Largest Consumer Stock on the Exchange, Eligible for Margin Trading

One of the factors highlighted by Vietcap is the potential eligibility for margin trading after the stock stabilizes post-listing. According to Mr. Hoàng Nam, Director of Research & Analysis at Vietcap: “Under current regulations, after approximately six months of trading, MCH stock will qualify for margin trading consideration.”

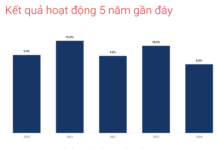

In this context, the company’s operational foundation is critical in determining post-listing capital absorption. Masan Consumer is one of Vietnam’s largest consumer goods companies, with a diverse product portfolio spanning essential categories and a nationwide distribution network. The company maintains stable operations, with revenue and profit margins outpacing industry averages. In recent years, MCH has consistently reported positive revenue and cash flow, alongside improved operational efficiency, establishing a robust financial foundation and strong institutional investor interest.

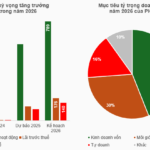

According to VCI estimates, upon listing on the HOSE, Masan Consumer (MCH) will become the largest consumer stock by market capitalization in the VN-Index, ranking seventh among Vietnam’s most capitalized companies. This underscores MCH’s growing significance in Vietnam’s equity market, where large-cap consumer stocks remain limited. Achieving this scale enhances the stock’s inclusion in key indices, broadening access to institutional and long-term investors who prioritize market leaders with sustainable growth.

These factors are pivotal in improving liquidity and meeting HOSE trading requirements.

From a market perspective, margin trading amplifies purchasing power and capital efficiency. While strong fundamentals are essential, stocks ineligible for margin often face limited capital inflows. Conversely, margin eligibility typically enhances investor participation and liquidity.

Enhancing Liquidity, Attracting Long-Term Capital

Beyond margin trading, Vietcap highlights MCH’s potential inclusion in major indices over the medium to long term, contingent on meeting capitalization, free-float, and liquidity criteria post-listing. Mr. Hoàng Nam notes: “Masan Consumer is likely to be considered for inclusion in key indices, starting with the VN30. By September 2026, MCH could qualify for passive investment indices like VanEck or Xtrackers. Notably, the company already meets most criteria for the FTSE Emerging Markets Index, a milestone Vietnamese investors have awaited for over a decade.”

Index inclusion not only expands the investor base but also enhances market visibility, providing medium-term support rather than immediate impact.

|

Masan Consumer, a subsidiary of Masan Group (HOSE: MSN), is a leading Vietnamese consumer and retail conglomerate. MCH stock will debut on HOSE on December 25th with a reference price of VND 212,800 per share, valuing the company at over VND 224,866 billion. With nearly three decades of serving consumers, Masan Consumer offers a diverse FMCG portfolio across seasonings, convenience foods, beverages, and personal care, featuring brands like CHIN-SU, Nam Ngư, Omachi, Kokomi, and Wake-up 247. Its products are present in over 98% of Vietnamese households and exported to 26 countries, cementing its position as a top-performing regional FMCG company. |

– 06:40 24/12/2025

PHS Falls Short of 2025 Plan, Projects 57% Profit Growth in 2026

Phu Hung Securities Corporation (UPCoM: PHS) is poised to conclude 2025 with a post-tax profit of nearly VND 90 billion, achieving 86% of its annual target. Riding on optimistic market forecasts for 2026, PHS anticipates a profit surge to over VND 140 billion, marking a 57% increase compared to the projected 2025 results.

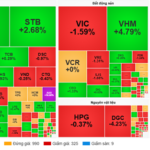

Market Pulse 24/12: Foreign Investors Net Buy Financial Stocks, VN-Index Surges Over 10 Points

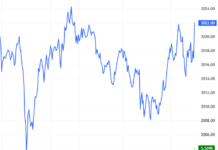

At the close of trading, the VN-Index climbed 10.67 points (+0.6%) to reach 1,782.82, while the HNX-Index dipped 2.87 points (-1.12%) to 252.6. Market breadth leaned bearish, with 360 decliners outpacing 338 advancers. Conversely, the VN30 basket showed bullish dominance, featuring 18 gainers, 11 losers, and 1 unchanged stock.

Viconship Seeks to Acquire Additional 14 Million HAH Shares of Hai An Stevedoring

Viconship has recently filed to acquire 14 million shares of HAH, with the strategic aim of increasing its ownership stake to 21.238% in Xep Do Hai An.

How to Digitally Transform Traditional Retail Channels?

In the digital age, the Fast-Moving Consumer Goods (FMCG) retail sector faces a pivotal moment: balancing fierce competition in product and pricing while mastering data analytics and optimizing supply chains. Amidst this landscape, Masan Consumer Holdings’ (MCH) Retail Supreme model emerges as the definitive solution to the market’s most complex challenge: digitizing traditional retail channels.