Binh Son Refining and Petrochemical Joint Stock Company (Stock Code: BSR, HoSE) has announced its resolution approving the provisional 2026 production and business operation plan.

In 2026, Binh Son Refining and Petrochemical will focus on safely, stably, and continuously operating the Dung Quat Oil Refinery at optimal capacity, ensuring product structures align with market demands to maximize operational efficiency. Additionally, the company will strengthen security, safety, health, environmental protection, and fire prevention measures at the refinery.

Simultaneously, the company will adopt a proactive and flexible approach to crude oil and intermediate material procurement, developing strategies and plans to secure a stable supply chain while optimizing costs.

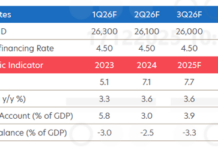

According to the production plan, the total output for 2026 is projected to reach nearly 7.7 million tons. Key products include diesel, with an estimated output of over 3.5 million tons, and RON 95 gasoline, expected to reach nearly 2.4 million tons.

Source: BSR

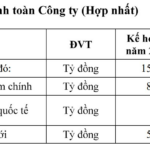

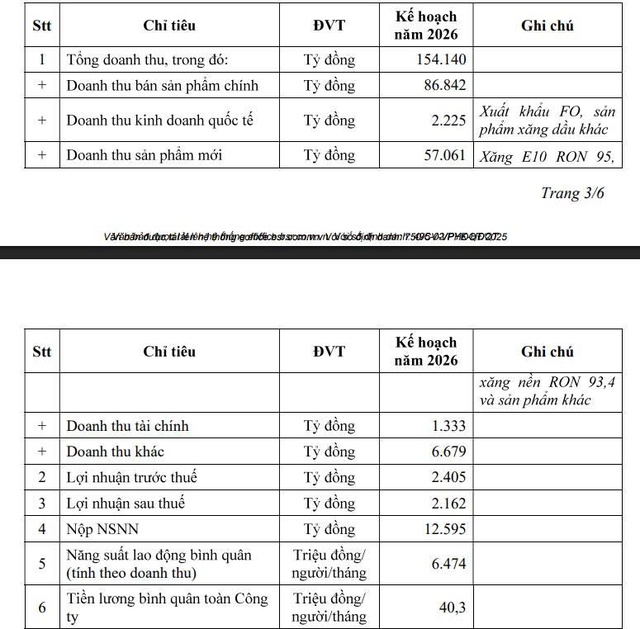

In terms of consolidated financial planning, Binh Son Refining and Petrochemical aims to achieve a revenue of 154.140 trillion VND in 2026. This includes 86.842 trillion VND from core products, 57.061 trillion VND from new products, and 2.225 trillion VND from international business.

Pre-tax profit is expected to reach 2.405 trillion VND, with post-tax profit estimated at 2.162 trillion VND. The company also plans to contribute approximately 12.595 trillion VND to the state budget.

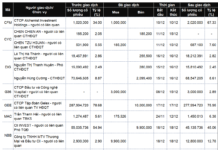

Regarding dividend distribution, Binh Son Refining and Petrochemical plans to allocate 1.001 trillion VND for dividend payments to shareholders at a rate of 2%, meaning shareholders will receive 200 VND per share (as per the resolution of the 2025 Annual General Meeting).

Furthermore, the company has outlined an investment plan for 2026 totaling 8.578 trillion VND, comprising 8.454 trillion VND for capital construction and 124 billion VND for equipment procurement. All funding will be sourced from the company’s equity capital.

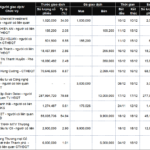

In the first nine months of 2025, Binh Son Refining and Petrochemical reported a net revenue of nearly 103.956.8 trillion VND, a 19.4% increase compared to the same period in 2024. Post-tax profit reached over 2.154.7 trillion VND, up 219.5% year-on-year.

As of September 30, 2025, the company’s total assets decreased by 5.1% from the beginning of the year to 83.843.7 trillion VND. Term deposits stood at nearly 31.112 trillion VND, a 121.9% increase from the start of the year, accounting for 37.1% of total assets.

On the liabilities side, total payable debt was over 26.389.9 trillion VND, down 19.7% from the beginning of the year. Short-term loans and financial lease liabilities amounted to nearly 14.137 trillion VND, representing 53.6% of total debt.

Billion-Dollar Refinery Projects 2025 Revenue at $6 Billion, Pre-Tax Profit at $200 Million

In the second half of 2025, BSR sustained an average plant capacity utilization rate of 122% and significantly boosted product sales. As a result, profits surged by 113% compared to the first half of the year, despite a 7% decline in crude oil prices and challenging weather conditions.

BSR Proactively Navigates the 2026 Storm

Despite successfully weathering the storm to achieve early milestones by 2025 with significant accomplishments, Binh Son Refining and Petrochemical Joint Stock Company (BSR) is anticipated to face even larger challenges ahead. Proactive and focused solutions are essential for the company to navigate these impending storms and fulfill its pivotal objectives in the critical year of 2026.