Sales figures reveal a sharp decline in compact car popularity.

Plummeting Sales

In November 2025, the Kia Morning, once a favorite among first-time car buyers in Vietnam, recorded a mere 16 units sold. This figure pales in comparison to the Toyota Land Cruiser, a luxury SUV priced ten times higher, which sold 80 units in the same period. Year-to-date, the Land Cruiser’s sales (554 units) still double those of the Morning (263 units).

The Hyundai Grand i10, a long-standing A-segment hatchback, managed only 3,000 sales in the first 11 months of 2025—equivalent to just one month’s sales of the VinFast VF 5 or VF 3. Compact gasoline-powered hatchbacks like the Kia Morning, Hyundai Grand i10, and Toyota Wigo are witnessing record-low sales in Vietnam’s automotive market.

Kia Morning’s November sales of 16 units highlight waning consumer interest.

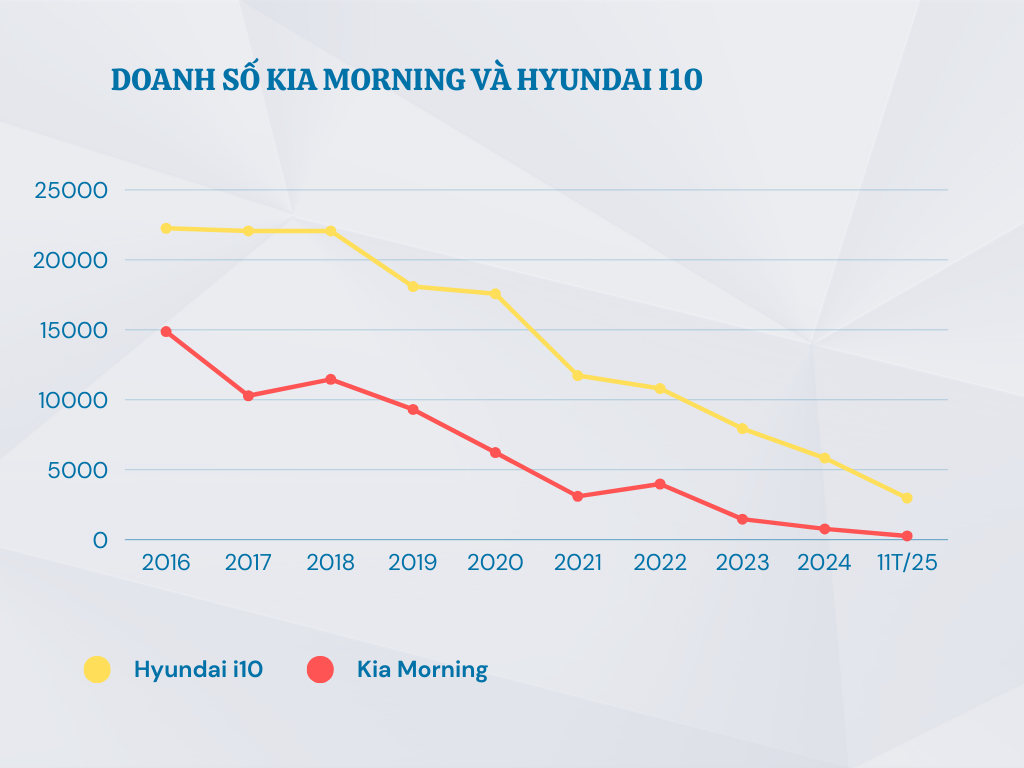

According to VAMA and Hyundai Thanh Cong, the A-segment hatchback category sold only 5,403 units in 2025—a stark contrast to its peak performance between 2016 and 2018. The Hyundai i10 leads with 2,977 units, followed by the Toyota Wigo (2,163 units) and the Kia Morning (263 units), which hit an all-time low.

This crisis isn’t limited to traditional hatchbacks. Even A-segment gasoline SUVs, once expected to revitalize the market, are struggling. In November 2025, the Kia Sonet sold 682 units, the Toyota Raize 380 units, the Hyundai Venue 185 units, and the newly launched Suzuki Fronx a mere 116 units.

After a golden era, Kia Morning and Hyundai i10 face an unprecedented decline.

In 2016, the Kia Morning and Hyundai i10 dominated with a 10.54% market share and 36,000 units sold. Today, their rapid decline is hard to fathom.

Automakers are offering aggressive incentives—cash discounts, premium accessories, and registration fee support—but these efforts seem futile as consumer preferences shift. Traditional values like affordability and fuel efficiency are now overshadowed by demands for advanced technology, enhanced driving experiences, and electrification.

What’s Driving the Decline?

The rise of electric vehicles (EVs) is the primary culprit. In 2025, VinFast’s VF 3 and VF 5 Plus achieved record sales of 40,660 and 38,000 units, respectively, thanks to lower operating costs and government tax exemptions.

Electric vehicles are the new market leaders, capturing significant market share.

Hatchbacks are also losing appeal among ride-sharing drivers, who now favor electric taxis like Xanh SM over traditional gasoline vehicles. Independent drivers opt for cost-effective EVs like the BYD M6, a 7-seater with spacious interiors and low operating costs.

The trend toward higher ground clearance vehicles further erodes hatchback sales. A-segment SUVs like the Kia Sonet, Toyota Raize, and Hyundai Venue, despite higher prices (by VND 100-150 million), offer elevated driving positions and modern designs, appealing to consumers.

The Toyota Vios offers excellent value for its price.

Additionally, pricing strategies from higher segments are intensifying competition. B-segment sedans like the Hyundai Accent, Toyota Vios, and Honda City are priced competitively at VND 439 million, VND 458 million, and VND 499 million, respectively.

Compared to the Kia Morning (starting at VND 349 million) and Hyundai Grand i10 (VND 360 million), the price gap is minimal. Consumers increasingly opt for B-segment sedans for their spacious interiors, powerful engines, and higher resale value. Meanwhile, A-segment cars, lacking technological updates and safety features, are becoming obsolete in a demanding market.

BYD Launches Revolutionary Feature: Solving Charging Station Scarcity While Generating Passive Income for Owners

BYD has recently enhanced its app with a new feature allowing owners to share their home charging stations with other drivers, creating an additional passive income stream for vehicle owners.

Billionaire Pham Nhat Vuong’s Bold Moves in the World’s Most Populous Market

VinFast is accelerating its expansion in India with an ambitious goal: launching a new car model every six months.