A report highlights that Vietnam’s retail market has reached an impressive scale of approximately $269 billion by 2025.

|

A report highlights that Vietnam’s retail market has reached an impressive scale of approximately $269 billion by 2025, with total retail sales and service revenue growing by 9-10% compared to 2024—the highest growth rate in the past five years, excluding years affected by the pandemic.

This growth not only reflects the rapid recovery of purchasing power but also demonstrates consumers’ restored confidence in the domestic market. This shift is driven by the growing awareness of supporting locally produced goods under the “Vietnamese People Prioritize Using Vietnamese Goods” campaign.

Modern trade infrastructure has expanded significantly, with 1,293 supermarkets and 276 shopping centers nationwide, alongside a network of 8,274 traditional markets. This development not only enhances the image of urban economies but also signifies a shift in consumer behavior from traditional to modern shopping methods.

However, data reveals a stark disparity between urban and rural areas. Modern trade infrastructure is concentrated in major cities like Hanoi, Ho Chi Minh City, Da Nang, and Hai Phong, accounting for nearly 50% of all such facilities. In contrast, mountainous and rural regions remain heavily reliant on traditional markets.

E-commerce reaches $32 billion

One of the report’s standout findings is the explosive growth of e-commerce, which reached $32 billion in 2025, representing nearly 12% of total retail sales and services nationwide. This sector’s growth rate exceeds the overall retail growth, increasing by over 20% compared to 2024—the second-highest in Southeast Asia.

This surge reflects changing consumer behavior in Vietnam and highlights businesses’ significant investment in digital technology. This includes inventory management systems, cashless payments, online sales platforms, and livestreaming.

The report also objectively analyzes and candidly reflects the existing challenges and limitations of Vietnam’s domestic market. These include high economic integration, vulnerability to international market fluctuations, administrative inefficiencies, high rental costs, and workforce quality issues. Additionally, infrastructure gaps in transportation, payments, and telecommunications persist, particularly in rural areas, alongside concerns about product quality and market information.

In 2025, currency fluctuations, external inflationary pressures, and job security concerns amid automation and AI advancements impacted consumer sentiment. While domestic enterprises have improved their competitiveness, they still lag behind multinational corporations in scale, technology, and modern management practices.

The report forecasts a promising outlook for 2026-2030. With a population exceeding 100 million, a young demographic, and rapidly growing per capita income, Vietnam is poised to become one of the region’s largest retail markets. E-commerce is projected to reach $50 billion by 2030, solidifying Vietnam’s position as one of Southeast Asia’s fastest-growing e-commerce markets.

– 13:50 30/12/2025

Dullness in the Peak Shopping Season

In a cautious spending climate, traditional market vendors are hesitant to stockpile goods, while modern retail systems are proactively launching early promotions and extending sales periods to capture the anticipated slow and uneven recovery in consumer demand.

Smart Tools for Sellers: Leveraging Platform Intelligence to Surge Ahead

Unlock the full potential of your online business with Shopee’s cutting-edge solutions. Designed to elevate customer shopping experiences, streamline operations, and swiftly adapt to evolving digital consumer behaviors, these tools empower sellers to thrive in today’s competitive e-commerce landscape. Transform your business, maximize efficiency, and stay ahead of the curve with Shopee.

Vietnam’s Fast-Food Market: Fried Chicken Combos Reign Supreme, American Burgers Lose Their Edge

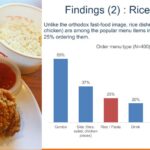

Q&Me’s report on Vietnam’s fast-food market reveals that fast food is no longer just a quick, Western-style meal option. Instead, it’s being localized to better suit Vietnamese tastes and preferences.