in liquidity. After a period of adjustment, many stocks had retreated to their lowest levels in several months, triggering bottom-fishing demand.

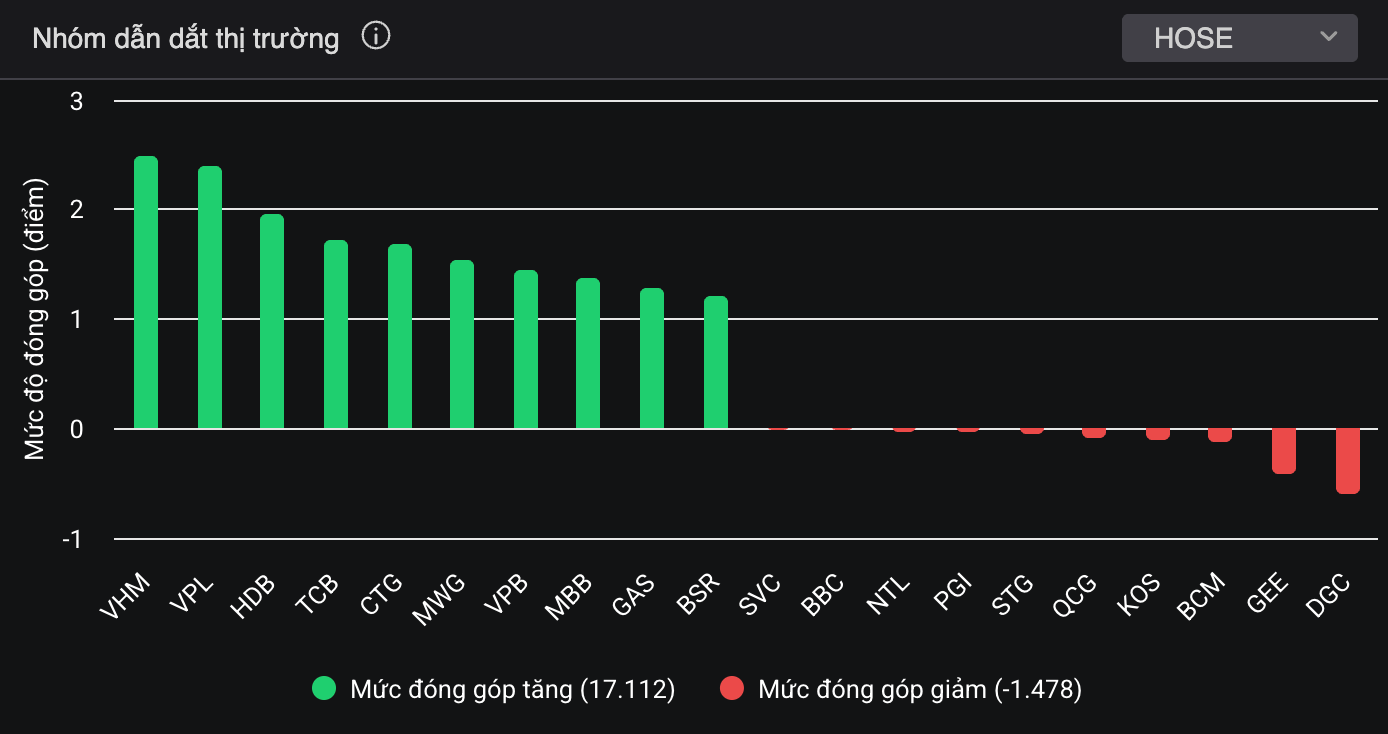

Leading the charge were the “Vin group” stocks, with VPL breaking out strongly and closing at the ceiling price, becoming a crucial support for the index. VRE and VHM also rose over 2%, contributing to the VN-Index’s escape from the day’s lows.

Bottom-fishing demand and the leadership of the Vin group stocks, particularly VPL, helped the market end its five-session losing streak.

In contrast, VIC, despite surging over 5% in the early afternoon session, quickly faced profit-taking pressure, narrowing its gains and closing near the reference price. VIC’s inability to maximize its potential caused the index to give back some of its intraday gains, but it did not disrupt the overall recovery trend.

Beyond the Vin group, liquidity also spread to banking and securities stocks. HDB and EIB hit their ceiling prices; TCB, MBB, VPB, and CTG rose 2-4%. The securities group saw strong gains in SSI, VND, VIX, and VCI, amplifying the market’s rebound.

However, a notable exception in the securities group was VCK of VPS Securities, which fell over 15% to 50,800 VND per share. More than 14.8 million shares changed hands on its first trading day. VPX of VPBankS Securities also saw a surprising reversal, falling to the floor in the morning session but closing up 1.4%, disappointing many short-term investors who bought into the IPO.

Divergence emerged even during the strong recovery session. Notably, QCG of Quoc Cuong Gia Lai fell to the floor after a previous hot streak.

At the close, the VN-Index gained 33.17 points (2.02%) to 1,679.18 points. The HNX-Index rose 5.71 points (2.29%) to 255.08 points, while the UPCoM-Index fell 0.25 points (0.21%) to 118.3 points. Liquidity increased significantly, with HoSE trading value exceeding 24,450 billion VND.

Market Pulse 12/16: Spectacular Comeback as VN-Index Surges Over 30 Points

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”a7a554af-917f-4105-8a7f-1986e1c24ef9″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Ex”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”cit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” persisted”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” throughout”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” today”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”‘s”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” session”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” with”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” numerous”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” stocks”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” even”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” closing”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” at”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” their”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” upper”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” limits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” The”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” VN”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Index”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” surged”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” to”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”8″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” points”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” marking”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gain”}

Vietstock Daily 17/12/2025: Bottom-Fishing Demand Triggered?

The VN-Index staged a robust reversal in the afternoon session, reclaiming its position above the 100-day SMA. However, with both the Stochastic Oscillator and MACD trending downward, and the index lingering below the Bollinger Bands’ Middle Line, the market remains susceptible to unexpected volatility in upcoming sessions.