Specifically, spot silver surged approximately 4%, reaching $66.3 per ounce, after briefly hitting an all-time high of $66.51 per ounce. This remarkable rally has positioned silver as the top-performing precious metal this year, with gains of up to 126%, significantly outpacing gold’s 65% increase.

According to Edward Meir, an analyst at Marex, there’s a notable shift in capital flow within the precious metals sector. “Silver is driving gold higher. Some capital is moving out of gold and into silver, platinum, and palladium. In the short term, $70 per ounce is a reasonable next target for silver,” he stated.

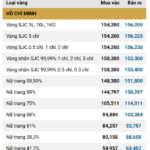

Meanwhile, spot gold rose by 0.7%, reaching $4,332.21 per ounce, after earlier gains of over 1% during the session. U.S. gold futures also climbed 0.7%, to $4,364 per ounce.

Silver surpasses $66 per ounce for the first time, while gold gains approximately 1%. Image: IG.

The primary driver for gold’s strength stems from expectations of accommodative monetary policy from the U.S. Federal Reserve (Fed). Recent data revealed that the U.S. economy added 64,000 jobs last month, exceeding forecasts, yet the unemployment rate rose to 4.6%, the highest since September 2021. This development fuels hopes that the Fed will soon resume rate cuts, benefiting non-yielding assets like gold.

“The market is still betting on two rate cuts by the Fed in the first half of 2026, which could continue to support gold prices in the coming period,” noted Bas Kooijman, CEO and Portfolio Manager at DHF Capital S.A.

Last week, the Fed implemented its third and final 0.25 percentage point rate cut of the year. Investors are now pricing in two additional rate cuts for 2026.

Beyond monetary factors, geopolitical tensions are also boosting safe-haven demand. U.S. President Donald Trump recently ordered a full blockade on sanctioned oil tankers entering or leaving Venezuela, intensifying pressure on President Nicolas Maduro’s administration.

Among other precious metals, platinum advanced 2.5%, reaching $1,896.90 per ounce, its highest level in over 17 years, while palladium also rose nearly 2.5%, to $1,643.79 per ounce, the highest since February 2023.

Silver Hits Record High, Then Plunges: Experts Predict Triple-Digit Prices by 2026

Silver prices soared to unprecedented heights in 2025, more than doubling and outpacing gold in a rally experts dubbed a “historic surge.”