Illustrative Image

Platinum Victory PTE.LTD has recently submitted a report to the State Securities Commission, Ho Chi Minh City Stock Exchange (HoSE), and REE Corporation regarding the trading activities of insiders and related parties.

According to the report, from November 17, 2025, to December 16, 2025, the Singapore-based fund acquired 223,400 REE shares out of the 18,115,447 shares previously registered. The shortfall was attributed to unfavorable market conditions.

The transactions were executed through negotiated agreements, order matching on the stock exchange, or via the Vietnam Securities Depository and Clearing Corporation.

Following these transactions, Platinum Victory PTE.LTD increased its holdings from 225,576,549 REE shares (41.65%) to 225,799,949 shares (41.69%).

In terms of relationships, Platinum Victory PTE.LTD’s authorized representatives, Mr. Hsu Hai Yeh and Mr. Alain Xavier Cany, serve as a Board Member and Vice Chairman of the Board of REE, respectively.

Previously, Platinum Victory PTE.LTD faced challenges in acquiring REE shares due to market conditions. Most recently, during the trading period from October 13, 2025, to November 11, 2025, the fund successfully purchased only 20,000 shares out of the nearly 18.14 million shares registered.

Earlier, from September 8, 2025, to October 7, 2025, Platinum Victory managed to acquire just 91,000 REE shares out of the over 18.2 million shares registered for purchase.

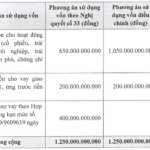

In other developments, REE recently announced a resolution to increase the charter capital and amend the charter of REE Energy LLC.

Specifically, the charter capital of REE Energy was raised from VND 7,248 billion to VND 10,500 billion. The capital increase was achieved through additional contributions from the company’s owner.

REE Energy is a wholly-owned subsidiary of REE, with REE holding 100% of its capital as of September 30, 2025.

“The $10 Billion ‘Diamond’ of Nguyen Dang Quang: Listing Price Set on HOSE”

MCH shares are set to officially commence trading on the Ho Chi Minh City Stock Exchange (HOSE) on December 25, 2025.

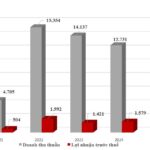

How is GELEX Infrastructure Performing on the Eve of its IPO?

In 2025, GELEX Infrastructure is poised to achieve remarkable business results, targeting a revenue of VND 15,445 billion, a 21.5% increase, and pre-tax profit of VND 1,925 billion, up 18.5% compared to 2024 performance.