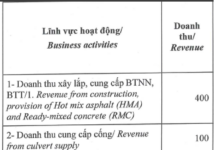

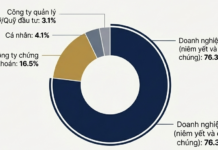

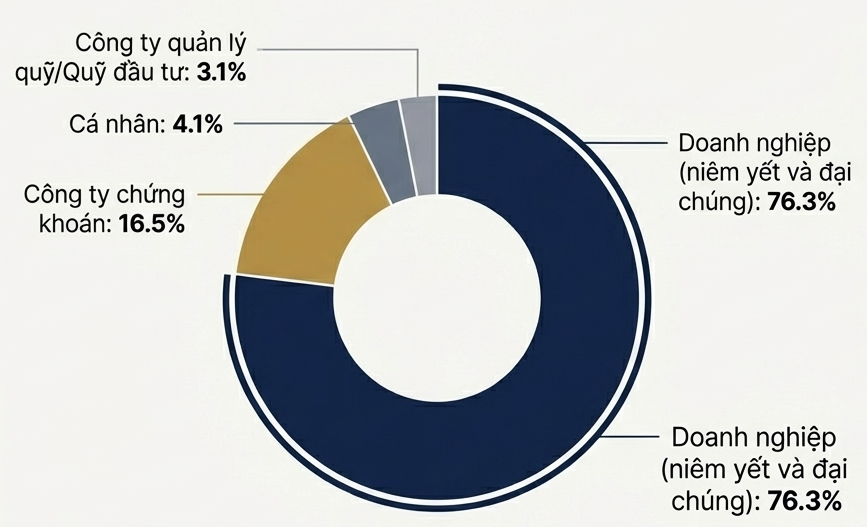

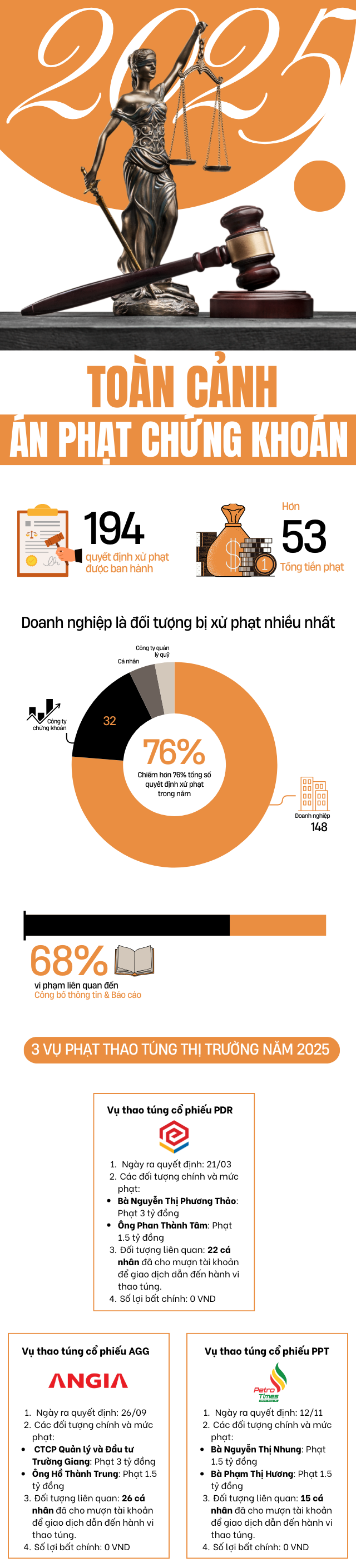

Vietnam’s stock market entered 2025 with a growing scale and increased complexity, placing greater pressure on regulatory oversight and enforcement. As of December 19, 2025, the State Securities Commission (SSC) has issued 194 administrative penalty decisions, totaling over VND 53 billion in fines, averaging more than VND 274 million per decision. Publicly listed companies and public companies remain the most affected, accounting for over 76% of cases with 148 penalty decisions. Securities companies, individuals, and fund management companies follow.

|

Securities companies received 32 penalty decisions, nearly 16.5%; individuals and related parties received 8 decisions, impacting a total of 72 individuals.

Most violations by publicly listed and public companies relate to information disclosure, indicating that compliance burdens remain unaddressed despite improving legal frameworks.

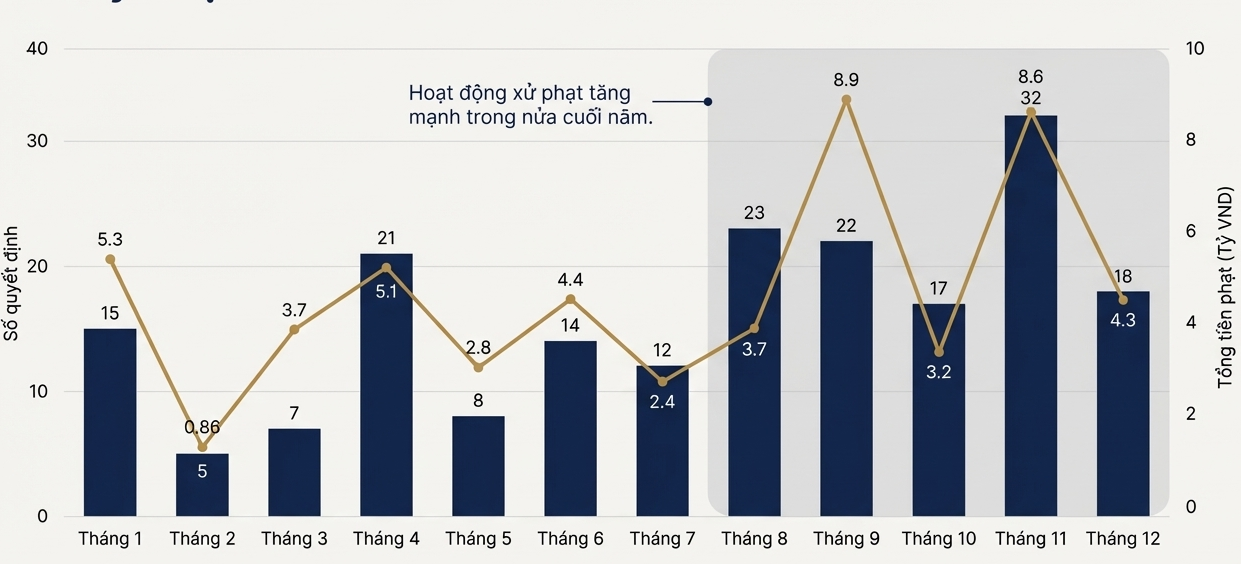

Enforcement peaked towards the year-end. November saw the highest number of decisions at 32, while September recorded the largest total fines, nearly VND 9 billion, primarily due to market manipulation. This year-end concentration reflects cyclical regulatory scrutiny of financial reports and corporate activities ahead of annual reporting.

|

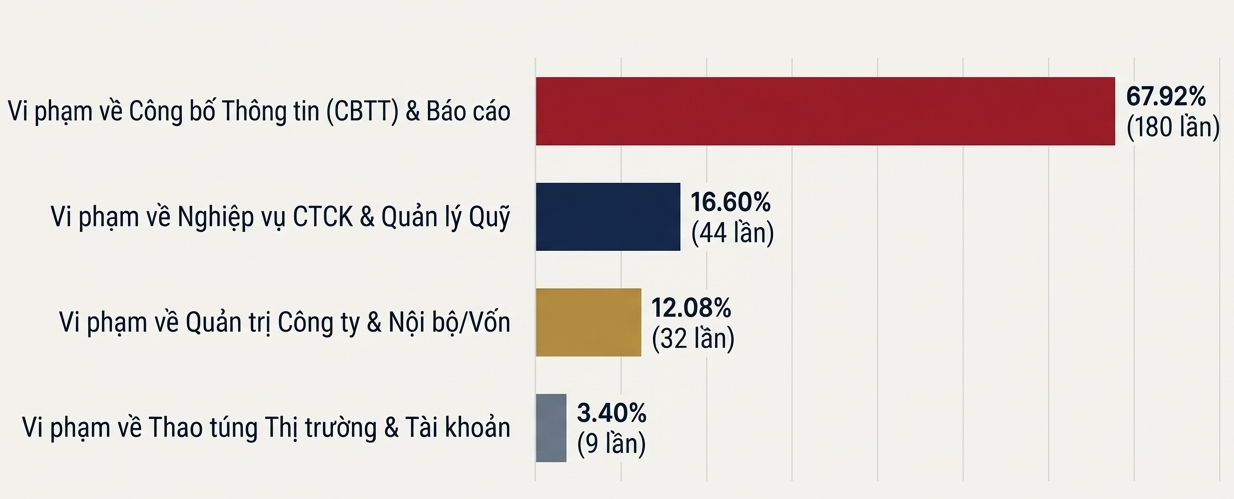

Information disclosure violations dominate

Information disclosure violations account for nearly 68% of total offenses, remaining a key issue in 2025. From delayed to misleading disclosures, these violations directly impact market transparency and investor access. Some companies, like Novaland (NVL) and Angimex (AGM), were repeat offenders, highlighting inadequate compliance processes relative to their operational scale.

The recurrence of these fundamental errors reflects systemic governance issues, particularly in complex organizations or those with limited internal controls.

|

Corporate governance and related-party transaction violations account for over 12%. While less frequent than disclosure violations, these reflect structural risks like conflicts of interest or governance shortcomings.

Several companies, including COMECO, L10, and PC1, were penalized for failing to maintain independent board structures. Others, like VXB, EVG, and VNE, lacked designated corporate governance officers. Some cases involved transactions with major shareholders or insiders, raising concerns about transparency and minority shareholder rights.

Securities companies and fund management companies accounted for nearly 16% of violations, with many related to operational regulations. Infractions ranged from margin lending exceeding limits to commingling client assets and providing unauthorized services.

Notably, three securities companies exhibited systemic issues: SHS led with 10 violations in a single decision, followed by EVS and APG with 9 each. These cases highlight internal control weaknesses in key market intermediaries.

Market manipulation: fewer cases, heavier penalties

Market manipulation cases, though only 3% of the total, incurred the highest penalties, underscoring their severity. In 2025, three cases involved An Gia (AGG), Petro Times (PPT), and Phat Dat (PDR), a decrease of one from 2024.

Violators used large account networks to create false supply and demand: 26 individuals lent accounts in the AGG case, 15 in PPT, and 22 in PDR. Notably, none of these cases generated illegal profits.

Disparity between minor and major violations

Approximately 130 of the 194 decisions (67.5%) imposed fines below VND 200 million, correlating with information disclosure violations. This raises questions about the deterrence of transparency-related penalties. Are low fines encouraging companies to treat them as acceptable costs, especially given repeat offenses?

Conversely, 30 decisions imposed fines over VND 400 million, indicating significant market violations. Market manipulation led with fines ranging from VND 1.5 to 3 billion, followed by operational violations at securities companies like APG, SHS, and VISECO. Notably, Korea Investment Management Co., Ltd (KIM), managing a multi-billion USD portfolio, was fined over VND 1.1 billion for failing to report planned fund sales.

Beyond fines, the SSC employed corrective measures, including 23 instances of information correction or retraction, crucial for restoring transparency and mitigating investor impact. Stronger sanctions, such as trading bans (6 cases) and business suspensions (5 cases), demonstrate significant deterrence, directly affecting corporate operations.

In summary, 2025’s enforcement landscape reflects a Vietnamese stock market in self-improvement, with regulators striving for discipline and transparency. Rigorous oversight, coupled with market participants’ enhanced compliance, is essential for the market’s healthy and sustainable development.

|

– 08:02 24/12/2025

VIN-Index Propels VN-Index to New Heights

“Fund managers, with a hint of humor, quip that this year’s VN-Index should be rebranded as the VIN-Index, given the overwhelming dominance of this corporate group in driving the index’s performance,” shared the head of Pyn Elite Fund.

December 22: Bank Stock Surges to Upper Limit, HDB Hits Record High

At the close of the session, the banking sector witnessed a predominantly positive performance, with 24 stocks advancing, only one declining, and two remaining unchanged from their reference prices.