BVBank’s Extraordinary General Meeting (EGM) 2025 was held on the afternoon of December 26, 2025.

|

Pre-tax profit for the first 11 months reached VND 515 billion.

At the beginning of the meeting, Chairman of BVBank’s Board of Directors, Mr. Le Anh Tai, noted that the period from 2020 to 2025 saw significant global economic fluctuations: pandemics, crises, wars, inflation, and climate change. Despite recovering from the COVID-19 pandemic, global economic growth remains slow and volatile. However, with flexible and market-aligned management strategies, BVBank ensured operational safety. As of December 2025, the bank’s customer base exceeded 2.9 million, a sixfold increase compared to 2020.

By the end of November 2025, BVBank’s total assets reached VND 127,281 billion, doubling since 2020. Its network expanded to 126 business locations, a 1.4-fold increase. Pre-tax profit stood at VND 515 billion, achieving 94% of the annual target of VND 550 billion.

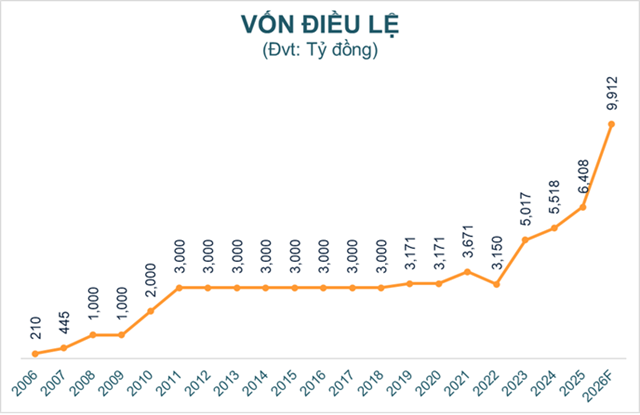

For the 2025-2030 term, BVBank aims to grow total assets to VND 154,000–296,000 billion (up 18%), outstanding loans to VND 92,000–179,000 billion (up 18%), and chartered capital to VND 9,500–14,000 billion. The bank targets an average ROE of 10% and maintains a non-performing loan ratio below 3%.

The Chairman emphasized that BVBank will continue its vision of becoming a modern, customer-centric retail bank, focusing on individual and SME clients. The bank aims to enhance its market competitiveness over the next five years.

In 2026, BVBank plans to establish five new business locations, including two branches and three transaction offices. The bank will diversify its products and services to better meet customer needs, aiming for non-interest income to account for 10–20% of total revenue by the end of the period.

Chartered capital to increase to VND 9,912 billion in 2026.

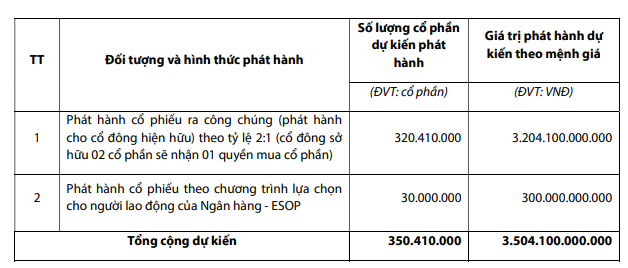

The EGM approved two capital increase plans totaling VND 3,504 billion for 2026.

Under Plan 1, BVBank will issue 320.41 million shares to existing shareholders at a 2:1 ratio (2 shares held = 1 right, 2 rights = 1 new share). Rights are non-transferable, and new shares are unrestricted. The offering price will not be below VND 10,000 per share. The VND 3,204 billion raised will fund lending activities, with implementation expected in 2026.

Under Plan 2, BVBank will issue 30 million shares under an Employee Stock Ownership Plan (ESOP). Eligible participants include bank employees and subsidiaries’ staff, as approved by the Board. The VND 300 billion raised will also support lending activities.

If both plans are executed, BVBank’s chartered capital will rise from VND 6,408 billion to VND 9,912 billion.

This capital increase will significantly enhance BVBank’s financial capacity, operational scale, and market competitiveness.

Source: VietstockFinance

|

The EGM also approved amendments to the bank’s charter. The current clause, “The CEO is the bank’s legal representative,” was revised to: “The legal representative is the CEO or the Chairman of the Board if the CEO position remains unfilled.”

Election of Board Members for the 2025-2030 Term

The EGM elected members to the Board of Directors and Supervisory Board for the 2025-2030 term. The Board comprises seven members: one executive, four non-executives, and two independents. The Supervisory Board includes five members.

Personnel changes were made to comply with the 2024 Law on Credit Institutions, which prohibits concurrent management roles in two organizations. Mr. Ngo Quang Trung, Ms. Nguyen Thanh Phuong, and Ms. Phan Thi Hong Lan will not continue as Board or Supervisory Board members. Ms. Nguyen Thanh Phuong will remain as Chair of the Strategy and Innovation Committee, overseeing strategic planning and modernization for 2025-2030.

The 2025-2030 Board includes: Mr. Le Anh Tai, Mr. Nguyen Nhat Nam, Mr. Ly Hoai Van, Ms. Nguyen Thi Thu Ha, Mr. Pham Quang Khanh, and Mr. Pham Thanh Son (independent). A second independent member will be elected within 90 days.

The Supervisory Board includes: Mr. Ly Cong Nha, Ms. Nguyen Thi Thanh Thuy, Mr. Le Hoang Nam, Ms. Nguyen Thi Thanh Tam, and Ms. Bui Thi Quanh.

BVBank’s 2025-2030 Board of Directors

|

– 16:08 26/12/2025

Rivals of Nguyen Phuong Hang’s Dai Nam Tourism Complex Prepare to Pay High Cash Dividends

This company boasts a longstanding tradition of delivering substantial cash dividends, consistently distributing double-digit percentage returns to shareholders on an annual basis.

Hodeco Offers Over 1.9 Million Unsold Convertible Bonds to 115 Individual Investors

As of December 10, 2025, Hodeco has over 1.9 million convertible bonds remaining undistributed. Consequently, the company will continue offering these bonds to 115 individual investors at a price of 100,000 VND per bond.