April 2, 2025, marked a historic moment when President Donald Trump officially signed and announced a reciprocal tariff order on imported goods from all of America’s trading partners. Among them, 57 countries faced higher individual tariff rates, including Vietnam with a reciprocal tariff of up to 46%, before being reduced to the current 20%.

This came as a significant shock, as the public had previously hoped that Vietnam could benefit from President Trump’s escalating trade war with China, similar to what occurred in 2018.

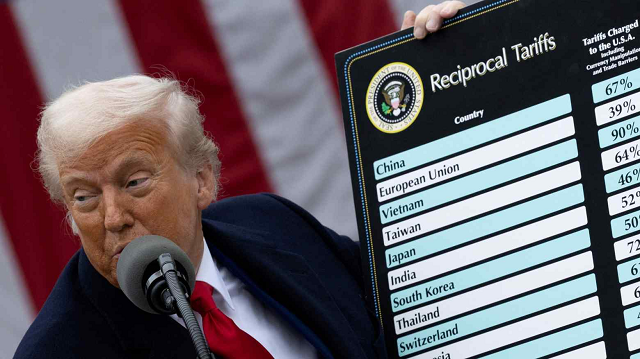

President Donald Trump announces America’s reciprocal tariff policy in the Rose Garden of the White House on April 2, 2025.

|

Not only Vietnam but the entire global economy was shaken as the international trade system faced a critical juncture. Stock markets plummeted in response to the sudden and drastic changes in economic prospects. However, initial tensions eased as the U.S. government quickly suspended tariffs to engage in bilateral negotiations with each partner.

Amid the tensions, China was the only country to directly retaliate with tariffs against the U.S. Both sides repeatedly escalated reciprocal tariffs, reaching up to 125% at one point, while also imposing export restrictions on strategic goods such as semiconductors (U.S.) and rare earths (China). Nevertheless, the two sides later resumed negotiations to de-escalate and reduce tariffs. During this period, both countries frequently accused each other of non-compliance while continuing to use export controls as leverage.

Trade Agreement

However, on October 30, 2025, President Donald Trump and Chinese President Xi Jinping held their first direct meeting since 2019. The two leaders finally signed a one-year trade agreement, with the possibility of periodic extensions. This agreement not only involved reducing reciprocal tariffs but also focused on strategic goods such as rare earths, semiconductors, and agricultural products.

Earlier, at the 47th ASEAN Summit in Kuala Lumpur, Malaysia, on October 26, 2025, Vietnam and the U.S. issued a joint statement on the framework of a reciprocal trade agreement. Under this agreement, Vietnam expanded market access for most U.S. agricultural and industrial goods, while the U.S. committed to maintaining a 20% reciprocal tariff on goods originating from Vietnam, with some products eligible for a 0% tariff. On this occasion, Malaysia and Cambodia also reached tariff agreements with the U.S.

As part of the effort to balance trade, businesses from Southeast Asian countries made significant commitments to purchase goods from the world’s largest economy, including aircraft, petroleum products, and agricultural goods.

|

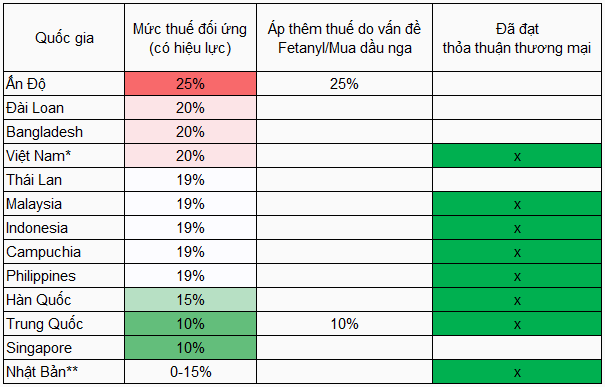

Trump 2.0 Tariffs

Additional tariff rates imposed by the Trump administration on major Asian exporters in 2025. – Based on officially applied tariffs, excluding threatened tariffs.

– (*) Joint statement on the reciprocal trade agreement framework. – () U.S. reciprocal tariff mechanism for Japan: goods with Column 1 tariffs (under the U.S. Harmonized Tariff Schedule – HTSUS) of 15% or higher will not face additional reciprocal tariffs (0%); goods with Column 1 tariffs below 15% will face additional tariffs to reach a total of 15%. Source: Compiled by global law firm Reed Smith.

|

|

Starting April 5, 2025 (effective date), the U.S. government began applying a basic reciprocal tariff of 10% on imported goods from all trading partners. Higher individual tariffs were expected to take effect on April 9 but were suspended for 90 days for negotiations. By August 7, 2025, higher reciprocal tariffs—ranging from 10% to 50% depending on the partner—officially took effect. Goods from Vietnam faced a 20% tariff (reduced from the initial 46% announcement). As the U.S. reciprocal tariff map took shape, a notable issue was President Trump’s threat to impose a 40% tariff on goods classified as transshipped. However, identifying and classifying such goods proved technically controversial, as today’s global supply chains are highly integrated: a final product often consists of components and materials from multiple countries. |

Export Sector Adapts Amid Uncertainty

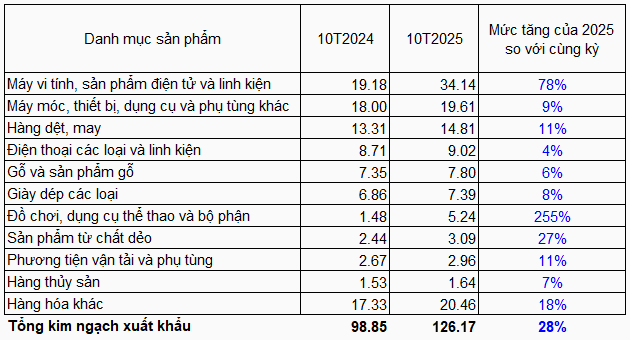

Despite the unpredictable tariff policies, Vietnam’s global exports continued to flourish. According to the General Department of Customs, the country’s total export turnover in the first 10 months of 2025 reached nearly $391 billion, a 16% increase year-on-year. For the U.S. market alone, export turnover exceeded $126 billion, up nearly 28%, driven primarily by computers, electronics, and components.

More broadly, U.S. imports from countries like Vietnam, India, Indonesia, Malaysia, Taiwan, and Thailand increased by over 20% in the first 8 months of the year compared to the same period last year. Conversely, the value of goods imported from China into the U.S. decreased by nearly 22%.

In Vietnam, major exporters in the textile and seafood sectors reported significantly better-than-expected results. In the first 9 months of the year, companies like May Sông Hồng, TNG, and Dệt may Hòa Thọ reported record-high profits. Similarly, seafood exporters such as Vĩnh Hoàn, Sao Ta, and Minh Phú saw improved revenue and profits. However, the stocks of these export companies remained among the poorest performers this year.

|

Expanding Trade

Export turnover to the U.S. market surged amid uncertain reciprocal tariff policies, particularly in computers, electronics, and components. Unit: Billion USD

Source: Compiled by the General Department of Vietnam Customs.

|

“We initially expected exports to stall or even decline once tariffs took effect… but this did not happen,” said Michael Kokalari, Chief Economist at VinaCapital, at an investment conference in late October 2025. Instead, exports to the U.S. market surged, becoming a key driver of the economy this year, despite weak domestic consumption.

The economist noted that the key factor was how U.S. tariffs on Vietnamese goods compared to those on other exporting countries. “As long as the difference does not exceed 10%, we are not significantly affected, as Vietnam’s other advantages can compensate. Therefore, exports are expected to remain unaffected, and FDI inflows will continue.”

VinaCapital forecasts that export turnover to the U.S. in 2026 will continue to grow, but at a slower rate of around 8%.

– 08:00 17/12/2025

Spectacular IPOs: Anticipated Blockbusters Hit the Market, Only to Fizzle Out as Major Disappointments

After years of stagnation, the stock market has recently witnessed a robust surge in initial public offerings (IPOs), with several high-profile names emerging as potential blockbusters. However, post-IPO performance on the trading floor has left investors disillusioned, as these so-called “blockbusters” have failed to meet expectations.

Why Did Masan Consumer Choose This Moment to List on HOSE?

Following approval from the Ho Chi Minh City Stock Exchange (HOSE), Masan Consumer has announced that its stock, MCH, is expected to commence trading on HOSE on December 25, 2025.

Nationwide Affordable Housing Projects Break Ground on Special Occasion

On December 19th, a wave of groundbreaking ceremonies will sweep across the nation as numerous social housing projects are set to commence simultaneously. This unprecedented surge in development marks a significant milestone for affordable housing, catering specifically to low-income individuals. The initiative is a celebratory gesture in honor of the 14th National Congress of the Communist Party of Vietnam.

Cuba’s Underground Secret: Vietnam’s Bold Move to Cultivate 2,500 Hectares and Transform It into a “Capital”

Beneath Cuba’s surface lies a treasure far more valuable than oil or rare minerals: a rich, fertile layer of red basalt soil that has captured the attention of Vietnamese agricultural engineers. This natural bounty, teeming with potential, promises to revolutionize farming practices and foster sustainable growth.