In the latest trading session, silver prices surged by 5.89%, reaching an all-time high of $79.11 per ounce. Since the beginning of 2025, silver has seen a staggering 173.94% increase, marking an extraordinary performance.

However, silver isn’t the top-performing precious metal in the market. During the same session where silver rose nearly 6%, platinum soared by 10.91%, hitting $2,507.7 per ounce. Platinum’s year-to-date gain stands at 180.5%, outpacing both silver and gold (which has risen by approximately 72%).

Several factors have driven platinum’s record-breaking rally. One key reason is the tightening of platinum reserves in London, as major banks relocate the metal to U.S. vaults to avoid potential import tariffs imposed by Washington. Over 600,000 ounces of platinum are now stored in the U.S., significantly higher than usual, exacerbating supply shortages.

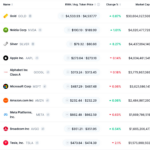

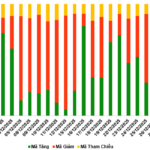

Price surge of silver and platinum in 2025.

Additionally, production disruptions in South Africa have further tightened the market. Heavy rainfall and operational halts have reduced supply, leading to a third consecutive year of platinum deficits. South Africa accounts for roughly 70% of global platinum production.

Meanwhile, demand remains steady. Platinum is widely used in catalytic converters for electric vehicles, jewelry, and the chemical industry.

Robust trading activity on the Guangzhou Futures Exchange (GFEX) has also propelled prices beyond traditional benchmarks. “China’s growing demand for platinum and silver has been a primary driver of the 2025 rally and is likely to remain influential in 2026,” noted Wael Makarem, Chief Market Strategist at Exness. “Since GFEX began trading platinum group metals, London platinum prices have surged, reflecting speculative and investment activity from China,” he added.

Geopolitical factors are another critical driver of the price surge, as trade policy concerns fuel stockpiling. “Geopolitics and trade policies have become major catalysts for commodity prices, including platinum, silver, and gold. Tariffs and trade tensions are top concerns for businesses. Fears of new import taxes have prompted investors to shift platinum reserves to U.S. vaults, tightening London supplies and driving prices higher,” Makarem explained.

Silver Surges 10% Overnight, Becoming the World’s Third Most Valuable Asset

Sprott Asset Management’s CIO, Maria Smirnova, expresses a bullish outlook on silver in the medium term. The technical models they monitor suggest a potential silver price surge to $100–200/oz in the coming quarters, as predicted by several analysts.

Silver Prices Surge by 169% Annually: What’s Driving This Phenomenal Rise?

This morning (December 27th), silver prices surged by over 4 million VND per kilogram, reaching nearly 82 million VND per kilogram. Over the past month, silver has seen a remarkable 46% increase, and since the beginning of the year, its value has skyrocketed by 169%.