Back in July 2025, when the VN-Index was just 5 points shy of its early 2022 record high, Mr. Petri Deryng expressed strong optimism about the market’s prospects. In a letter to investors on the same day, the head of PYN Elite Fund suggested that the VN-Index could reach 1,800 points by Christmas, emphasizing that this was not an unrealistic scenario.

Later, this prediction faced skepticism as the VN-Index, after surpassing 1,700 points in October, entered a correction phase due to increased profit-taking pressure in November, particularly in the 1,700-1,750 range. At one point, the index dipped below 1,600 points in November. However, after hitting its low, the VN-Index gradually recovered and resumed its upward trend, approaching its previous peak.

And on Christmas Day, the market witnessed a memorable moment when the VN-Index surpassed 1,800 points around 10 a.m. on December 25, 2025, confirming the forecast made by the head of PYN Elite Fund.

|

VN-Index Movement on December 25, 2025

Source: VietstockFinance

|

During this session, the VN-Index opened on a positive note, extending gains from previous sessions. Early inflows, particularly in large-cap stocks, propelled the index upward from the morning session, marking the first time in history it breached the psychological 1,800-point threshold.

However, immediately after reaching this milestone, profit-taking pressure intensified, causing the VN-Index to quickly narrow its gains and retreat below 1,800 points. This highlights the challenges in sustaining a breakthrough above this level in the short term.

Despite the VN-Index only briefly touching 1,800 points, this development holds significant meaning as it breaks an unprecedented psychological barrier, laying the groundwork for expectations that the index could successfully conquer this level in the near future.

PYN Elite Raises VN-Index Target to 3,200 Points

In a late November letter to investors, Mr. Petri Deryng revealed that when PYN Elite set its target allocation for Vietnam in its portfolio about 10 years ago, the fund had a long-term target for the VN-Index at 2,500 points. Now, PYN Elite has decided to raise this target to 3,200 points.

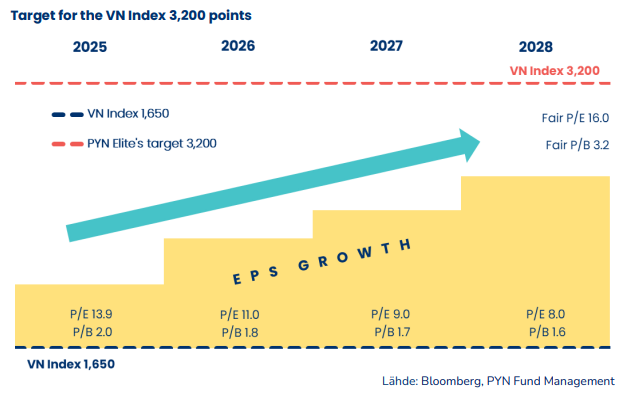

The index target chart illustrates the projected earnings growth of the stock market and how positive VN-Index movements could bring P/E and P/B ratios to reasonable levels.

|

According to PYN Elite, this decision was made in the context of Vietnam’s new administration decisively steering the country toward higher prosperity. Mega public investment projects are acting as catalysts for a new phase of robust growth, while also stimulating private sector investment. Simultaneously, the modernization of the financial market is accelerating, and bank credit growth is being actively supported.

In essence, these policies are creating increasingly favorable conditions for Vietnam’s economic expansion and sustainable corporate earnings growth.

The fund believes that the current GDP growth rate of 6-8% per year is no longer sufficient, as the government aims for growth exceeding 10% annually. The clear objective is to elevate the economy and living standards over the next 10-15 years. This ambition is driven by growing domestic demand, large-scale public investment, and administrative reforms.

Currently, Vietnam’s public debt ratio has fallen below 35% of GDP and could rise to 45% without posing significant risks to the economy. With domestically focused companies dominating the stock market, earnings growth for listed enterprises is expected to be strongly boosted in the coming years, which will be reflected in market performance.

Moreover, Vietnam’s stock market is making significant strides in infrastructure, with upgraded trading systems and the partial removal of margin deposit requirements. Thanks to these reforms, FTSE decided to upgrade Vietnam to emerging market status in October, with implementation expected in 2026.

Regulators are also exploring the introduction of a central counterparty clearing mechanism (CCP), which would shorten settlement times, along with other reforms such as fully removing margin deposit requirements, enabling day trading, and potentially introducing a new foreign ownership limit (FOL) model in the coming years.

PYN Elite believes that following these reforms, MSCI will also consider upgrading Vietnam to emerging market status.

“Our 3,200-point target for the VN-Index is based on expected average earnings growth of 18-20% per year in the coming years; in 2025 alone, earnings growth could exceed 20%,” Mr. Petri emphasized. The fund believes this target could be achieved within the next 3 years.

Over the past 15 years, the VN-Index’s P/B ratio has surpassed 3.0 three times, while its long-term average P/E ratio has been around 16 times, with three periods exceeding 20 times. According to PYN Elite, the index’s upward trajectory in the coming years could bring P/E and P/B ratios back to reasonable levels, accurately reflecting the earnings growth potential of listed companies.

– 09:16 26/12/2025

Foreign Investors Pour 3.4 Trillion VND into Vietnamese Stocks in Just 5 Sessions, Signaling a Major Market Comeback

The consistent net buying across multiple sessions underscores a more assertive stance from foreign investors compared to previous periods, shifting from mere observation or defensive positions to proactive engagement.

VPBankS: Steadfastly Pursuing a Robust Growth Trajectory

In the new growth cycle of Vietnam’s stock market, VPX shares are emerging as a compelling choice, underpinned by a robust foundation and impressive business performance.