Vietnam’s stock market witnessed another vibrant trading session, primarily driven by the Vingroup family of stocks. All four Vingroup stocks—Vingroup (VIC), Vinhomes (VHM), Vinpearl (VPL), and Vincom Retail (VRE)—surged dramatically on December 23, with VIC notably surpassing its previous peak.

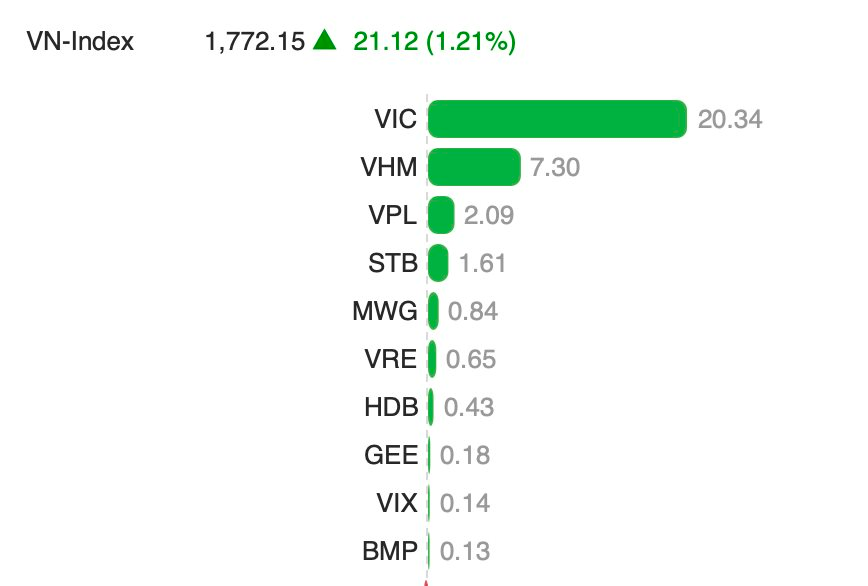

The VN-Index closed the December 23 session up 21.12 points (1.21%), surpassing the 1,770-point mark and setting a new record high (based on closing prices). Notably, the VIN-Index (Vingroup group), comprising the four stocks VIC, VHM, VPL, and VRE, contributed over 30 points to the index on this day.

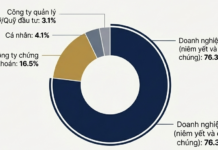

This trend has been recurring throughout the year. The VIN-Index currently constitutes approximately 20% of the VN-Index, significantly influencing the market. Since the beginning of the year, the Vingroup family has contributed a total of 388 points to the VN-Index, while the index itself has risen by about 500 points.

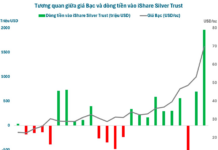

Mr. Petri Deryng, head of Pyn Elite Fund, attributes the strong performance of Vingroup stocks to the benefits derived from infrastructure investment projects. The company’s valuation is based on future cash flows, making it challenging to convert into precise short-term profit figures.

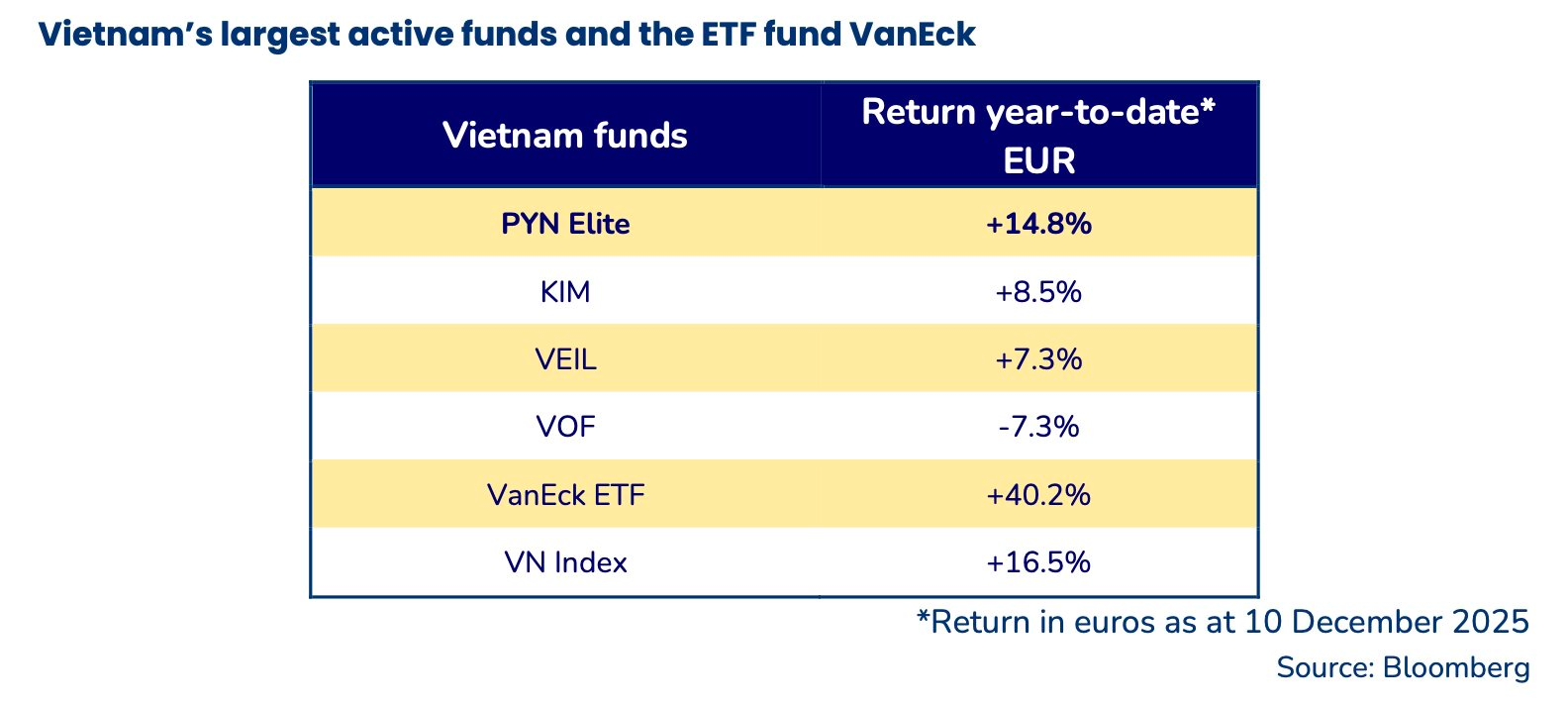

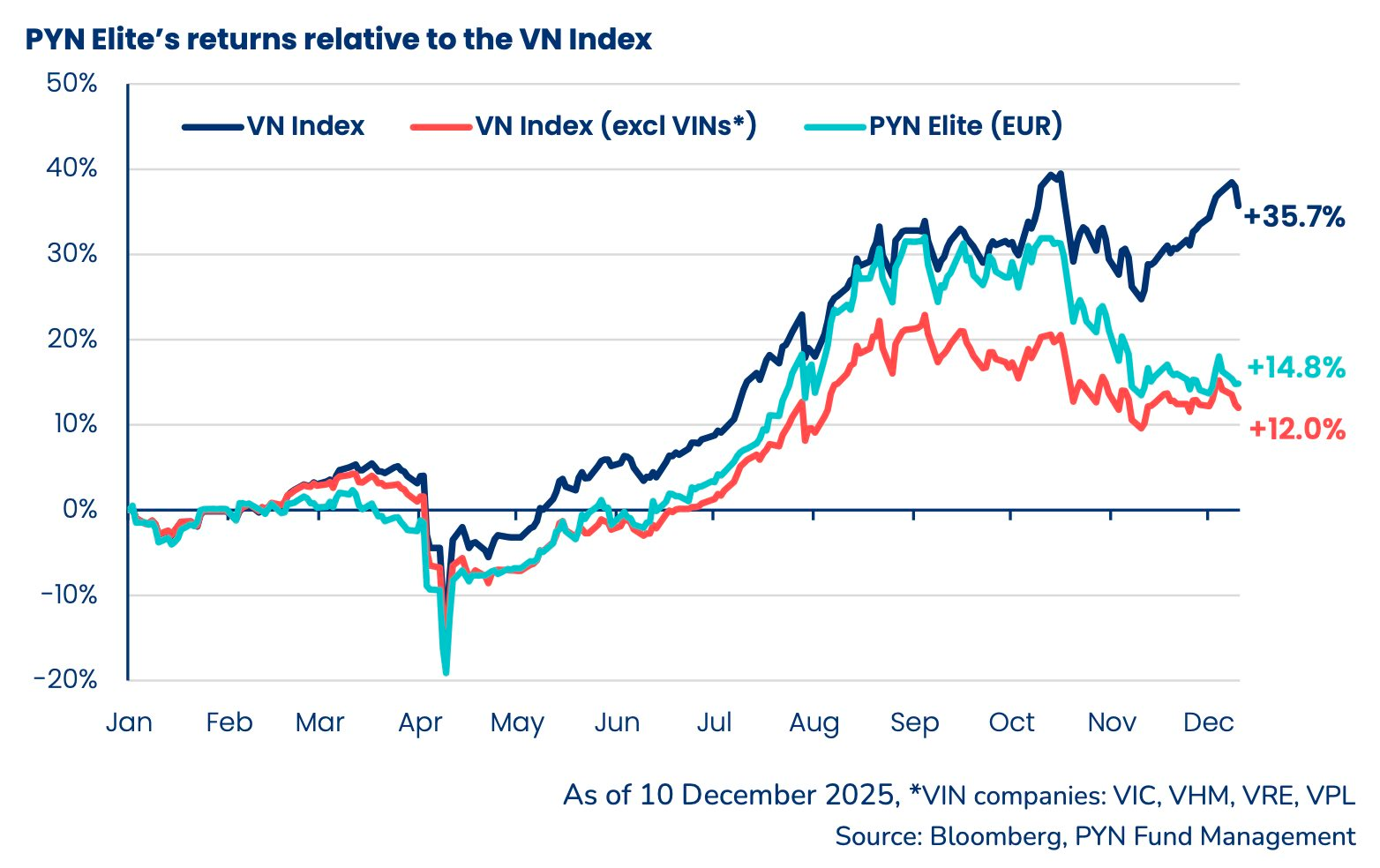

Undeniably, the Vingroup family’s breakout has been the primary force driving the stock market to new heights. However, Mr. Petri Deryng also notes that this has made the year 2025 particularly challenging for most investors. “Fund managers (those who can still smile) joke that this year’s VN-Index should be called the VIN-Index, as this group of companies has completely dominated the index’s performance,” shared the head of Pyn Elite Fund.

According to Mr. Petri Deryng, the challenging trading year in Vietnam’s stock market has impacted all actively managed funds, with the largest ones—VEIL, VOF, KIM, and Pyn Elite Fund—being no exception. Most of these funds do not hold a significant allocation in Vingroup stocks.

Passively managed ETF funds have fared better, as their investments are allocated according to local indices. However, Mr. Petri Deryng emphasizes that the weight of Vingroup stocks has exceeded necessary levels due to rapid price changes. In recent rebalancing periods, many large ETF funds have had to reduce their holdings of Vingroup stocks to maintain equilibrium.

The head of Pyn Elite Fund believes that, excluding the Vingroup family, the fund’s performance has been quite good. “We did not purchase Vingroup stocks during the rally. On the other hand, investing in them would be very challenging, and we are not considering buying them at this time, as it’s difficult to calculate their long-term fair value,” Mr. Petri Deryng stressed.

Unfortunately, many other stocks in the market have seen significant declines in the fall. Mr. Petri Deryng noted that Pyn Elite Fund has made allocation adjustments to position its portfolio for the coming year. “We should have sold more of some stocks that had risen strongly at favorable prices earlier in the fall,” the fund manager stated.

Vietstock Daily 24/12/2025: Breaking Boundaries?

The VN-Index has set a new all-time high (based on closing price), marking its fourth consecutive session of gains while closely tracking the Upper Band of the Bollinger Bands. Both the MACD and Stochastic Oscillator indicators maintain their positive upward trajectory, reinforcing earlier buy signals. The outcome of testing the previous October 2025 peak (around 1,740-1,795 points) will be pivotal in determining the index’s future direction.

Market Pulse 23/12: Surges on Vingroup Stock Rally

As the trading session drew to a close, VIC and VHM surged to their upper limits, further fueling the index’s upward momentum. At the bell, the VN-Index climbed over 20 points, closing at 1,772. Meanwhile, the HNX-Index experienced a slight dip of nearly 2 points, settling at 255.5.