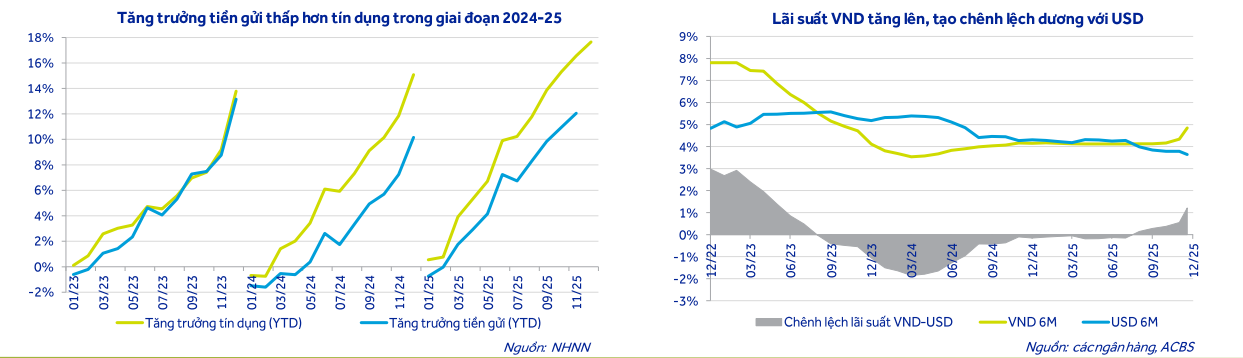

ACBS Securities has released its 2026 strategy report, highlighting the prolonged negative interest rate differential between the Vietnamese Dong (VND) and the US Dollar (USD). This disparity has failed to attract deposits from foreign direct investment (FDI) enterprises, leading to liquidity strain within the banking system. Additionally, the government’s budget surplus has contributed to the Loan-to-Deposit Ratio (LDR) in Market 1 reaching a historic high of 115%, further pressuring VND interbank interest rates. By late November 2025, these rates surged from 4.5% to over 7%.

Deposit interest rates for both individuals and businesses in Market 1 rose by 0.7 percentage points to nearly 5% for six-month terms since Q3 2025. In contrast, the Federal Reserve lowered the USD interest rate to 3.6%, creating a positive differential for VND. This shift is expected to attract foreign capital back into the system, stabilizing liquidity in the near term. ACBS forecasts that six-month deposit rates will remain around 5% in 2026, 1% higher than the lows seen in the first nine months of 2025.

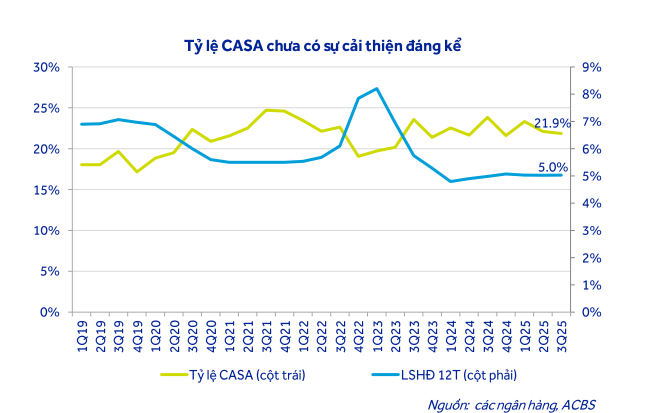

ACBS also predicts that the CASA ratio (current and savings accounts) will remain flat due to higher cash usage and less attractive interest rates, reducing online payment trends and investment channel recovery.

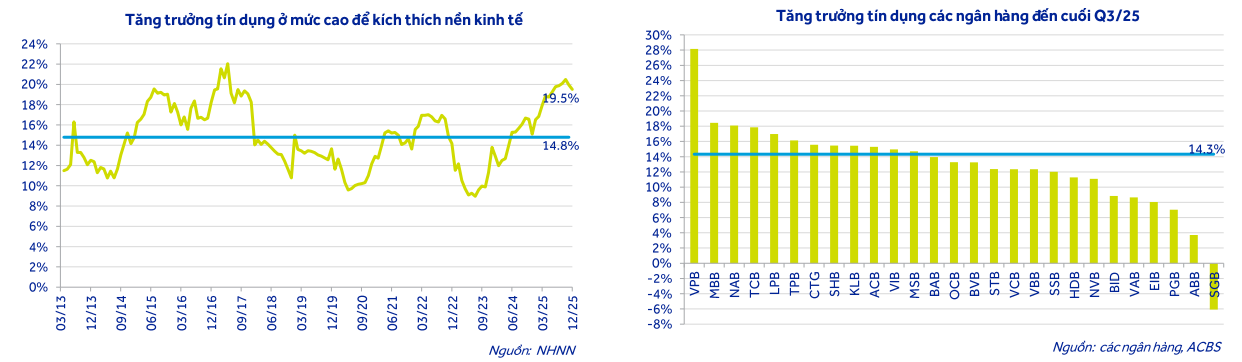

In credit markets, as of December 22, 2025, total outstanding loans grew by 17.65% year-to-date and 19.5% year-on-year, surpassing the historical average of 14-15%. Many banks have exhausted their credit limits, slowing growth momentum compared to previous years. Despite a 2-3% rise in lending rates reducing loan demand, ACBS projects 2026 credit growth at approximately 16%.

Analysts anticipate that in early 2026, banks will leverage new credit growth limits to accelerate disbursements through more favorable interest rates, reigniting credit demand. Vietnam’s ambitious 10% GDP growth target for 2026-2030 is expected to boost credit demand in infrastructure, construction materials, and other sectors. Housing loans will remain robust as the real estate supply improves. Bank credit continues to be the primary capital source for the economy, given the slow recovery of the corporate bond market.

August 1st Currency Market Update: Overnight Interest Rates Dip to 4%, State Bank Nets Over 35 Trillion VND in Withdrawal

The January 7th trading session witnessed a continued sharp decline in Vietnamese Dong (VND) interbank interest rates, with the overnight rate plunging below 5% per annum. Against this backdrop, the State Bank of Vietnam (SBV) intensified its net liquidity withdrawal through open market operations, while the USD exchange rate fell across both the interbank and free markets.

Why More Banks Are Raising Interest Rates on Social Housing Loans

Unlock exclusive savings with Agribank’s unbeatable 5.6%/year interest rate for the first 5 years of your loan. Meanwhile, top banks like Vietcombank, BIDV, and Vietinbank have halted their special 5.2-5.5% fixed-rate offers for borrowers under 35, making Agribank’s deal even more irresistible. Act now to secure your financial future!

Currency Strategists Predict Continued USD Weakness in 2026

The US dollar edged higher on Thursday morning (January 8th) following a robust private sector jobs report from ADP, bolstering expectations that the Federal Reserve will maintain interest rates in January. Despite this uptick, most currency strategists remain pessimistic about the greenback’s outlook for 2026.