Stock Market Shares – Attractive Valuation

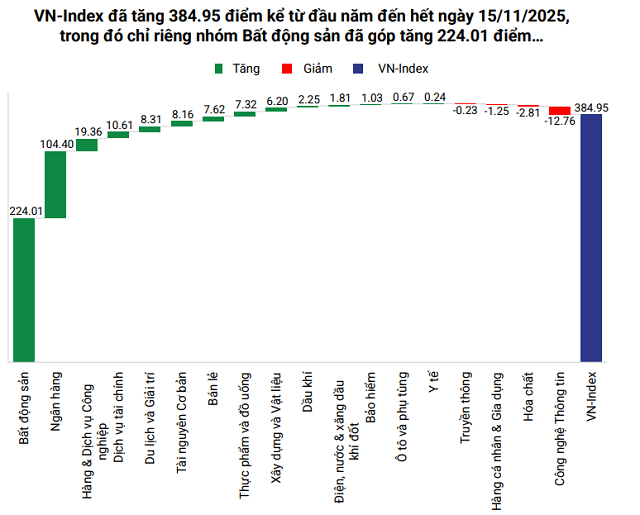

The stock market is closing out 2025 with impressive gains, but alongside this growth is a significant divergence among industry groups. According to data from Petroleum Securities (PSI), the VN-Index ranks third globally in year-to-date gains, with a 29.1% increase as of November 15, 2025. However, this remarkable performance is primarily driven by the real estate and banking sectors, which account for over 85% of the VN-Index’s total growth this year.

This has led to a situation where, despite the VN-Index’s strong rise, the performance across different stock groups is uneven, and valuation disparities between sectors are significant. This presents an opportunity for investors.

Much of the VN-Index’s 2025 growth stems from the real estate sector. (Image: PSI).

|

As market divergence intensifies, valuation gaps between sectors widen. Investors are shifting their focus from short-term trends to long-term, sustainable opportunities. In this landscape, securities stocks emerge as an attractive choice.

“The current P/E ratio for the securities sector stands at 15.9 times, significantly lower than the historical average (16.3x) and peak (46.3x). We believe securities stocks still have substantial growth potential,” stated the analysts at An Binh Securities (ABS Research) in their 2026 Market Strategy Report.

Similarly, SSI Research maintains a positive outlook for the securities sector in 2026, anticipating continued market growth following Vietnam’s upgrade to emerging market status by FTSE Russell and its clear path toward MSCI reclassification. Liquidity is expected to remain high, driven by both passive (ETF) and active funds, alongside sustained participation from retail investors.

These factors will fuel profit growth for securities stocks, supported by high trading volumes and expanded margin lending.

Which Stocks Are Worth Investing In?

Within the sector, analysts frequently highlight two key terms when forecasting securities stocks: “industry leaders” and “appropriate valuation.”

SSI Research’s recent sector analysis suggests that well-capitalized securities firms will have a competitive edge in this growth cycle, as capital increases enhance margin lending capacity. Likewise, ABS Research advises investors in their 2026 Market Strategy Report to focus on industry-leading stocks with suitable valuations and strong fundamentals during market corrections.

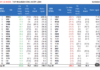

In terms of valuation, FiinPro data shows the securities sector’s average P/E ratio was 15.6 times as of mid-November. Among the top 10 securities stocks by market cap, four trade below this average: VPX (P/E 15.3x), SSI (15.2x), VIX (7.9x), and VND (14x).

Amid heightened market divergence, many securities firms are targeting significant profit growth, making valuations even more appealing. For instance, VPBankS aims for a 5-year CAGR of over 32%. In 2025 alone, the company revised its pre-tax profit target upward to 4.45 trillion VND, ranking second in the industry.

Regarding price-to-book (P/B) ratios, the sector’s average is around 2 times as of year-end 2025. Among the top 3 securities firms by market cap, only VPX trades below this level, while TCX and SSI have P/B ratios of 2.5 and 2.3 times, respectively.

In terms of scale, the rankings have shifted over the past three years with the emergence of new players, notably VPBank Securities (VPBankS, HOSE: VPX).

From a capital base of a few hundred billion VND, VPBankS increased its charter capital to 15 trillion VND just one year after joining VPBank, and further to 18.75 trillion VND following its mid-November IPO. This positions VPBankS among the top 3 securities firms by equity, alongside TCBS and SSI.

A larger capital base enables firms to expand operations, particularly margin lending. After a sluggish period in late 2022 and early 2023, total margin debt has rebounded for three consecutive years, reaching a record 370 trillion VND by Q3 2025 (up 51.7% year-to-date). This has driven the sector’s margin lending profits to nearly 9.4 trillion VND in the first nine months, up 54%, making it the most stable and significant profit contributor.

However, many securities firms have reached the maximum margin lending limit of 200% of equity. Meanwhile, VPBankS’s post-IPO capital infusion expanded its margin lending capacity to over 66 trillion VND, leaving approximately 40 trillion VND in available margin.

“Despite persistent net selling by foreign investors, domestic capital remains the driving force, reflecting optimism amid Vietnam’s robust economic growth,” noted ABS Research.

– 10:12 29/12/2025

Market Pulse 12/29: VN-Index Surges Over 25 Points, Energy and Utility Sectors Shine

At the close of trading, the VN-Index surged by 25.04 points (+1.45%), reaching 1,754.84 points, while the HNX-Index climbed 0.69 points (+0.28%) to 251.22 points. Market breadth favored the bulls, with 422 advancing stocks outpacing 273 decliners. Similarly, the VN30 basket saw green dominate, as 19 stocks rose, 5 fell, and 6 remained unchanged.

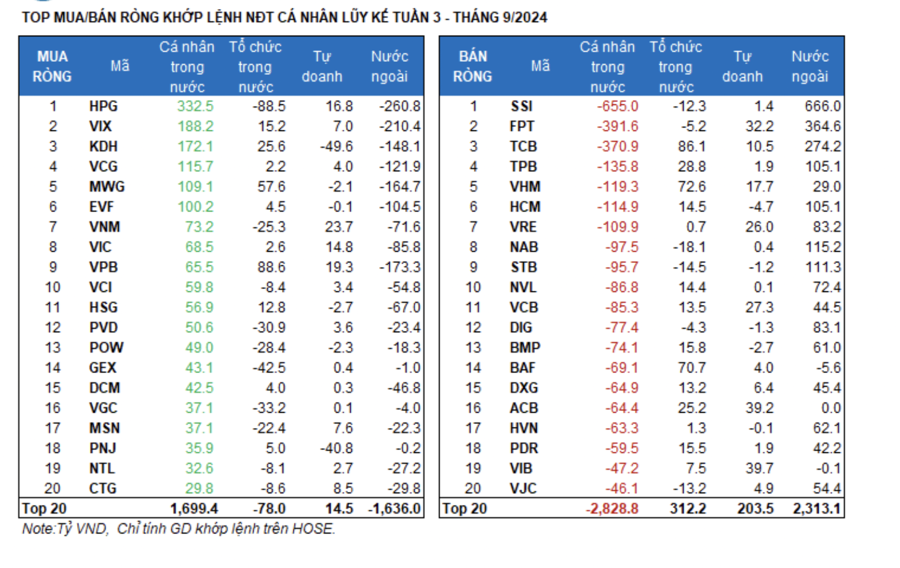

Foreign Investors Net Buy Nearly VND 1.6 Trillion in Week 22-26/12: Which Stocks Were Most Heavily Accumulated?

Foreign investors resumed net buying for the first four sessions of the week, only to reverse course and net sell on Friday.