Phat Dat Real Estate Development Joint Stock Company (HoSE: PDR) has recently announced its business plan for the 2026-2030 period.

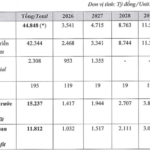

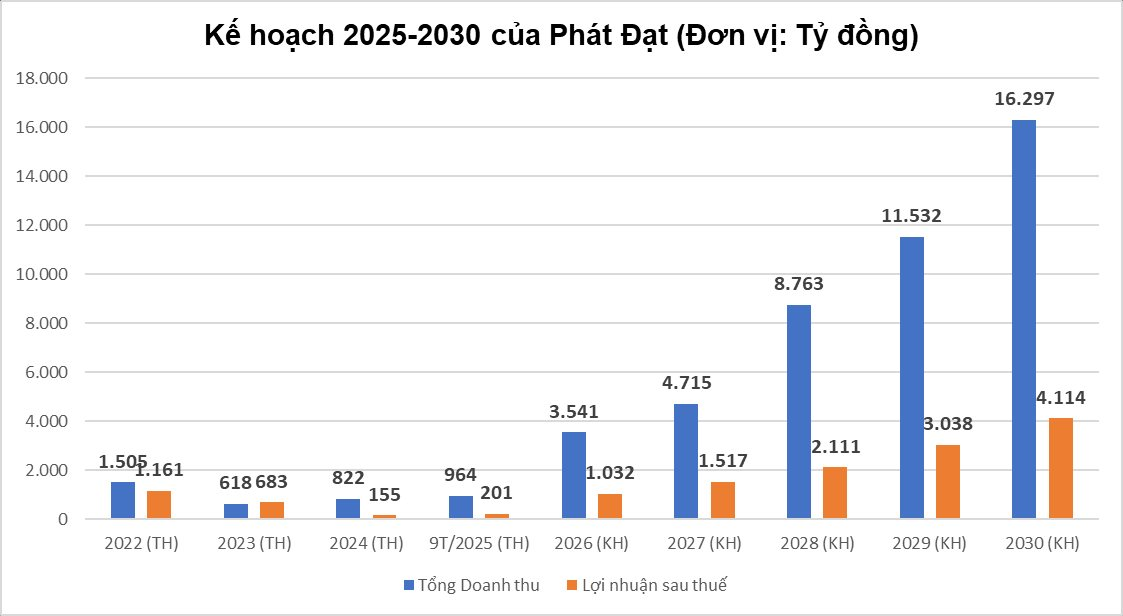

According to Resolution No. 37/2025/HĐQT-QĐ dated December 12, 2025, Phat Dat aims to achieve a total revenue of VND 44,848 billion (equivalent to over USD 1.5 billion) and an after-tax profit of VND 11,812 billion over the next five years.

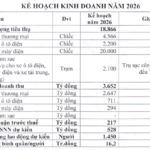

The plan projects a revenue of VND 3,541 billion for 2026, a slight increase from the 2025 plan. However, a higher growth rate is expected in subsequent years, with 2030 revenue forecasted to reach VND 16,297 billion (4.6 times that of 2026) and an after-tax profit of VND 4,114 billion (four times the initial year).

Project development dominates the revenue structure, contributing VND 42,344 billion. Notably, financial revenue is expected to add VND 2,308 billion, primarily from the transfer of two projects, Thuan An 1 and Thuan An 2 Complex High-Rise Residential Areas, during 2026-2027.

This ambitious goal is set against the backdrop of the company’s modest 2025 performance. In the first nine months of 2025, Phat Dat achieved only 28% of its annual profit plan. Achieving such significant revenue growth in the next five years will require substantial resources and a favorable real estate market.

Project Portfolio and Actual Progress

To reach the USD 1.5 billion revenue target, Phat Dat relies on six key projects, expected to generate VND 35,525 billion. However, only two projects, Bac Ha Thanh and Thuan An 1, currently contribute revenue, while others are still in the legal completion phase:

The Bac Ha Thanh Urban Renovation and Residential Area Project (Gia Lai) – commercially known as ICONIC Quy Nhon – is the only project with active sales, recording over VND 400 billion in Q3/2025.

Thuan An 1 (Binh Duong) is expected to complete in December 2025, but Phat Dat has transferred most of its capital contribution, converting it into an associate company. Thus, revenue primarily comes from financial income.

Other major projects, such as Han River (Da Nang), plan to develop an inland waterway port in phase 1 from 2025-2030.

Poulo Condor Tourism Area (Con Dao) and Phuoc Hai Complex (Ba Ria – Vung Tau) are still in the legal completion phase or have not begun construction.

The new project at 239 Cach Mang Thang Tam (Ho Chi Minh City) has just completed share acquisition and requires time for implementation, with an estimated value of VND 5,500 billion.

Financial Situation

According to the Q3/2025 financial report, Phat Dat’s net revenue for the first nine months of 2025 reached VND 964.4 billion, with an after-tax profit of VND 201.3 billion.

Despite profits, net cash flow from operating activities was negative at VND 131 billion. Cash on hand decreased sharply from VND 343 billion at the beginning of the year to VND 116 billion by the end of September.

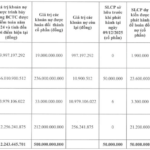

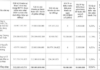

Total financial debt stands at VND 5,892 billion, with bank loans accounting for VND 5,360 billion (91% of total debt). Interest expenses for the nine months were VND 203.1 billion. The company also raised capital from individuals at a 12% annual interest rate.

Major loans include VND 3,840 billion from MBBank Saigon Branch for the Bac Ha Thanh and Thuan An projects; VND 1,058 billion from VietinBank for projects in central Ho Chi Minh City; and VND 235 billion from VPBank.

Inventory is concentrated in older projects like The EverRich 2 and The EverRich 3 (over VND 4,400 billion), which remain unsold due to prolonged legal issues. On December 15, 2025, the Board approved the transfer of The EverRich 2 to Big Gain.

In Q4/2025, the company approved the transfer of 99% of shares in Bac Cuong Investment Joint Stock Company for at least VND 1,100 billion.

Alongside asset sales, Phat Dat seeks internal funding through an ESOP issuance of 18 million shares at VND 10,000 per share. The payment period is from December 15 to 22, 2025, expected to raise VND 180 billion for working capital and debt reduction.

Conversely, the company continues land expansion by investing nearly VND 296 billion (35% equity) in Dong Nai Riverside New Urban Area Joint Stock Company and VND 346.438 billion (35% equity) in Tam Hiep Urban Development Joint Stock Company.

On the stock market, PDR shares are undergoing a correction. By the close of December 15, 2025, PDR’s price dropped 3.55% to VND 19,000 per share, continuing a decline from early December (VND 22,000). Increased selling pressure has caused a 13% loss in value over two weeks.

Long Thành Airport Real Estate Market Celebrates Milestone in $16 Billion Mega Project

The infrastructure connecting Long Thanh Airport is entering a rapid acceleration phase, with several key projects gaining significant momentum. These positive developments in connectivity are directly fueling the real estate market in the surrounding area.

Unveiling the Investor Behind the 1.7 Trillion VND Harmonia Bay Project in Da Nang

The People’s Committee of Da Nang City has officially approved Blue Land’s investment in the Harmonia Bay project, located in An Hai Ward. With a total investment capital of nearly 1.730 trillion VND, this development marks a significant milestone for the region.