The 2025 Extraordinary General Meeting of MB Securities Corporation (stock code: MBS, listed on HNX) held on December 16 approved the continuation of the ESOP issuance plan and the issuance of additional shares to increase the charter capital.

Firstly, the Board of Directors presented to the meeting the approval to continue the Employee Stock Ownership Plan (ESOP) previously adopted in Resolution No. 01/NQ-MBS-ĐHĐCĐ dated April 15, 2025, and to approve the eligibility criteria for employees participating in the program.

Specifically, MBS plans to issue 8.59 million shares under the employee stock option program at a price of 10,000 VND per share. The proceeds of over 85.9 billion VND will be used to supplement the margin trading capital.

50% of the ESOP shares will be restricted from transfer for 3 years, and the remaining 50% will be restricted for 5 years.

Previously, in Resolution No. 85 dated September 29, 2025, the MBS Board of Directors approved a list of 322 employees eligible to purchase ESOP shares in this round.

Among them, Mr. Lê Viết Hải, Chairman of the Board, is expected to receive the largest allocation with 570,000 shares; Vice Chairman and CEO Phan Phương Anh plans to purchase 528,194 shares; Board members Nguyễn Minh Hằng and Phạm Xuân Thanh each plan to purchase 200,000 shares…

Secondly, MBS presented a plan to offer up to 333.6 million shares to the public through a rights issue. The ratio is 2:1, meaning shareholders holding 2 shares will be entitled to purchase 1 new share.

The shares offered to shareholders will be freely transferable. Shareholders may transfer their purchase rights once. The issuance is expected to take place in 2026, following the completion of the ESOP issuance.

The offering price is 10,000 VND per share. MBS anticipates raising up to 3,336.5 billion VND from this offering. Of this amount, 1,000 billion VND will be used to supplement proprietary trading capital, and 2,336.5 billion VND will be allocated for margin lending.

If both plans are successfully executed, MBS’s charter capital will increase to 10,000 billion VND.

In the past two months, MBS has successfully completed two capital increase plans. On September 25, 2025, the company finalized the distribution of 17.18 million shares to increase equity capital from owner’s equity.

On November 13, 2025, MBS completed the sale of 68.73 million shares to existing shareholders through a rights issue.

As a result, MB Securities’ current charter capital stands at 6,587.2 billion VND.

How Bao Minh Securities Allocates 1.250 Trillion VND from Its Private Placement?

Revised Introduction:

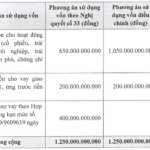

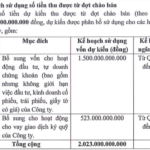

Bao Minh Securities has revised its allocation strategy for the 1.250 trillion VND proceeds from its recent private placement of shares.

HOSE Adds Two Stocks to Margin Cut List

On December 12th, the Ho Chi Minh City Stock Exchange (HOSE) announced the addition of two stocks to its margin trading ineligible list. These include HID, issued by Halcom Vietnam JSC, due to delayed financial report submissions, and the newly listed VPX, issued by VPBank Securities JSC.