The Ministry of Finance recently released the “Citizen’s Budget Report – State Budget Estimate for 2026, as Decided by the National Assembly.”

The report outlines key macroeconomic indicators for 2026, targeting a Gross Domestic Product (GDP) growth rate of 10% or higher, an average Consumer Price Index (CPI) increase of approximately 4.5%, and a 5.8% rise in total export turnover.

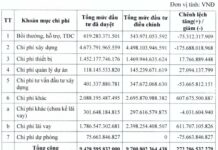

According to the Ministry of Finance’s report, the estimated state budget revenue for 2026 is 2,529.467 trillion VND, marking a 28.6% increase compared to the 2025 estimate and a 5.9% rise from the 2025 actual figures. The mobilization rate into the state budget is approximately 17.4% of GDP, with taxes and fees accounting for around 13% of GDP.

Source: Ministry of Finance

Specifically, domestic revenue is projected at 2,199.967 trillion VND; crude oil revenue at 43 trillion VND; trade balance revenue from import-export activities at 278 trillion VND; and aid revenue at 8.5 trillion VND. The estimated total revenue for the Central Budget is 1,225.356 trillion VND, while the Local Budget is expected to reach 1,304.111 trillion VND.

The estimated state budget expenditure for 2026 is 3,159.106 trillion VND. This includes 1,120.227 trillion VND for development investment; 121.131 trillion VND for debt interest payments; 1,808.996 trillion VND for regular expenditures; and 108.752 trillion VND for other expenditures.

The report also provides detailed breakdowns of the Central and Local Budget expenditures for 2026 by sector. The estimated budget deficit for 2026 is approximately 605.8 trillion VND, equivalent to 4.2% of GDP. This includes a Central Budget deficit of 583.7 trillion VND (4% of GDP) and a Local Budget deficit of 22.1 trillion VND (0.2% of GDP).

Regarding the implementation of salary policies and social welfare programs, ministries, central agencies, and local governments will continue to implement measures to generate resources for salary reforms as mandated.

Starting in 2026, the government will proactively utilize accumulated funds for salary reforms to ensure the implementation of salary systems, allowances, and income regulations. The scope of using the Central Budget’s accumulated funds for salary reforms will be expanded to adjust pensions, social insurance benefits, monthly allowances, preferential allowances for meritorious individuals, and workforce streamlining. Local Budget salary reform funds will be used to implement centrally issued social welfare policies and workforce streamlining.

Budget Revenue Surges: Unraveling the Land-Driven Anomaly

The General Statistics Office under the Ministry of Finance reports that Vietnam’s state budget revenue for the first 11 months reached nearly VND 2.4 trillion, surpassing the annual estimate by 21.9% and marking a 30.9% increase year-on-year. Notably, land-related revenue saw a significant surge. Economist Nguyen Tri Hieu questions why other revenue streams lagged while land contributions dominated the budget.

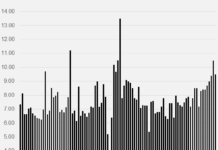

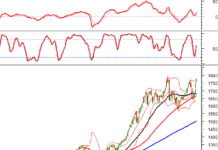

Will the Stock Market Shift Gears Next Week?

The VN-Index continued its recovery last week, though investor sentiment remained cautious with subdued trading volumes. Despite this, positive signals emerged in select stock groups, attracting bottom-fishing demand. Analysts advise investors to position for a potential trend reversal once recovery signals are confirmed, while maintaining a cash reserve to capitalize on emerging opportunities.