Technical Signals of VN-Index

During the morning trading session on December 29, 2025, the VN-Index staged an impressive recovery, firmly holding above the Middle line of the Bollinger Bands.

The index is now testing the previous October 2025 peak (equivalent to the 1,740-1,795 point range), and the outcome of this test will determine the trend in the coming period.

Technical Signals of HNX-Index

In the morning session on December 29, 2025, the HNX-Index reversed with a slight gain, ending a streak of consecutive declines.

However, both the MACD and Stochastic Oscillator indicators suggest a sell signal, indicating that short-term risks remain relatively high.

BVH – Bao Viet Group

During the morning session on December 29, 2025, BVH shares continued to surge, accompanied by a Big White Candle pattern and trading volume exceeding the 20-session average, reflecting investor optimism.

Currently, the stock price remains close to the Upper Band and is approaching the August 2025 peak (equivalent to the 61,900-64,200 range).

Additionally, both the MACD and Stochastic Oscillator indicators continue to rise after generating buy signals, suggesting that positive short-term prospects persist.

PC1 – PC1 Group Corporation

PC1 shares reversed sharply upward during the morning session on December 29, 2025, accompanied by a Big White Candle pattern and trading volume surpassing the 20-session average, indicating investor optimism.

Currently, PC1 prices are above the Middle line of the Bollinger Bands, with the MACD indicator having generated a buy signal and remaining above the zero level.

If these positive technical signals are sustained and the stock price successfully breaks through the 38.2% Fibonacci Projection level (equivalent to the 23,400-24,000 range), the short-term upward momentum will become more robust.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:01 December 29, 2025

Market Pulse 12/29: VN-Index Surges Over 25 Points, Energy and Utility Sectors Shine

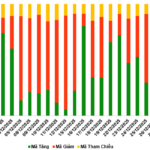

At the close of trading, the VN-Index surged by 25.04 points (+1.45%), reaching 1,754.84 points, while the HNX-Index climbed 0.69 points (+0.28%) to 251.22 points. Market breadth favored the bulls, with 422 advancing stocks outpacing 273 decliners. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 5 fell, and 6 remained unchanged.

Stunning Surge in ‘Vin Group’ Stocks

Today’s stock market (December 26) witnessed an emotionally charged trading session, as the VN-Index plummeted below the 1,700-point threshold early on, only to stage a remarkable reversal by day’s end, thanks to a lifeline from Vingroup stocks.

Expert Insights: VN-Index May Face Further Sell-Offs, Opportunities Arise in Q4 Earnings-Driven Stocks

According to experts, historical trends in Vietnam’s stock market reveal a consistent pattern: capital inflows tend to rebound post-holiday periods, thereby enhancing overall market liquidity.