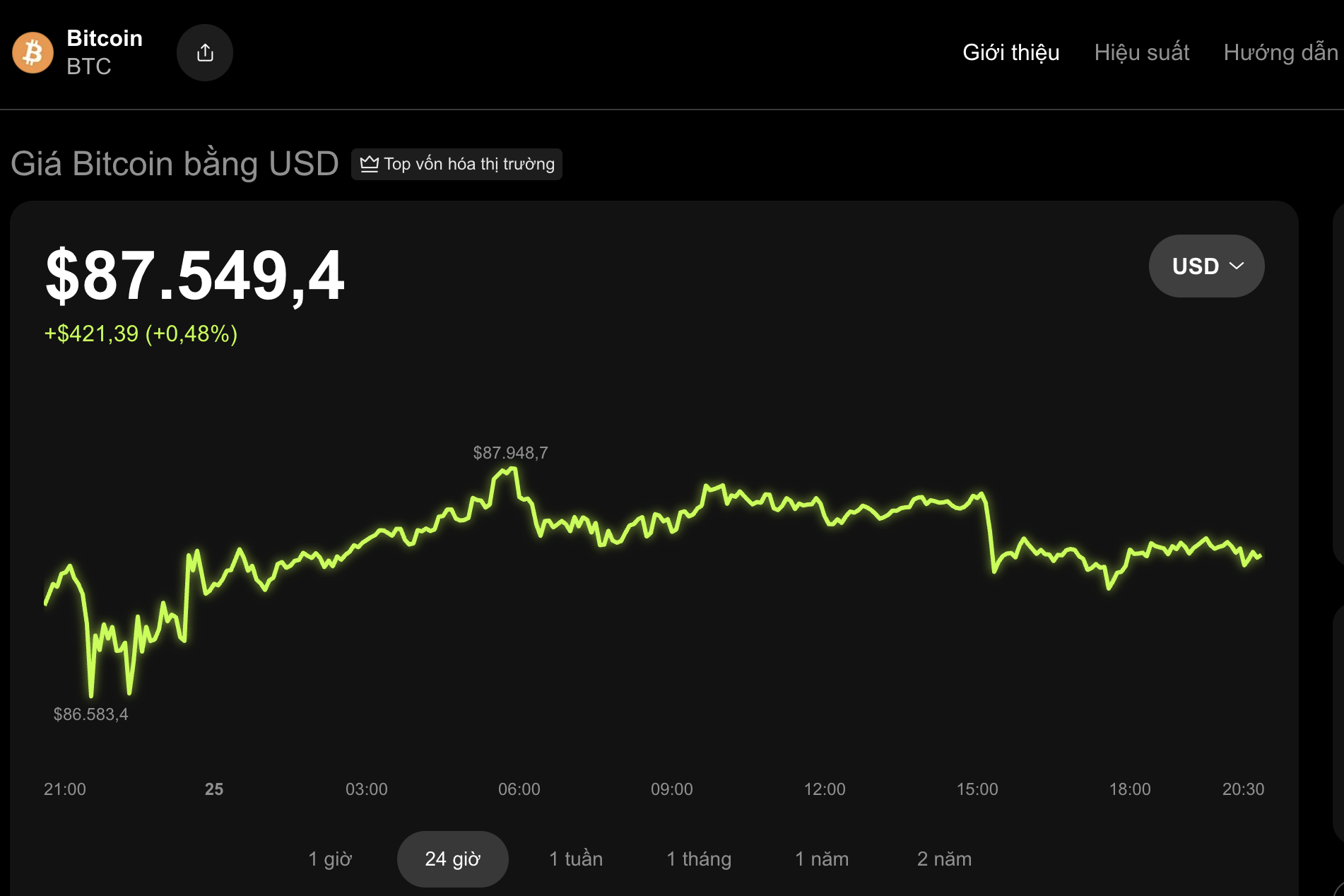

On the evening of December 25th, the cryptocurrency market showed mixed movements. Data from OKX revealed that Bitcoin rose by nearly 0.5% over the past 24 hours, reaching $87,549.

Ethereum and Solana saw modest gains of 0.02%, trading around $2,931 and $122, respectively. Conversely, BNB and XRP declined by over 0.5%, dropping to $836 and $1.8.

According to Cointelegraph, spot Bitcoin ETFs in the U.S. experienced net outflows exceeding $175 million on Christmas Day. These investment vehicles allow investors to gain exposure to Bitcoin through the stock market rather than holding the digital asset directly.

Notably, institutional selling persisted during the holiday period, even as Wall Street remained open. The net outflows extended into the final trading session before Christmas, totaling $175.3 million.

Bitcoin is currently trading at $87,549. Source: OKX

Over the last five trading sessions, U.S.-based Bitcoin funds have consistently recorded outflows, totaling $825.7 million.

Market observers suggest that investors may be selling losing assets to optimize tax obligations before the fiscal year ends. This activity is typically short-term and could subside soon.

Additionally, events related to futures contracts have made investors more cautious. Market data indicates that Bitcoin prices often decline during U.S. trading sessions, reflecting weakening demand from American investors.

Meanwhile, Asia is seen as a more active buying region, partially offsetting the reduced demand from the U.S. However, net selling by U.S. investors remains a barrier to Bitcoin’s short-term breakout.

Despite this, many experts argue that outflows do not necessarily signal a market peak. The current capital is viewed as being on the sidelines, potentially returning once market conditions stabilize, paving the way for a new upward trend in the future.

Today’s Crypto Market, December 24: Bitcoin Fails to Deliver on Christmas Eve

Every Christmas season, Bitcoin historically experiences significant volatility, fluctuating between 5% and 7%. This heightened movement is often attributed to large-scale transactions strategically planned and executed during the year-end period.

December 25, 2025: VHM Warrants Continue to Shine in the Warrants Market

As the trading session closed on December 24, 2025, the market witnessed 136 stocks advancing, 96 declining, and 27 remaining unchanged. Foreign investors resumed net selling, with a total net sell-off of 1.08 billion VND.